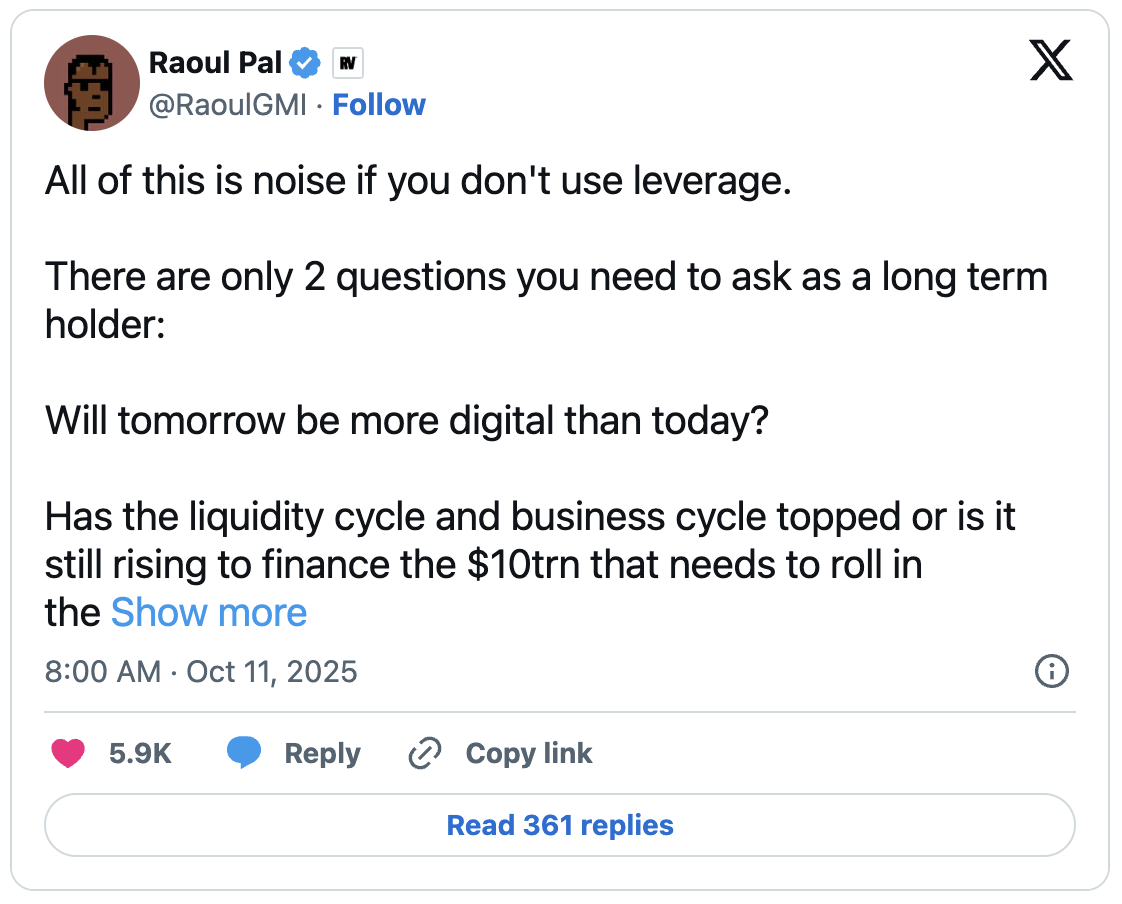

The cryptocurrency market encountered a significant shakeup in the past 24 hours, experiencing liquidations amounting to $19.38 billion. According to CoinGlass, macroeconomic uncertainties surrounding trade tariffs significantly influenced this sudden shift. Major assets such as Bitcoin (BTC) $112,467 , Ethereum (ETH) $3,841 , and XRP suffered losses, with the market witnessing an overall decline of 9.18%. Raoul Pal, the founder of Real Vision, described this decline as “short-term noise,” attributing most of the downturn to short-term investors engaging in leveraged positions.

Liquidity and the Impact of Artificial Intelligence

Pal advises long-term investors not to panic, emphasizing that “tomorrow will be more digital than today,” highlighting the enduring significance of digital assets. He asserts that blockchain and artificial intelligence technologies will continue playing central roles in financial transactions. Furthermore, he mentioned the global liquidity cycle as being on an upward trend, forecasting that the increase in money supply from central banks and governments will bolster the crypto market .

Pal projects that in the next 12 months, around $10 trillion of liquidity should enter the market, supporting cryptocurrency assets. The seasoned analyst argues that long-term investors should view such downturns as purchasing opportunities, reminding them that “in five years, these prices will be irrelevant.”

Significant losses in major assets have attracted attention. Bitcoin dropped by 7.86% to $112,104, while its trading volume surged by 167% to $198 billion, indicating that investors are viewing the price drop as a buying opportunity. Similarly, Ethereum plunged by 12% to $3,824, with XRP falling by 12.06% to $2.48.

Recurring Declines and Historical Context

Similar large-scale liquidations occurred during the 2022 Terra crash and the FTX bankruptcy. However, the market rebounded to record levels during those periods. Currently, despite “Uptober rally” expectations being shaken, many analysts predict that the market will regain momentum following short-term corrections.

The market’s harsh decline necessitates strategic behavior from long-term investors. Leveraged positions and short-term panic sales have caused significant losses, yet a long-term perspective maintains the potential for sustainable gains. As Raoul Pal suggests, the transition to a digital economy is accelerating, supporting the long-term value of crypto assets.