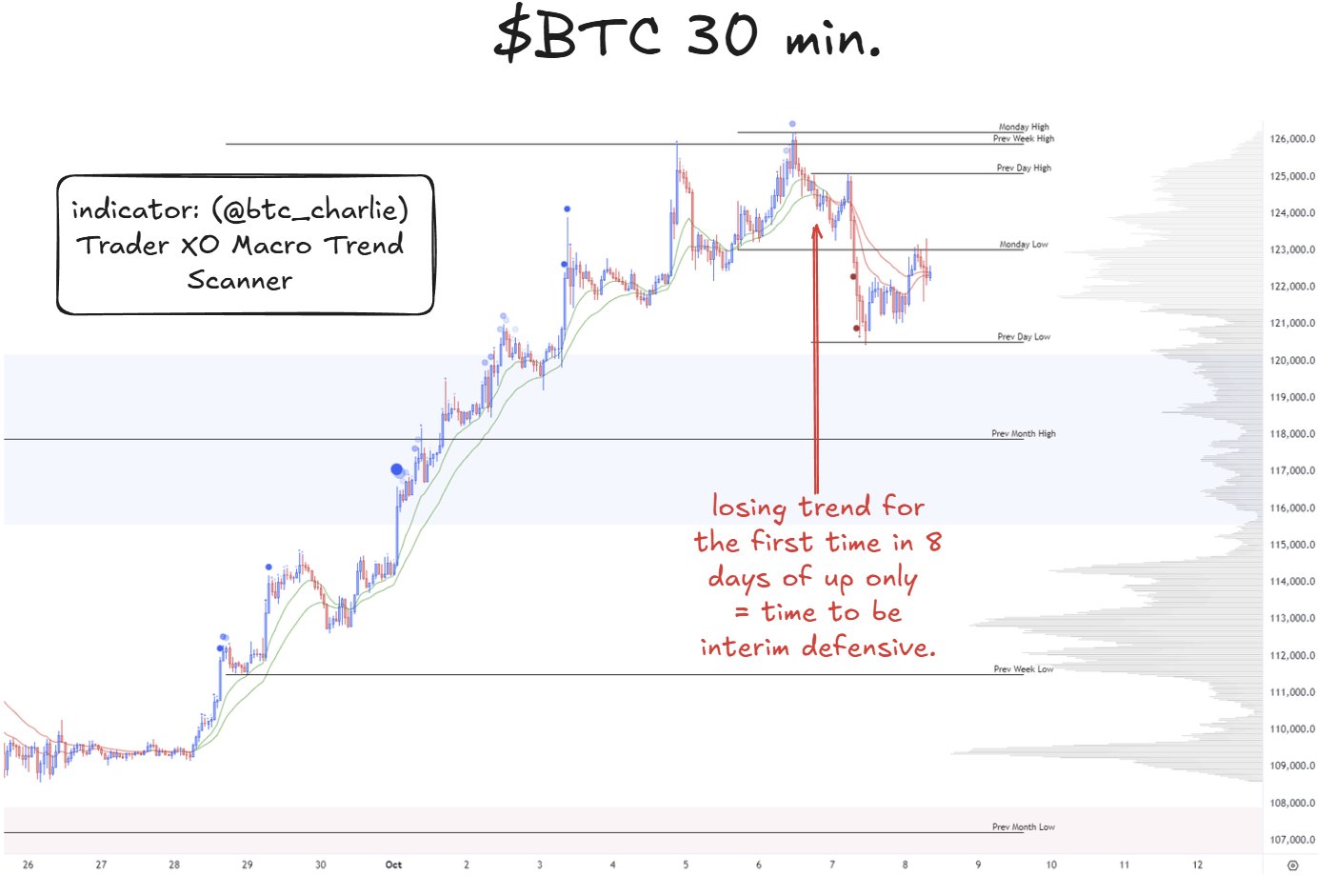

As the financial world anticipated the release of the Fed minutes, Bitcoin $122,918 was trading at $123,800. Historically, October has been a favorable month for cryptocurrencies, often witnessing notable surges. This trend seems poised to repeat itself, although not for every cryptocurrency . While some coins may continue to climb, INJ Coin appears to be preparing for a downturn, as Martinez sets a target at $9.

INJ Coin Target

The well-known cryptocurrency analyst Ali Martinez recently analyzed the current market trends for INJ Coin, forecasting a potential dip to $9. The reasoning lies in the recent breakdown of a previously optimistic triangular pattern and the inability of INJ bulls to reclaim support levels. This potential downturn suggests that not every altcoin will experience a positive cycle, raising the question of whether INJ Coin will rebound. Only time will reveal its fate.

The scenario could become challenging, as a sharp drop in INJ would require Bitcoin to briefly dip below $117,000, creating stress for other altcoins as well. When these analyses were made, Bitcoin was climbing towards $124,000, mere minutes before the Fed minutes were released.

