STBL Buyback Program to Initiate by End of October: CEO

Key Highlights

- Avtar Sehra, founder of STBL, has announced that buybacks for STBL will be initiated by October

- “Stablecoin 2.0” will function as a “TCP/IP of money”

- It introduces the Multi-Factor Staking (MFS) model that allows investors to amplify their earnings by staking

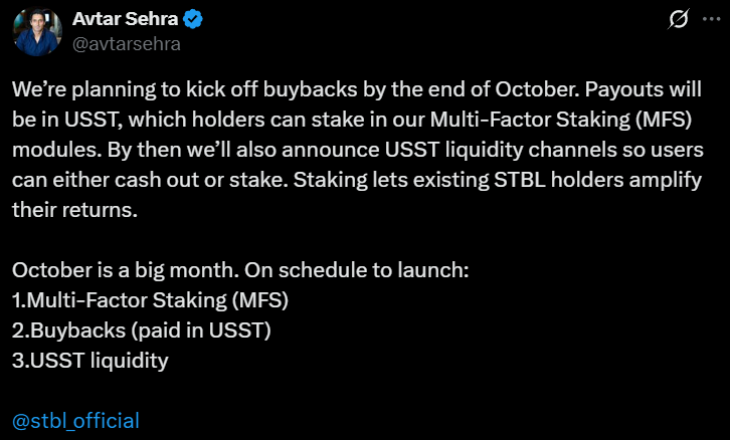

On October 13, Avtar Sehra, a British financial engineer and CEO of STBL, shared updates for his company’s plan to kick off buybacks for STBL by the end of October.

(Source: Avtar Sehra on X)

Details of STBL Buybacks

In a thread posted on X, Avtar Sehra revealed that STBL will start buying back its tokens using USST, which is a new stablecoin from STBL, co-founded by one of Tether’s founders.

This program will cut the number of tokens available, which could help maintain or increase their value. Payments will be made in USST, which gives holders clear options to use or save their tokens.

Avtar Sehra also unveiled a system called Multi-Factor Staking, where users can lock their USST tokens to earn rewards. This system is “multi-factor.” Technically speaking, this system uses smart calculations to distribute rewards. This MFS model will help investors boost their earnings by simply staking and supporting the network.

In a tweet, Avtar Sehra talked about USST Liquidity Channels to cash out stablecoins. These liquidity channels will enable USST to spend or trade by increasing its flexibility.

“We’re not “another stablecoin.” We’re building the TCP/IP of money: infrastructure that is open, decentralised, and durable. Once we’re done, the peg will hold because markets make it hold; collateral is clear; rights are enforceable; privacy will be a feature and not an afterthought. That was the thesis then, and this is the product emerging now,” Avtar Sehra writes in a post on X.

“When we’re done, STBL will be the base layer other stablecoins are built on,” he added.

Sehra Shares Roadmap for ‘Stablecoin 2.0’

In another post, Sehra explained the purpose of STBL and why it is different from other stablecoins, like Tether or USDC. He officially called STBL “Stablecoin 2.0.” His statement is connected to a research paper he authored in 2017, titled “On Cryptocurrencies, Digital Assets and Private Money.”

Seven years on: from theory to Stablecoin 2.0

Nearly eight years ago I published a paper on cryptocurrencies, digital assets and private money. Rereading it now, you can see exactly why we designed STBL the way we did. The core thesis still holds; our execution has matured.… pic.twitter.com/rYIcB6jhnv

— Avtar Sehra (@avtarsehra) October 13, 2025

Sehra explained that STBL is the real-world version of his early vision for a form of digital money that is decentralized, guided by market forces, and built with privacy in mind.

He made a comparison, calling STBL the “TCP/IP of money,” suggesting it could become the fundamental building block for the future of digital finance, much like TCP/IP is the base protocol for the internet.

He pointed out that major weaknesses persist in the first wave of stablecoins. These included a reliance on central authorities, extreme price swings, and a lack of private transactions.

It is built entirely on public blockchains, meaning all actions, from creating new coins to settling transactions, are handled by transparent smart contracts instead of a hidden central server.

This makes the system open and easily connectable to other financial applications.

Every STBL coin in circulation will be backed by a larger amount of real cash assets to keep its value stable. Sehra explicitly rejects models that lack this solid backing.

He said, “Price stability needs credible reserves. Fixed/inelastic supplies and speculative flows alone cannot support Store of Value, Medium of Exchange, and Unit of Account functions(SoV/MoE/UoA) without volatility controls; credible collateral is non-negotiable. Purely algorithmic or synthetic “money” is a non-starter for market stability.”

The third principle involves an automated system to maintain the coin’s value, which is expected to be tied to the USD. Instead of a company manually intervening, smart contracts will automatically adjust the supply of STBL based on market demand.

STBL also features a unique “three-token model” for enhanced compliance and clarity. One token is for spending, another earns yield, and a third is for community governance.

STBL has a composable design to work seamlessly across different blockchain networks with a privacy layer.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Do Kwon Wants Lighter Sentence After Admitting Guilt

Bitwise Expert Sees Best Risk-Reward Since COVID

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges