DASH Takes the Lead as Market Recovers, But Traders Expect the Party to End Soon

DASH leads the market rebound with a sharp 35% rally, but technicals warn the momentum may be fading. With traders shorting and RSI flashing overbought signals, a price correction could be just around the corner.

After last weekend’s brutal market bloodbath, during which several altcoins lost over 90% of their value within minutes, the crypto market is showing early signs of recovery.

Among the biggest movers today is DASH, a privacy-focused digital asset, which has surged 35% in the past 24 hours to reach a 10-month high, making it today’s top gainer. However, beneath the surface, market data paints a more cautious picture.

DASH’s Rally Faces a Reality Check

The recent uptick in demand for privacy coins has led to a sustained rally in DASH’s price since last week. Currently exchanging hands at $57.87, the altcoin’s value has rocketed nearly 70% in the past seven days.

However, this price rise may be nearing its end. On-chain and technical indicators point to a gradual buildup in buyers’ exhaustion, which may trigger a reversal in the near term.

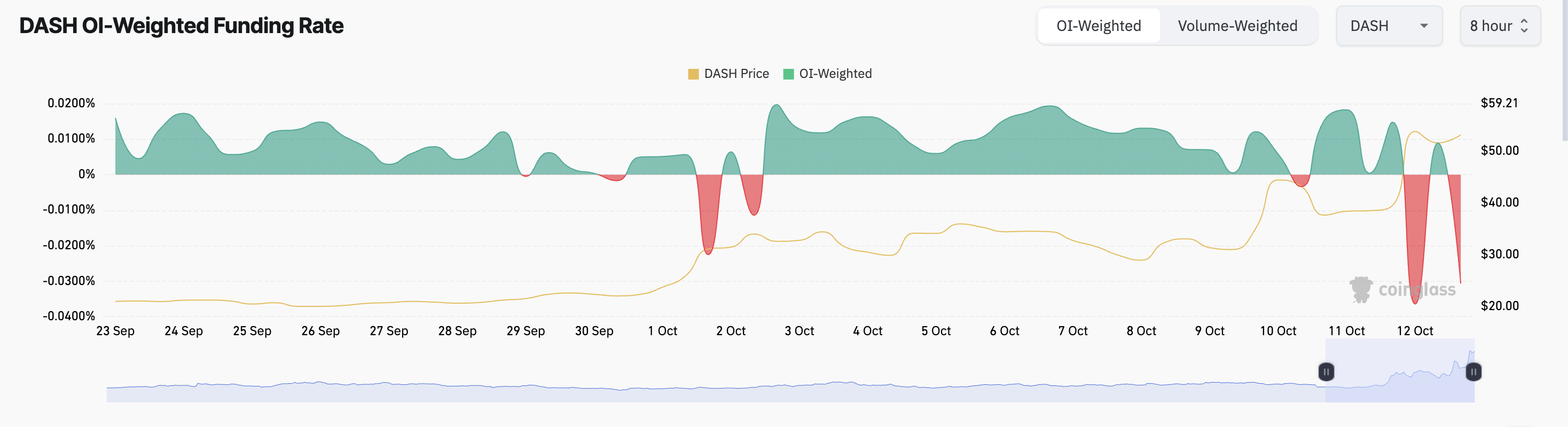

According to Coinglass data, futures traders have increasingly opened short positions against DASH over the past two trading sessions. Its negative funding rate of -0.037% at press time reflects this.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

DASH Funding Rate. Source:

Coinglass

DASH Funding Rate. Source:

Coinglass

The funding rate is a periodic fee exchanged between traders in perpetual futures markets to keep contract prices aligned with the spot price.

When positive, it implies that long positions are dominant and that long sellers are willing to pay short sellers to keep their positions open, a strong indicator of bullish sentiment.

Conversely, when an asset’s funding rate is negative, as with DASH, a growing number of traders are betting on its reversal. This means that the price surge could be losing steam and due for a correction.

