How Did Zcash Defy The Crypto Market Crash To Hit An All-Time High?

Zcash (ZEC) defied a $20 billion crypto liquidation wave, soaring 450% in a month to reach a four-year high.

Zcash (ZEC) has emerged as one of the few digital assets to rally amid one of the harshest liquidation waves in recent crypto history.

As nearly $20 billion in leveraged positions vanished following President Trump’s unexpected tariff announcement, the privacy-focused cryptocurrency surged to a four-year high.

Why is Zcash Price Rising?

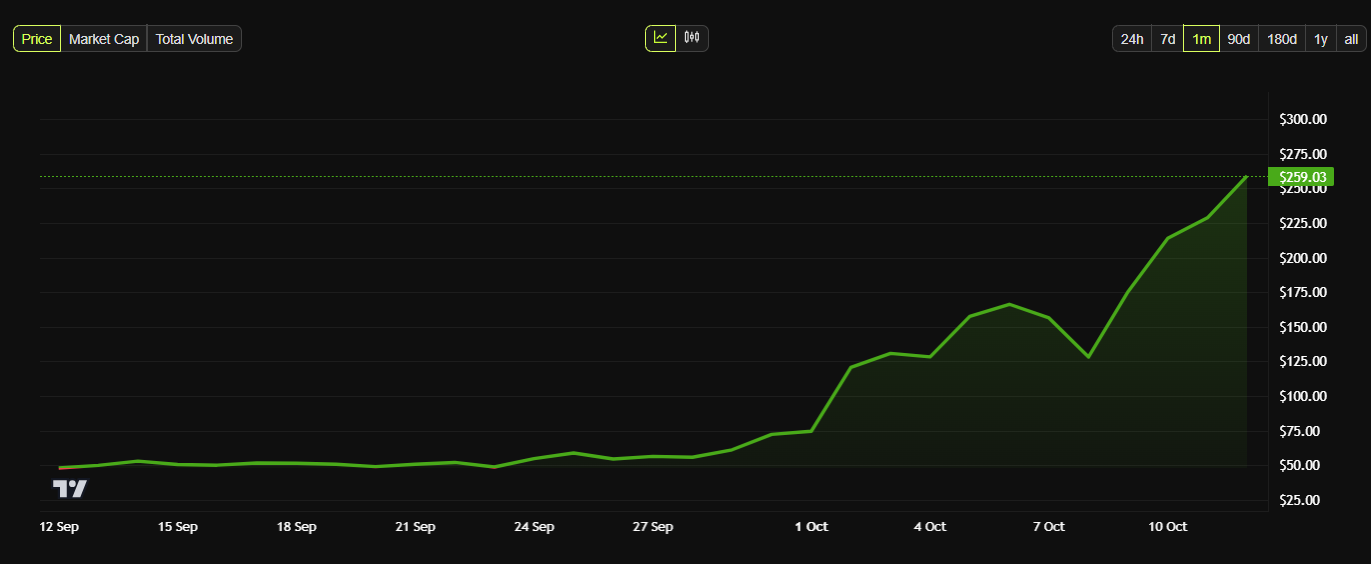

Data from BeInCrypto showed ZEC price briefly touching $282.59 on October 11 before easing to about $257.96. Even after that pullback, the token posted a 15% daily gain—its strongest since late 2021, when it last traded near $295.

This continues an upward movement for a digital asset that has climbed over 100% this week and nearly 450% in the past month.

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s rally has been aided by crypto traders’ rotation into privacy-centric projects following increased financial surveillance by global authorities.

Moreover, the token’s positive performance has been amplified by industry figures such as Barry Silbert, founder of Digital Currency Group. Notably, he has reshared multiple Zcash-related updates in recent days.

Outside of that, some community members have pointed out that Zcash remains undervalued relative to its fundamentals.

Mert Mumtaz, CEO of Helius Labs, argued that ZEC has operated as a proof-of-work, fully distributed network for nine years.

According to him, the project offers user sovereignty, advanced encryption, and Bitcoin-like tokenomics at a fraction of the market capitalization of peers such as Litecoin or Cardano.

Mumtaz also cited a “renaissance” of developer activity, with new contributors focusing on performance improvements and exchange integrations.

Considering this, he argued that the token “is the most obvious mispricing in crypto,” while adding that:

“The community using the power of crypto and public markets to breathe life back into the project,” Mumtaz said.

Launched in 2016, Zcash uses zero-knowledge proofs to enable private transactions without revealing the sender, receiver, or amount. These features are missing in top cryptocurrencies like Bitcoin and Ethereum.

So, as governments worldwide increase financial surveillance, Zcash’s shielded-transaction model is regaining relevance among privacy-minded users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Silver Soars Amid Ideal Conditions of Policy Shifts and Tightening Supply

- Silver surged to $52.37/oz as Fed rate cut expectations (80% probability) and falling U.S. Treasury yields boosted demand for non-yielding assets. - China's record 660-ton silver exports and 2015-low Shanghai warehouse inventories intensified global supply constraints, pushing the market into backwardation. - Geopolitical risks (Ukraine war) and potential U.S. silver tariffs added volatility, while improved U.S.-China relations eased short-term trade concerns. - Prices face critical $52.50 resistance; Fe

XRP News Today: As XRP Declines, Retail Investors Turn to GeeFi's Practical Uses

- GeeFi's presale hits 80% of Phase 1 goal with $350K raised, targeting 3,900% price growth as XRP declines 20% monthly. - GEE's utility-driven features like crypto cards, multi-chain support, and 55% staking returns contrast with XRP's institutional dependency and shrinking retail base. - Deflationary tokenomics and 5% referral bonuses drive FOMO, positioning GeeFi as a 2026 crypto disruptor amid XRP's regulatory and adoption challenges.

Sloppy implementation derails MegaETH's billion-dollar stablecoin aspirations

- MegaETH abandoned its $1B USDm stablecoin pre-deposit plan after technical failures disrupted the launch, freezing deposits at $500M and issuing refunds. - A misconfigured Safe multisig transaction allowed early deposits, causing $400M inflows before the team scrapped the target, citing "sloppy execution" and operational misalignment. - Critics highlighted governance flaws, uneven access (79 wallets >$1M vs. 2,643 <$5K deposits), and 259 duplicate addresses, raising concerns about transparency and bot ac

XRP News Today: Institutional ETFs Drive XRP's Phase 4 Surge, Targeting a Break Above $2.60

- XRP enters Phase 4 of its multi-year cycle, mirroring 2014–2017 patterns with $2.00 retest and $6.618 target potential. - Six new XRP ETFs (Franklin Templeton, Grayscale) boost institutional demand, though performance varies significantly between products. - Technical analysis highlights $2.05–$2.07 support and $2.20 resistance, with $2.60 breakout critical for confirming Phase 4 bullish thesis. - Macroeconomic factors like Fed rate cuts and improved U.S.-China relations could reduce risk aversion, ampli