October 13 Key Market Insights, A Must-Read! | Alpha Morning Report

Featured News

1.Due to Trump's Moderate Speech, Cryptocurrency and Major U.S. Stock Index Futures Rebound

2.Binance Has Compensated $283 Million to Users Affected by USDE and Other Assets' De-pegging, Spot "Zero Price" Only a Display Issue

3.$216 Million Liquidated Across the Network in the Past Hour, Mainly Short Positions

4.Cryptocurrency Total Market Cap Rebounds Above $4 Trillion, 24-hour Increase of 5.6%

5.Macro Outlook for the Week: Powell Speech on Tuesday Night

Articles & Threads

1.《Weekly Review | Epic Cryptocurrency Market Crash Leads to 1.6 Million Liquidations; Monad Airdrop Claim Portal to Open on October 14》

After hitting a historic high of $126,000, Bitcoin experienced an epic crash. The U.S. Bureau of Labor Statistics is expected to release the CPI report during the government shutdown, and Binance Alpha launched various Chinese narrative meme coins on the contract platform.

2.《Traders' View | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?》

October 11, 2025, a day that will be engraved in crypto history. Influenced by U.S. President Trump's announcement of restarting the trade war, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like decline, which quickly spread throughout the entire crypto market. However, why was this liquidation so intense? Has the market bottomed out? ReLive BlockBeats compiled perspectives from multiple market traders and well-known KOLs, analyzing this epic liquidation from the macro environment, liquidity, market sentiment, and other perspectives, for reference only.

Market Data

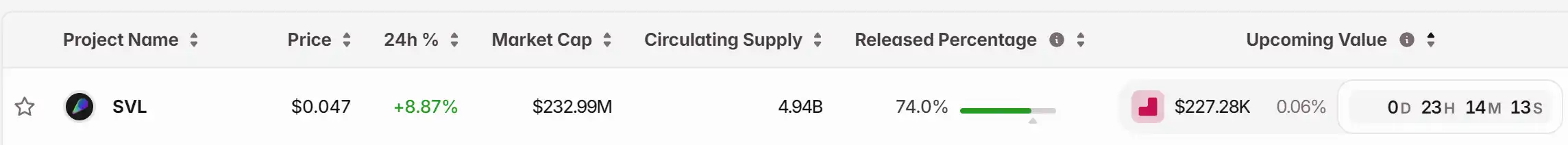

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Italy orders non-compliant VASPs to exit as MiCAR rules kick in

Local Leadership and the Drive for Technological Advancement: How Minneapolis is Building Economic Strength

- Minneapolis integrates AI and centralized IT systems to boost municipal efficiency and tech-driven governance. - The city's medical tech sector leads with 16% U.S. talent share and 16 expansion projects in 2024. - Workforce shortages (59% hiring challenges) and rising costs hinder scalability despite innovation gains. - Investors face opportunities in medtech and AI tools but lack transparent metrics for evaluating tech ROI. - Minneapolis highlights the need for balancing tech innovation with accountabil

The Impact of a 30% Increase in ICP Token Value on Investments in Blockchain Infrastructure

- ICP's 30% price surge to $4.71 in November 2025 stems from ICP 2.0 upgrades (Caffeine, Internet Identity 2.0) and institutional partnerships with Microsoft Azure and Google Cloud. - This growth challenges AWS/Azure dominance, with ICP's Fission upgrade enabling scalable decentralized storage and attracting enterprises seeking alternatives to centralized cloud providers. - However, regulatory uncertainty and market volatility (e.g., 91% drop in token transfers during dips) raise questions about long-term

The Economic Impact of Incorporating AI in Sectors Driven by Data

- Global AI infrastructure investments by tech giants like Alphabet and Microsoft are projected to reach $315B in 2025, generating $15T in economic value by 2030 through automation and analytics. - The U.S. leads with $470B in AI infrastructure funding (2013-2024), driven by cloud expansion expected to hit $3.4T by 2040, creating fragmented markets for consolidation. - Data-centric ecosystems (e.g., JHU, ICP Caffeine AI) enable pharmaceuticals and finance firms to build competitive barriers via proprietary