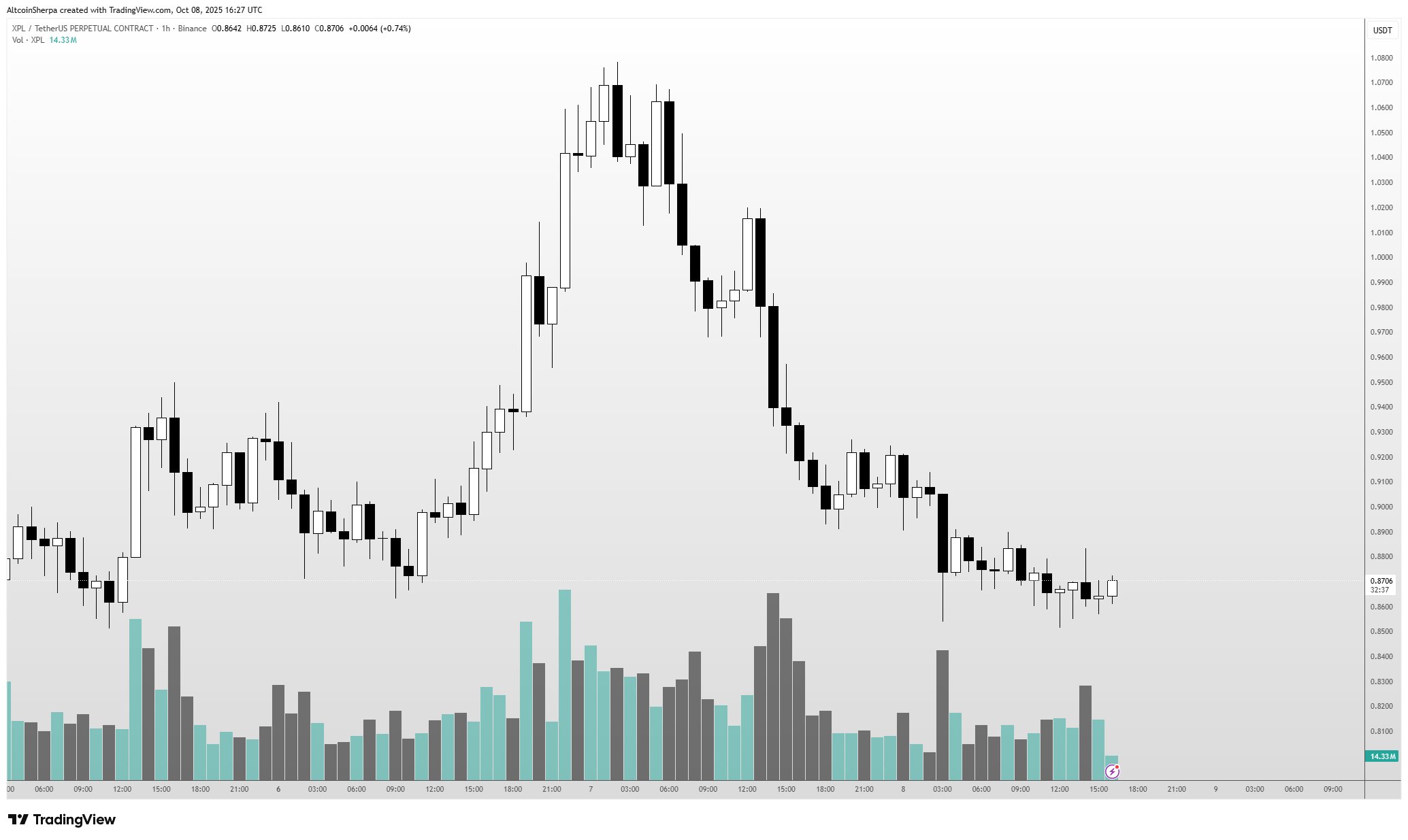

XPL Coin and Predictions

Sherpa has a keen focus on XPL Coin. The Plasma project made a strong debut, showcasing that success is not solely about price but also about the team’s capabilities and financial backing. Sherpa sees XPL Coin in a potential opportunity zone, driven by these factors.

“If you are highly certain of an upward trend, why cash in prematurely? Opportunity cost is key.

For instance, consider XPL. It seems 75% of CT+ is heavily invested in long positions. Will it recover? Most likely, yes.”

For altcoin investors, the sage advice is to simplify their strategies. Many investors focus on too many variables, often leading to losses. Stoic advocates for a straightforward approach.

“In trending markets, 99.99% of individuals could lose less by following basic indicators or strategies like MA/EMA, using plain charts.

Although based on historical data and considered primitive compared to real-time analysis, it’s a great tool for those who need simplicity in a complex financial world.”