Bitcoin, Ethereum Rebound as Trump Contains China Chaos to the Weekend

Trump’s measured China comments fueled a swift Bitcoin and Ethereum rebound after Friday’s market chaos, hinting at a deliberate de-escalation that steadied investor sentiment before Wall Street’s open.

The Trump-China drama may have been perfectly timed because Donald Trump struck a calm, almost rehearsed tone after Friday’s sudden market crash, before TradFi markets open on Monday.

Crypto is often caught holding the ball as President Trump’s market-moving announcements tend to come on Friday, almost sparing stocks from the carnage.

Trump Calms China Fears, Fuels Bitcoin and Ethereum Recovery

Global markets could be steady by Monday morning, and crypto, which absorbed the shock over the weekend, is already leading the rebound.

Bitcoin was approaching the $115,000 mark, while Ethereum reclaimed $4,100, following Trump’s comments on Truth Social, which eased China fears. Investors interpreted his remarks as deliberate de-escalation after a politically charged sell-off.

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment… The USA wants to help China, not hurt it,” Trump noted.

The timing raised familiar eyebrows. The plunge came late Friday, just as Wall Street shut for the weekend, leaving only 24/7 crypto markets to process the fallout.

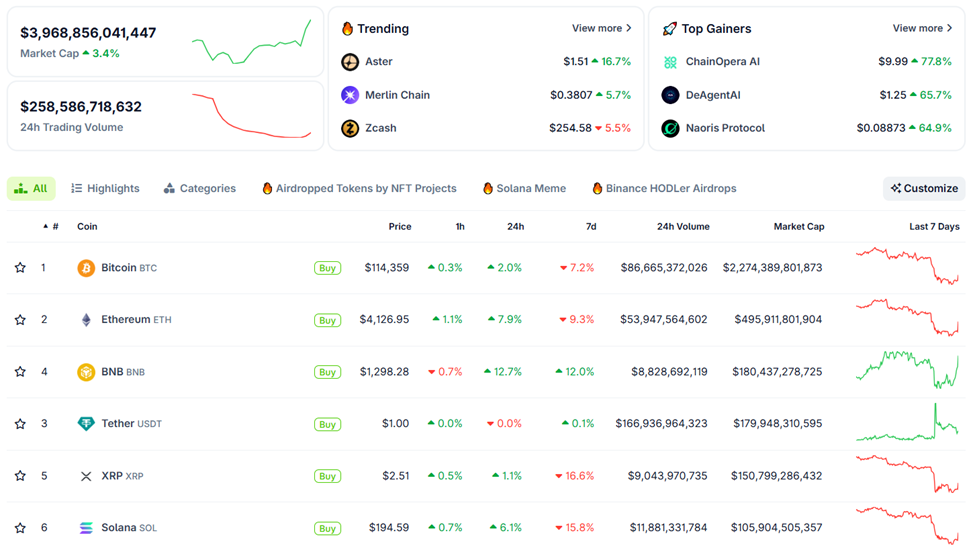

Indeed, markets are already on a rebound, with Bitcoin trading for $114,359 as of this writing, while Ethereum has already reclaimed the $4,100 mark. Notably, Ethereum is up by over 20% from its Friday low.

Crypto Markets on the Rebound. Source:

Crypto Markets on the Rebound. Source:

Sentiment is already flipping, and equities could open Monday largely unscathed. Many traders now suspect that Trump prefers weekend volatility, allowing crypto markets to bleed privately before the S&P 500 can react.

The White House also pointed to Trump’s softer stance, with reports indicating that Vice President JD Vance revealed his boss’s willingness to be a reasonable negotiator with China.

Similarly, White House officials reportedly suggested that markets would “calm down this week.” With crypto markets showing strength, traders may read this as a green light for risk assets.

