New Survey Shows Massive Missed Opportunity In Bitcoin Finance (BTCFi)

Despite Bitcoin’s record highs, a GoMining survey finds 77% of holders haven’t used BTCFi—missing out on potential passive income gains.

As Bitcoin reaches a new all-time high above $126,000, new data shows that most holders still haven’t explored Bitcoin Finance (BTCFi).

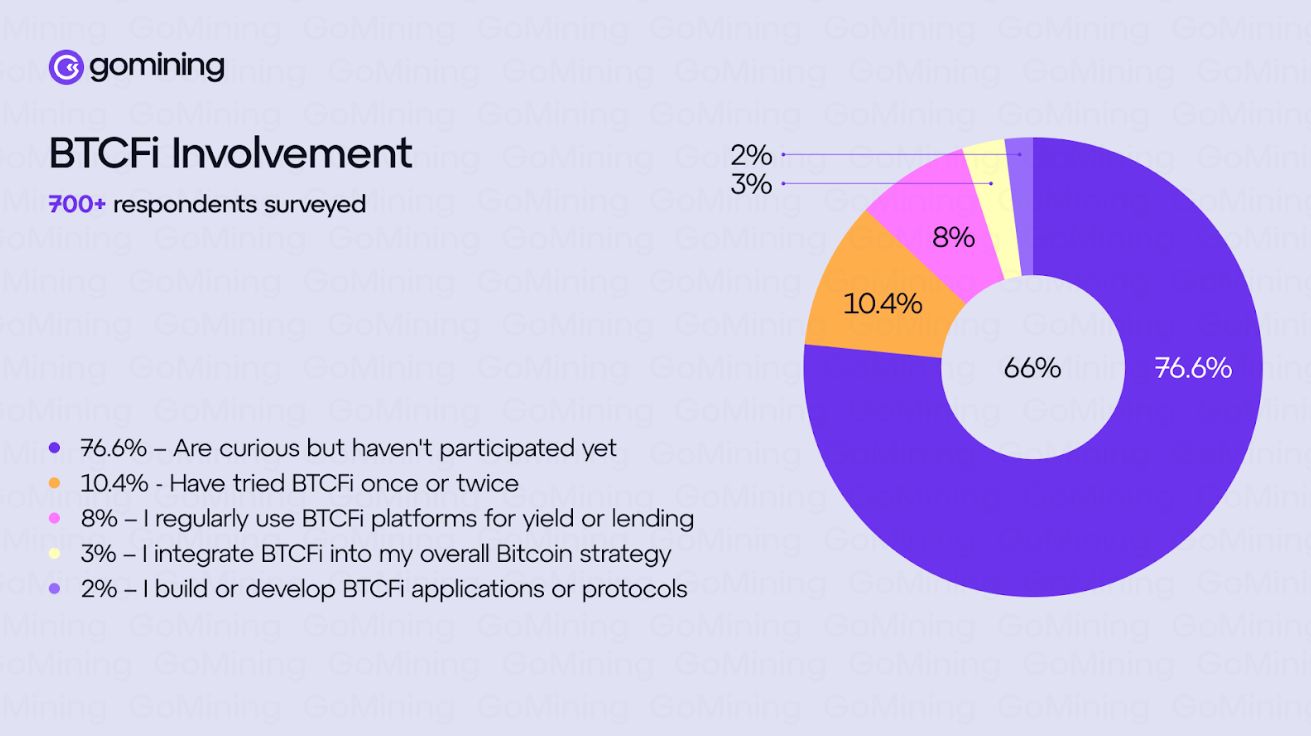

A survey by GoMining of more than 700 respondents across North America and Europe found that 77% of Bitcoin holders have never used a BTCFi platform.

77% of Bitcoin Holders Haven’t Tried BTCFi

This finding highlights a major disconnect between the growing hype around BTCFi and its real-world adoption. The sector has attracted significant venture capital and media coverage, yet the majority of its target users remain untouched.

The GoMining survey reveals that interest in BTCFi’s core offerings—yield and liquidity—is high, but trust remains the critical barrier.

