$100 Million Lost in One Hour: Bitcoin Drops Spark Rampaging Liquidations

Bitcoin’s $4,000 drop sparked $700 million in liquidations, proving retail traders still wield power despite institutional dominance. Analysts now eye how these dual forces will shape BTC’s next move.

Retail Bitcoin traders made themselves heard today, causing $700 million in crypto liquidations. The price of BTC fell by around $4,000 as on-chain activity spiked, even though institutions kept buying.

Whether or not BTC keeps dropping or recovers soon, we need to pay attention to these dynamics. Corporate liquidity is very influential in the market, but it’s not the final arbiter of price.

Bitcoin Causes Surprise Liquidations

When Bitcoin hit two successive all-time highs earlier this week, it caused a little consternation in the community. This took place despite a lack of retail activity, with institutional investors powering the growth.

Crucially, these corporations continued making huge purchases while BTC’s value was inflated.

In other words, there have been fears that these inflows could profoundly alter market cycles. Arthur Hayes even proclaimed that the four-year cycle was dead and that global institutional liquidity would determine token prices now.

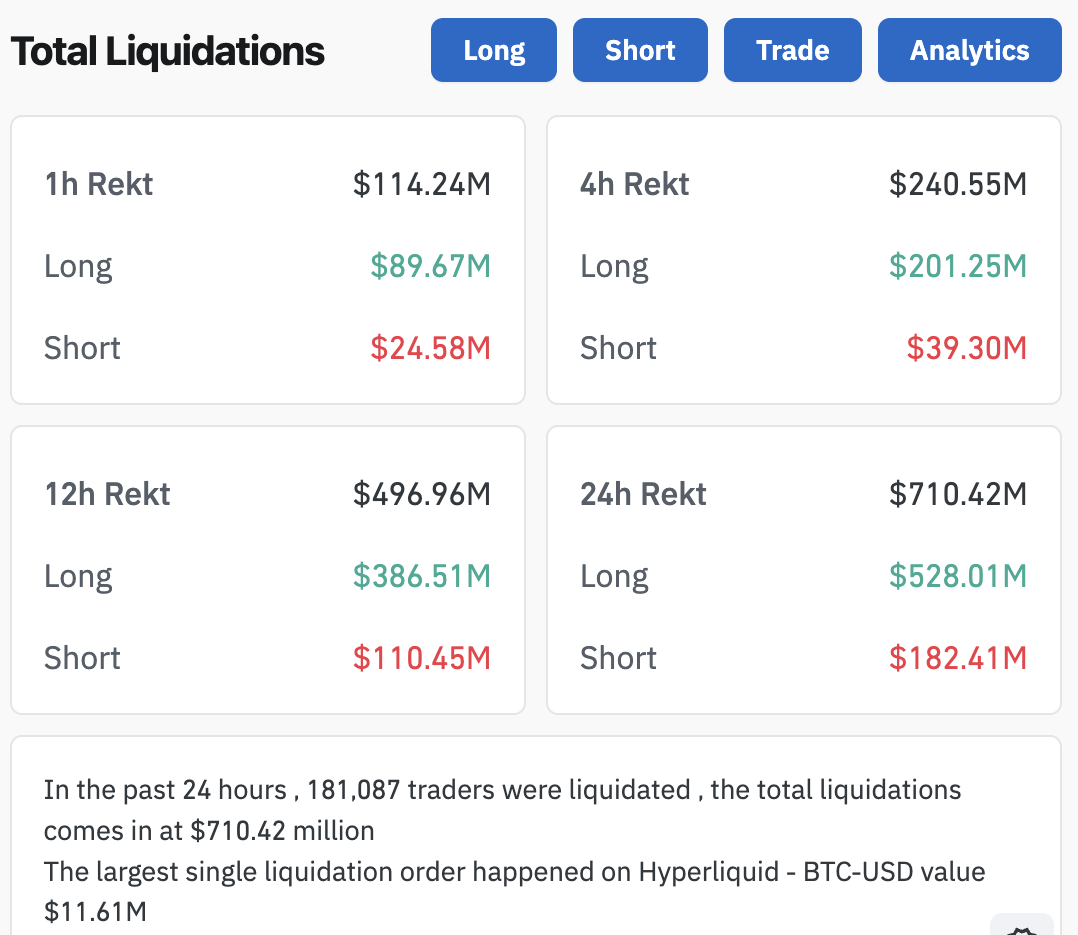

Today, however, these concerns seem less serious. Bitcoin fell around $4,000 in the last 24 hours, spawning a frenzy of crypto liquidations. Over $114 million in total short positions were eradicated in one hour:

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Retail Traders’ Impact

A few key factors suggest that retail Bitcoin traders caused all these liquidations. For one thing, ETF issuers continued buying BTC at elevated rates, and the products are seeing huge inflows. Meanwhile, BTC’s on-chain trading activity has spiked between 4% and 5%, showing that activity is stirring awake.

Analysts have already identified some of the most likely causes for Bitcoin’s retreat to $120,000, which triggered these liquidations. They seem like pretty standard price actions; long-term traders are taking profits, holder accumulation rates sparked low confidence, etc.

Furthermore, there are even signs that BTC could rebound in the near future.

This, too, presents a useful opportunity to gather valuable market data. These new structural forces are very powerful, but they aren’t all-powerful.

Retail activity still spurred a major Bitcoin price dump, causing a cascade of liquidations. What new narratives can help explain this behavior and enable accurate predictions?

