Clearpool secures $400K XPL funding from Plasma for PayFi growth

Key Takeaways

- Clearpool received $400,000 in XPL tokens from Plasma to boost PayFi, its credit infrastructure for stablecoin payments.

- Plasma is a blockchain network focused on improving stablecoin liquidity and facilitating global money movement through its native XPL token.

Share this article

Clearpool, a DeFi protocol focused on embedding credit infrastructure into stablecoin payments, secured $400,000 in XPL funding from Plasma, a blockchain network designed for stablecoin liquidity and global money movement.

The funding uses XPL, the native token of the Plasma network used for incentives and ecosystem growth, to support Clearpool’s expansion of PayFi, a credit layer concept that provides short-term financing for stablecoin-settled payments like remittances and merchant flows.

Clearpool partnered with Plasma to launch cpUSD, Clearpool’s permissionless yield-bearing stablecoin backed by PayFi credit vaults, and PayFi Vaults on the recently launched Plasma mainnet beta.

Plasma’s mainnet launch positions it as infrastructure for stablecoin velocity, with Clearpool integrating to provide credit rails for emerging payment ecosystems.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

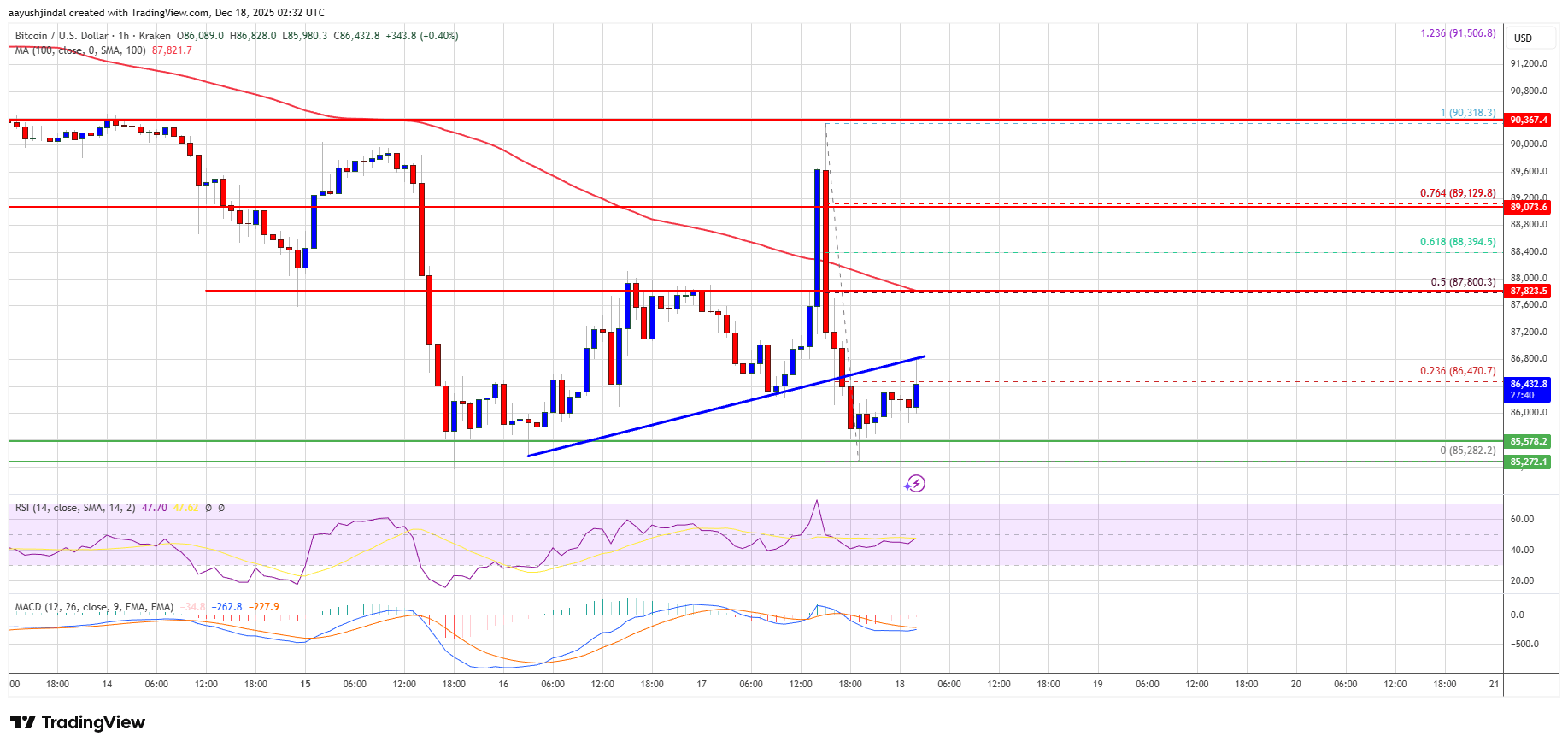

Bitcoin Price Rejection Sparks Bearish Pressure—Support Under Threat?

Instacart’s AI-driven pricing tool attracted attention — now the FTC has questions

Bitcoin Bearish Funding Rates Persist Across Major CEX and DEX, Coinglass Data Shows