Bitcoin Finance Survey Results. Source: GoMining

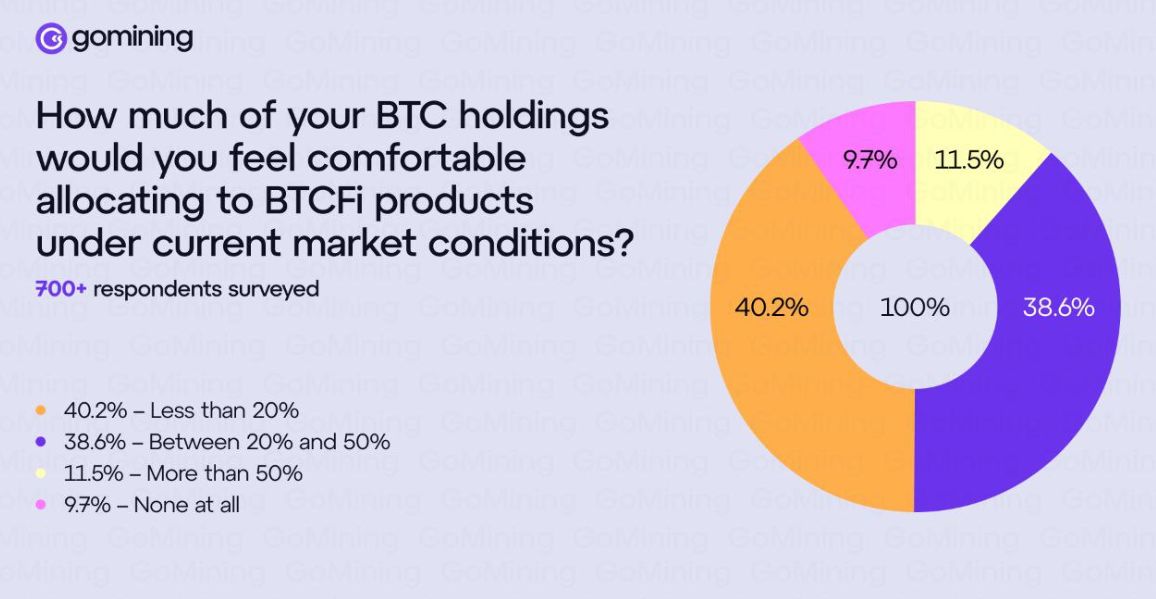

Bitcoin Finance Survey Results. Source: GoMining

Around 73% of respondents said they want to earn yield on their Bitcoin through lending or staking, and 42% expressed interest in accessing liquidity without selling BTC.

However, more than 40% of participants said they would allocate less than 20% of their holdings to BTCFi products.

This conservative stance reflects broader trust and complexity issues facing the industry.

“Although the majority of Bitcoin investors hold it in store for future valuation boost, the asset has more liquidity to power the next generation of DeFi applications. While the corporate adoption of Bitcoin as a treasury asset is growing, the coin can act as much more than a HODL asset. BTCFi will offer new potential use cases — earning, borrowing, and spending,” said Mark Zalan, CEO of GoMining.

A Bitcoin Education Problem

Perhaps the most revealing figure is that 65% of Bitcoin holders cannot name a single BTCFi project.

Despite millions in venture funding and an increasing number of conferences, BTCFi’s message has yet to reach its core audience—Bitcoin holders themselves.

Industry experts argue this is not a user failure but a communication failure. BTCFi platforms have largely replicated Ethereum’s DeFi model, assuming familiarity that many Bitcoin investors simply do not have.

BTCFi Survey Findings. Source: GoMining

BTCFi Survey Findings. Source: GoMining

Different Users, Different Expectations

The survey supports a growing view that Bitcoin users are fundamentally different from DeFi users.

While Ethereum users embrace experimentation and composability, Bitcoin holders prioritize security, regulation, and simplicity.

This difference explains why Bitcoin ETFs and custodial platforms have achieved mass adoption while BTCFi remains niche.

The timing of these findings is critical. Bitcoin’s surge to an all-time high reflects renewed institutional and retail interest in BTC.

“At $125,559, many still consider Bitcoin undervalued, drawing on its superior technology, Wall Street adoption, and its limited supply. The Bitcoin price outlook is benefiting from the September interest rate cut, the current US government shutdown, and the expanding M2 global money supply,” Zalan told BeInCrypto.

Yet, the survey shows the financial layer around Bitcoin remains underdeveloped.

If even a fraction of holders deploy their BTC into yield or liquidity protocols, the BTCFi sector could unlock billions in dormant capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Increasing Need for Expertise in AI and Computational Fields: Discovering Investment Prospects in Educational and Training Platforms

- Farmingdale State College (FSC) expands computing programs and partners with Tesla/Amazon to address AI/data science demand. - Edtech firms like Century Tech use AI for personalized STEM learning, aligning with FSC’s need to scale enrollment while maintaining rigor. - Global AI education market projected to reach $12.8B by 2028 (33.5% CAGR), driven by corporate/university collaborations like SUNY-NY Creates TII. - Investors face risks in regulatory scrutiny and curriculum obsolescence but gain opportunit

Magic Eden to expand $ME buybacks in 2026 using revenue from Swaps, Lucky Buy, and Packs

The Emergence of Hyperliquid (HYPE): Analyzing the Latest Market Rally

- Hyperliquid (HYPE) dominates 73% of decentralized derivatives market in 2025 via liquidity innovations and hybrid trading structures. - HIP-3 protocol and two-tier architecture drive $3.5B TVL, enabling EVM compatibility and 90% fee cuts to attract DeFi projects. - Platform's 71% perpetual trading share reflects strategic buybacks ($645M in 2025) and 78% user growth amid shifting capital toward on-chain infrastructure. - Hybrid model challenges CEX dominance while facing aggregator risks, but institution

The Emergence of Tokens Supported by MMT and Their Influence on Financial Systems in Developing Markets

- MMT-backed tokens leverage blockchain to tokenize sovereign debt, real estate , and carbon credits, reshaping emerging market fiscal strategies. - Tokenized bonds enable local-currency issuance with smaller denominations, as demonstrated by Hong Kong's 2025 digital green bonds and OCBC's commercial paper program. - Central banks integrate blockchain tools for real-time liquidity adjustments, while programmable features like inflation-linked coupons enhance fiscal flexibility in volatile economies. - Chal