Can EU Sanctions Stop The Russia-Backed Stablecoin’s Shocking Growth?

The EU is considering sanctions on A7A5, a ruble-backed stablecoin thriving despite US restrictions and mounting legal scrutiny. Its unclear origins and rapid growth challenge global regulators struggling to curb illicit crypto flows.

New reports claim that the EU is considering sanctions against A7A5, a ruble-backed stablecoin. The firm has been circumstantially linked to international money laundering, but there are many unanswered questions.

Meanwhile, the token has been growing in prominence despite US sanctions, moving $6 billion since August. A7A5 is now the world’s largest non-dollar stablecoin, and it’s making crucial inroads with the crypto community.

Sanctions Against A7A5?

Since a Kyrgyzstani firm launched A7A5 a few months ago, the asset has attracted a lot of controversy. Although its direct connections to the Russian government are unclear, A7A5 has surfaced in international money laundering and alleged election interference in Moldova.

To that end, the EU is considering new sanctions against A7A5, a few weeks after the US took similar measures. However, it’s unclear how much this will accomplish.

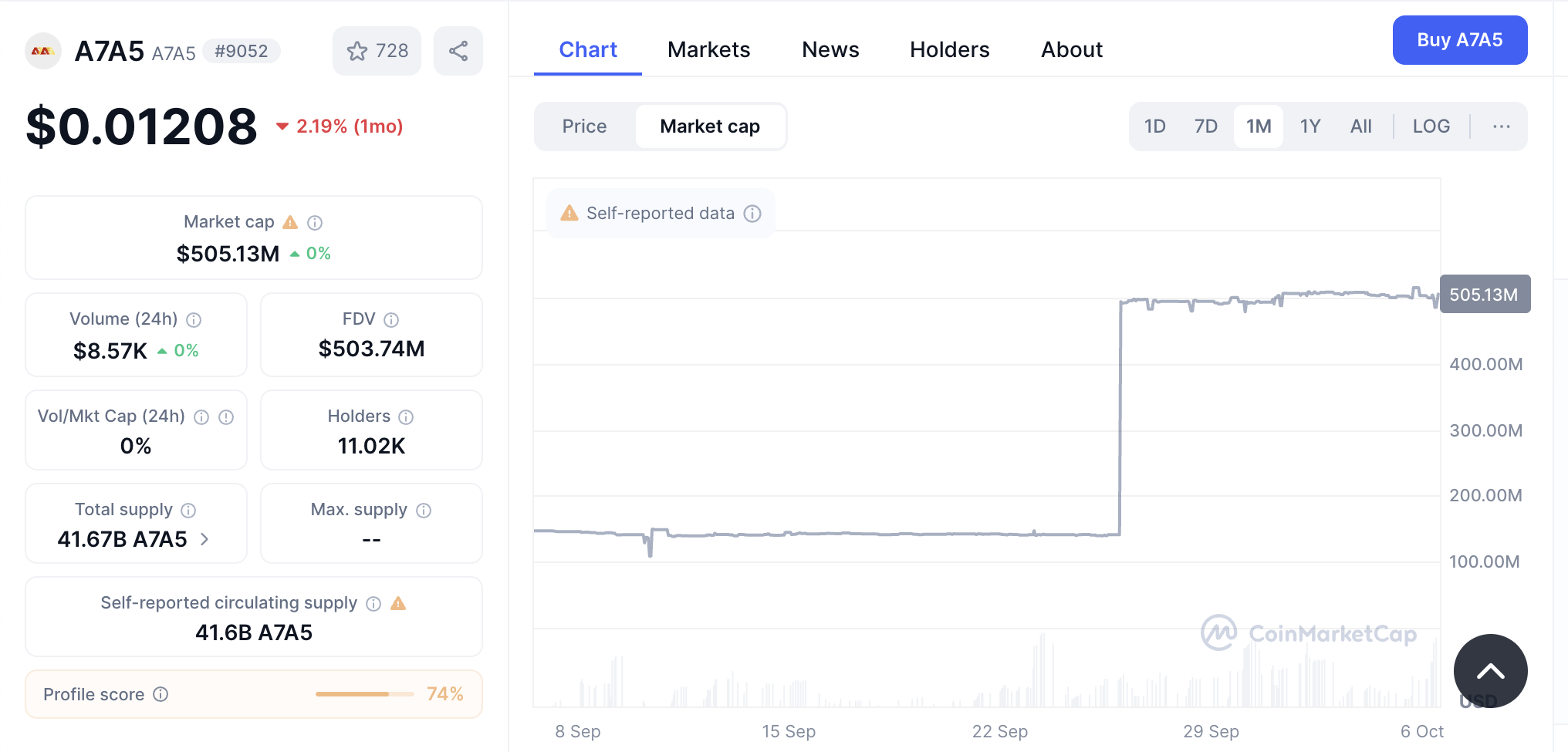

Even though legal pressure is mounting from leading financial markets, A7A5’s market cap has increased, making it the world’s largest non-dollar stablecoin:

A7A5 Market Cap (Self-Reported). Source:

CoinMarketCap

A7A5 Market Cap (Self-Reported). Source:

CoinMarketCap

Rising Prominence in Crypto

Indeed, despite the threat of sanctions, A7A5 has been making numerous inroads with the international crypto community. The firm was recently listed as a platinum sponsor at TOKEN2049, a major industry conference.

Although community backlash and questionable legal status caused organizers to revoke its sponsor designation, it still played a prominent role.

Furthermore, we have one important piece of data regarding the efficacy of sanctions against A7A5, and it’s not promising.

Since the US sanctions took place in August, the token has reportedly moved $6 billion from blacklisted wallets, demonstrating its ability to maintain normal operations.

Could a Russian Audit Help?

Some analysts have pointed to an upcoming audit that the Bank of Russia will conduct on its crypto industry next year. There are a few fingerprints connecting A7A5 to the Russian state, but no clear proof of involvement.

If Western sanctions can’t deter A7A5, maybe its own alleged patron could raise uncomfortable questions.

However, a look at Russian media outlets paints a different story. This 2026 survey will primarily concern TradFi’s interactions with Web3, including investments and loans into crypto firms.

It doesn’t seem like this measure is intended to audit the crypto companies themselves.

Moreover, on paper, A7A5 is based in Kyrgyzstan, not Russia. Although this stablecoin is backed by the ruble and circulated widely through Russian businesses, this jurisdictional issue may provide a fig leaf.

If the Bank of Russia doesn’t wish to uncover and publicize any fiscal inconsistencies, it has adequate reasons not to do so.

In other words, we’re in a wilderness of mirrors between these unanswered questions, and crypto money laundering techniques are improving all the while.

The EU may well sanction A7A5, but it’s unclear how effective this will be. This stablecoin may continue powering cross-border illicit transactions for the foreseeable future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.