DASH Bulls Begin to Lose Grip

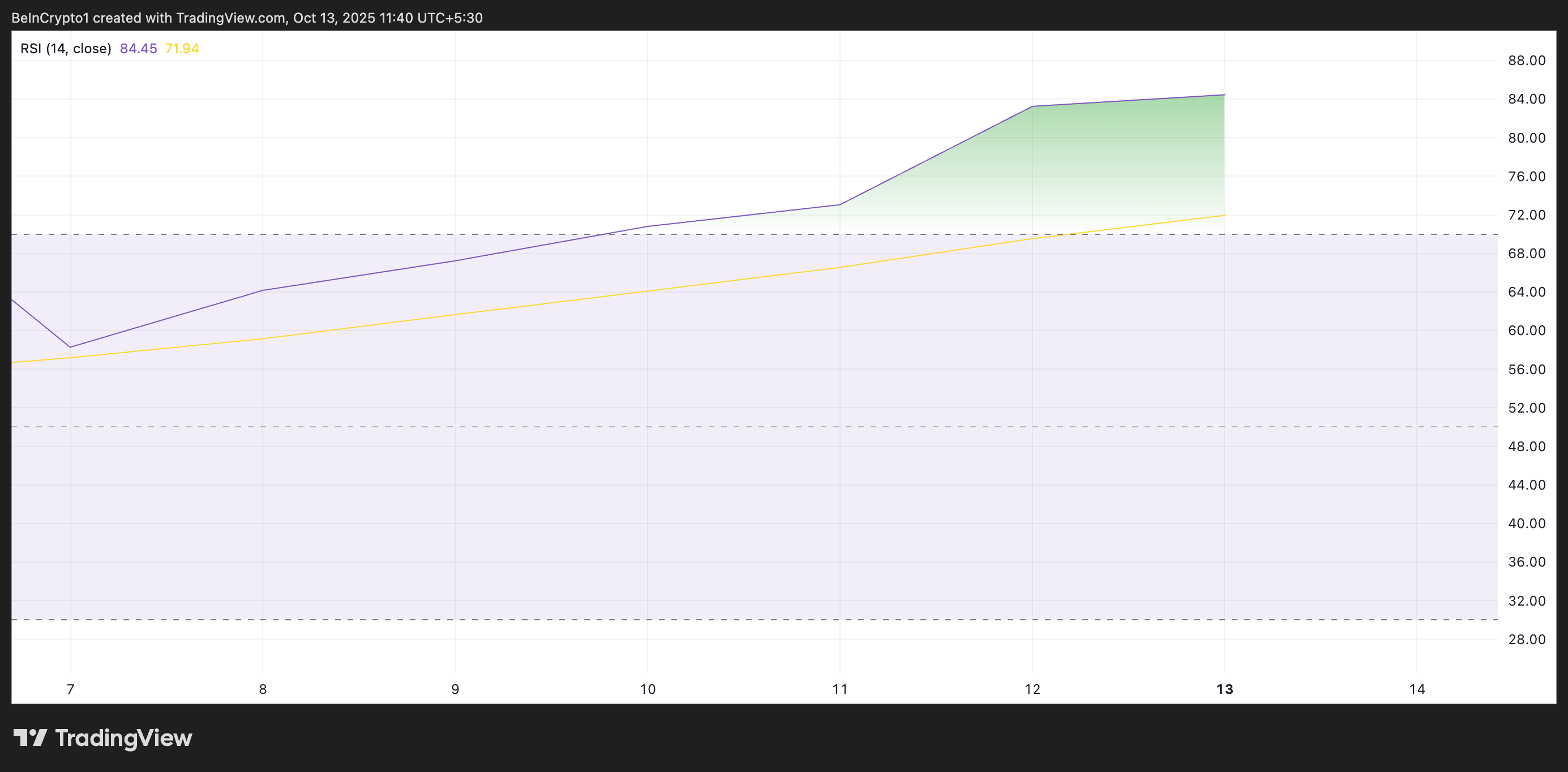

Moreover, spot market data shows that DASH is overbought, indicating that the current buying momentum is nearing exhaustion. At press time, its Relative Strength Index (RSI) is at 84.45 and trending upward, signaling an overextended market.

DASH RSI. Source:

TradingView

DASH RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

DASH’s RSI readings confirm that the asset is deep in overbought territory, supporting the view that its recent surge may not be sustainable. This signals that buying momentum is likely peaking, and a cooling-off phase could follow as traders begin to lock in profits.