Whether Bitcoin keeps going up or down, these questions should be at the forefront of traders’ minds. These institutions are apparently going to keep stockpiling Bitcoin either way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leveraged Position Liquidations and Market Fluctuations: Urging Proactive Risk Control Strategies

- 2025 crypto market saw $21B in leveraged liquidations as Bitcoin's volatility triggered systemic collapses in October and November. - Over-leveraged long positions, social media hype, and automated deleveraging mechanisms fueled cascading losses across exchanges. - Traders shifted to 1-3x leverage and AI-driven risk tools post-liquidations, with 65% reducing exposure in Q4 2025. - Experts emphasize dynamic position sizing, diversification, and 5-15% stablecoin allocations to mitigate volatility risks in

Urban Industrial Properties in Markets Following Corporate Divestitures: Approaches to Strategic Investment and Insights from the Xerox Webster Campus Example

- Xerox Webster campus in NY secures $14. 3M in public grants to transform 300-acre brownfield into advanced manufacturing hub. - Infrastructure upgrades reduced industrial vacancy to 2% by 2024, attracting $650M fairlife® dairy plant creating 250 jobs. - Public-private partnerships and policy alignment through Brownfield Opportunity Area designation ensure sustained investment and regulatory stability. - The model demonstrates how strategic infrastructure and policy frameworks can catalyze $1B+ developmen

Bitcoin’s Sharp Decline: Should Investors See This as a Chance to Buy or a Signal to Be Cautious?

- Bitcoin's November 2025 price drop below $86,000 reflects Fed policy uncertainty, geopolitical tensions, and leveraged retail trading. - Market fear indices hit "extreme" levels as ETF outflows and weak correlations with equities highlight structural crypto shifts. - While on-chain demand and seasonal buying optimism persist, critical support at $89,183 determines near-term bearish/bullish trajectories. - Long-term outcomes hinge on regulatory clarity, mining economics, and whether central bank liquidity

The PENGU USDT Sell Signal: A Significant Change in Stablecoin Approach?

- The 2025 PENGU/USDT sell signal triggered a 30% collapse, exposing algorithmic stablecoin fragility and a $128M liquidity shortfall on Balancer. - Technical indicators and $66.6M in team wallet withdrawals validated bearish trends, highlighting systemic risks in non-collateralized models. - Market shifts toward fiat-backed stablecoins like USDC accelerate as regulators push hybrid models combining AI governance with CBDCs. - PENGU's technical outlook remains bearish with RSI at 40.8 and projected 5-day r