Even gold and silver couldn't hold up: global stock markets and cryptocurrencies plunge, "all assets are falling"

Market sentiment reversed sharply, with global stock markets collectively declining on Tuesday. Gold, silver, and copper retreated, and cryptocurrencies experienced a widespread drop.

Market sentiment reversed sharply, with global stock markets plunging collectively on Tuesday, while gold, silver, copper, and cryptocurrencies all fell.

Written by: Long Yue, Li Jia

Source: Wallstreetcn

On Tuesday, October 14, global financial markets were once again shrouded in panic. Global stock markets, cryptocurrencies, precious metals, and crude oil all fell together, presenting the rare phenomenon of "all assets declining simultaneously."

"After last week's significant volatility, the market is shifting back to risk-off mode. Due to a lack of momentum, this weakness appears more like a rapid reallocation of fast money rather than a fundamental shift," said Billy Leung, investment strategist at Global X Management.

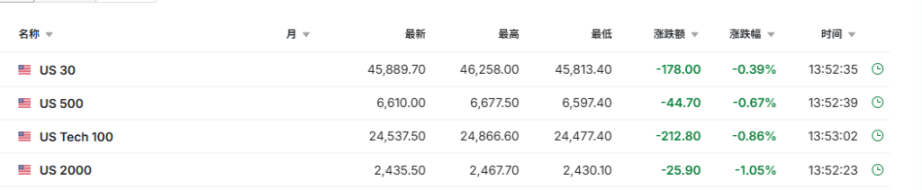

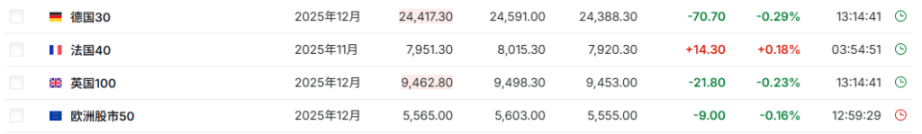

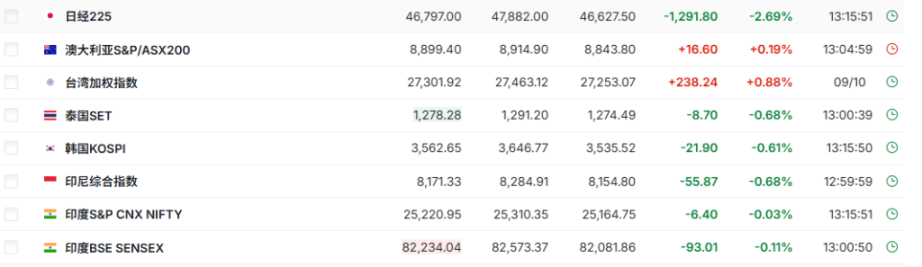

US and European stock index futures turned lower, with Nasdaq futures extending losses to 1%. Major Asian stock indices also saw expanded declines, with the MSCI Asia Pacific Index down 1% and the Nikkei 225 Index dropping as much as 3%.