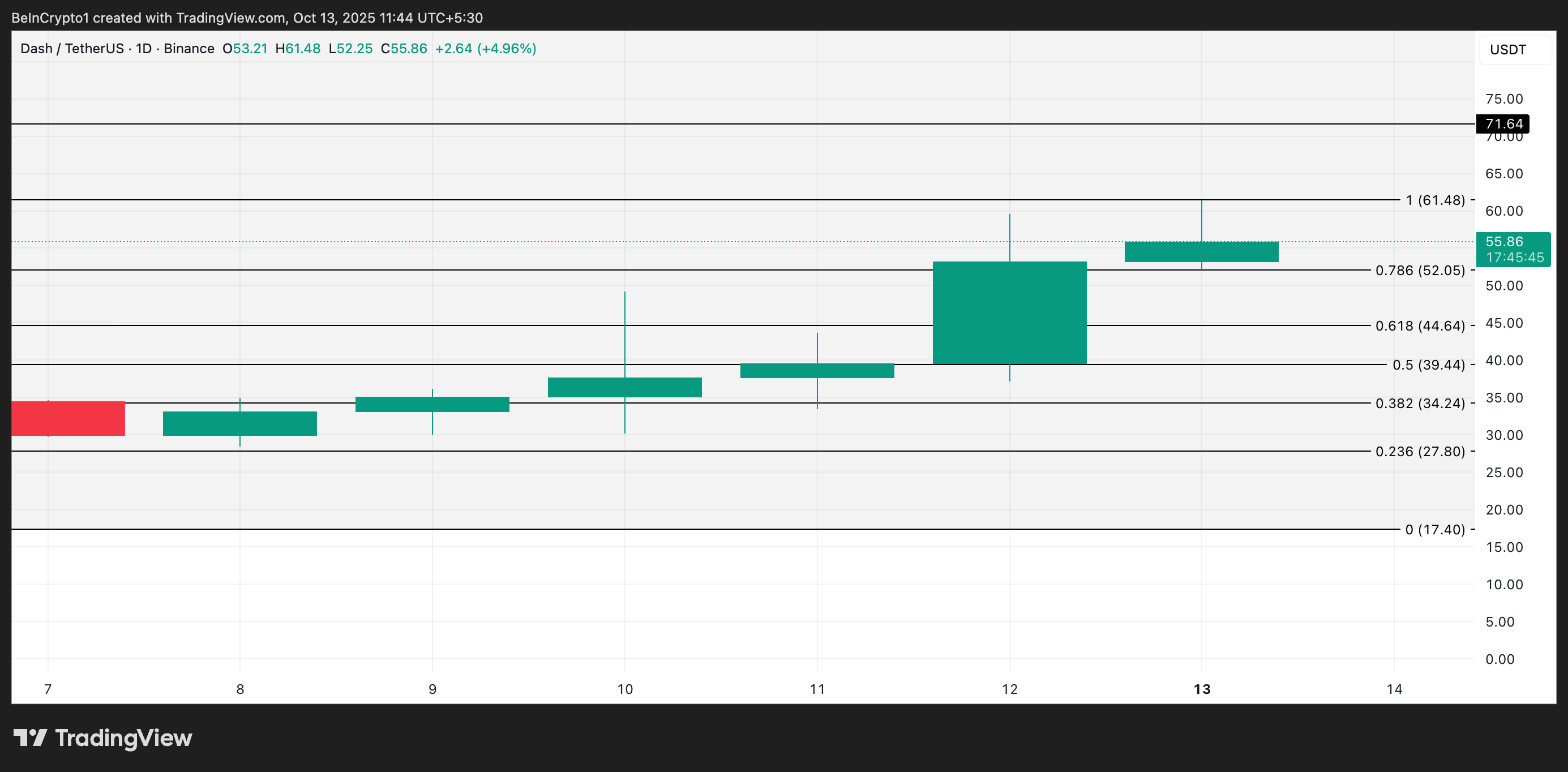

Will $52 Support Hold or Break Below $50?

At its current price, DASH trades above the support floor formed at $52.05. Once buying activity reaches exhaustion, the token could attempt to test this support level. If it fails to hold, DASH’s price could plummet under $50 to trade at $44.64.

DASH Price Analysis. Source:

TradingView

DASH Price Analysis. Source:

TradingView

On the other hand, if demand for the altcoin persists, its price could rally past $61.48.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.

Do Kwon Wants Lighter Sentence After Admitting Guilt

Bitwise Expert Sees Best Risk-Reward Since COVID

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?