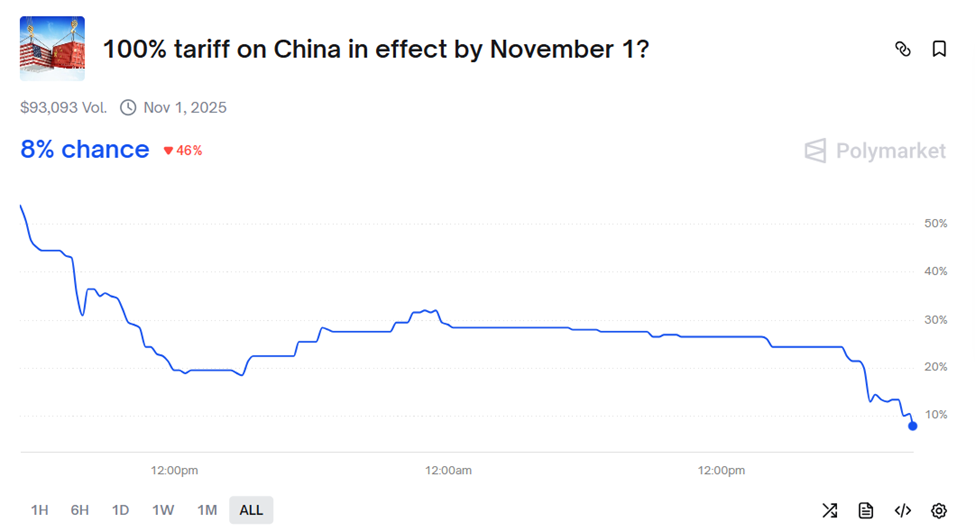

100% Tariff on China in Effect by November 1?

On whether Trump will impose a 100% tariff on China by November 1, Polymarket bettors see a measly 8% chance. This marks a significant drawdown from minutes before Trump’s announcement on Truth Social, where the odds stood at 26%.

Trump China 100% Tariffs by November 1. Source:

Trump China 100% Tariffs by November 1. Source:

The change points to de-escalation, implying most participants see Trump’s rhetoric as bluff, not brinkmanship.

Still, for crypto investors, the pattern feels intentional. Crypto trades nonstop, making it the first asset class to price in sudden political shocks, and the easiest to shake out leveraged players before calmer Monday headlines appear.

“Liquidating everyone just to push prices to new ATHs would be pretty frustrating… and honestly, it seems likely,” Crypto Rover quipped.

In the same tone, Helius Labs CEO, Mert, said the crypto markets are an oracle for Trump’s social media mood.

Whether orchestrated or coincidental, the weekend whiplash reflects how deeply political theater now intersects with digital assets. Trump crashes the market on Friday, calms it by Sunday, and the S&P may never even flinch, only Bitcoin does.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Delays Crypto Information Exchange Pending International Coordination

- Switzerland delays crypto tax data sharing with foreign nations until 2027, citing unresolved CARF partner agreements. - The OECD's 2022 framework requires member states to exchange crypto account details, but 75 countries including the EU and UK face implementation challenges. - Transitional measures ease compliance burdens for Swiss crypto firms while awaiting finalized international data-sharing protocols. - Major economies like the U.S., China, and Saudi Arabia remain outside CARF due to non-complian

Bitcoin Updates: SGX Addresses Offshore Perp Shortfall as Bitcoin Decline Increases Demand for Hedging

- SGX launched Bitcoin and Ethereum perpetual futures, becoming a first-mover in regulated onshore crypto derivatives to meet institutional demand. - The $187B/year perp market, dominated by Asia, now gains a regulated alternative to offshore platforms with SGX's 22.5-hour trading window. - Perps enable hedging during Bitcoin's 2025 downturn, with SGX's margin-call system prioritizing investor protection over instant liquidations. - Regulatory caution limits access to accredited investors, aligning with gl

Bitcoin News Update: Institutional ETF Adjustments Challenge Key Bitcoin Support Thresholds

- Analysts warn Bitcoin faces 25% drop risk if key support levels fail amid shifting institutional ETF dynamics. - Texas's $5M IBIT purchase highlights growing government interest, but ETFs fall short of direct BTC ownership criteria. - Technical analysis shows Bitcoin trapped in a broadening wedge pattern, with breakdown below $80,000 risking $53k decline. - Institutional rebalancing sees $66M IBIT outflows vs. $171M FBTC inflows, signaling tactical ETF rotation over accumulation. - Abu Dhabi's $238M ETF

XRP News Today: IMF Cautions That Rapid Tokenized Markets Could Intensify Crashes in the Absence of Regulation

- IMF warned tokenized markets like XRP could worsen flash crashes without regulation, citing risks from decentralized systems lacking traditional safeguards. - Report acknowledged tokenization's potential to cut cross-border payment costs but highlighted volatility risks from rapid liquidity loss seen in crypto markets. - SEC's approval of crypto ETFs signals growing institutional acceptance, though regulators emphasize oversight frameworks to mitigate systemic risks. - IMF proposed a global digital marke