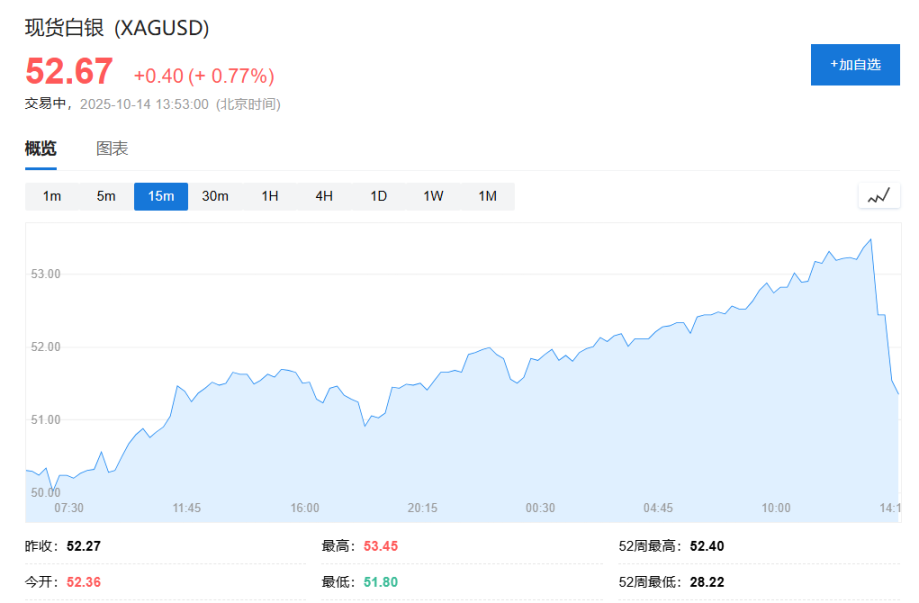

Safe-haven assets gold and silver retreated, with spot gold falling below $4,100 per ounce, down 0.3% on the day. Spot silver lost the $51 per ounce level, dropping about 2.8% on the day. New York copper futures fell nearly 4% intraday, now quoted at $4.969 per pound.

Bloomberg analysis pointed out that sudden drops in silver prices are nothing new. In the commodity system, silver is considered one of the high-beta assets, meaning that when gold performs well, silver often does even better. This year has been a case in point: gold has risen 57%, while silver has soared an astonishing 82%. However, gold has an advantage that silver seems to lack: although both are prone to corrections, gold is better able to maintain its inflation-adjusted value over the long term.

Cryptocurrencies broadly declined, with bitcoin plunging as much as 3.75% and ethereum dropping 7.5% intraday. WTI crude oil fell 3% on the day, now quoted at $57.32 per barrel. Brent crude oil fell 2.8%, quoted at $61.55 per barrel.

The main asset trends are as follows:

- Stock Markets: Global stock markets generally declined. US and European stock index futures turned lower, with Nasdaq futures at one point extending losses to 1%. Major European stock indices also fell slightly, with the STOXX 600 Index down 1%. Asian stock markets saw expanded declines, with the Nikkei 225 Index down as much as 3% and the MSCI Asia Pacific Index down 1%.

- Safe-haven Assets: Gold and silver retreated after a round of intraday gains. Spot gold once fell below $4,100 per ounce, down 0.3% on the day; spot silver lost the $51 per ounce level, down about 2.8% on the day. Bloomberg analysis pointed out that as a high-beta asset, silver is usually more volatile than gold. Despite strong performance this year, its long-term value preservation is inferior to gold.

- Commodities: New York copper futures fell nearly 4% intraday. WTI crude oil fell 3% on the day, now quoted at $57.32 per barrel. Brent crude oil fell 2.8%, quoted at $61.55 per barrel.

- Cryptocurrencies: Cryptocurrencies broadly declined, with bitcoin plunging as much as 3.75% and ethereum dropping 7.5% intraday.

[18:53 Update]

Brent crude oil fell 2.8%, quoted at $61.55 per barrel.

[17:11 Update]

Bitcoin once plunged 3.75%, now quoted at $112,061.2 per coin. According to CoinGecko data, tokens with smaller market caps and higher volatility saw even larger declines, causing the total market capitalization of all cryptocurrencies to shrink by more than $150 billions within 24 hours.

[14:35 Update]

Bitcoin fell more than 2%. Ethereum dropped over 6% intraday, now quoted at $4,030 per coin.

[14:25 Update]

Spot gold once fell below $4,100 per ounce, down 0.3% on the day. Spot silver once lost the $51 per ounce level, down about 2.8% on the day.

[13:50 Update]

Stock market declines continued to widen.

The three major US stock index futures all plunged, with Nasdaq futures at one point extending losses to 1% (UTC+8), S&P 500 futures down 0.79% (UTC+8), and Dow futures down 0.54% (UTC+8).

Meanwhile, spot gold plunged more than $40 in the short term, now quoted at $4,130 per ounce (UTC+8), after previously breaking above $4,170 (UTC+8).

[13:15 Update]

During today's Asian session, US stock index futures fell, with S&P 500 futures down 0.4% (UTC+8) and Nasdaq 100 futures down 0.5% (UTC+8). Major stock indices in Germany, the UK, and others also fell slightly, with the Euro Stoxx 50 Index down 0.16% (UTC+8).

Asian stock indices also turned sharply lower, with the Nikkei 225 Index dropping as much as 3% (UTC+8). The MSCI Asia Pacific Index fell 1% (UTC+8) to 218.82 points.

Spot gold and silver continued to rise, with spot gold breaking above $4,175 (UTC+8), up about 1.6% on the day. Spot silver rose more than 1.8% (UTC+8).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.