Bitcoin Hits New $126,000 Record While Retail Engagement Sleeps

Bitcoin’s record-breaking rally to $126,000 signals a new era led by institutions, not retail traders. Analysts now question whether this shift has permanently rewritten the rules of crypto market behavior.

Bitcoin reached a new all-time high, breaking $126,000 despite an apparent lack of engagement from retail traders. Corporate inflows overwhelmed a huge volume in short positions, creating an unusual situation.

If institutional investors really are directing the valuation of BTC, it might invalidate years of data on crypto price cycles. The future may be harder to predict than ever before.

Bitcoin’s Unusual All-Time High

Bitcoin hit an all-time high yesterday, but this apparently hasn’t slowed the train down one bit. Throughout 17 years of price data, new heights typically recede somewhat, with records manifesting as brief spikes on an upward trend.

Profit-taking and other hedging activities often cause this, pulling prices back despite fierce enthusiasm.

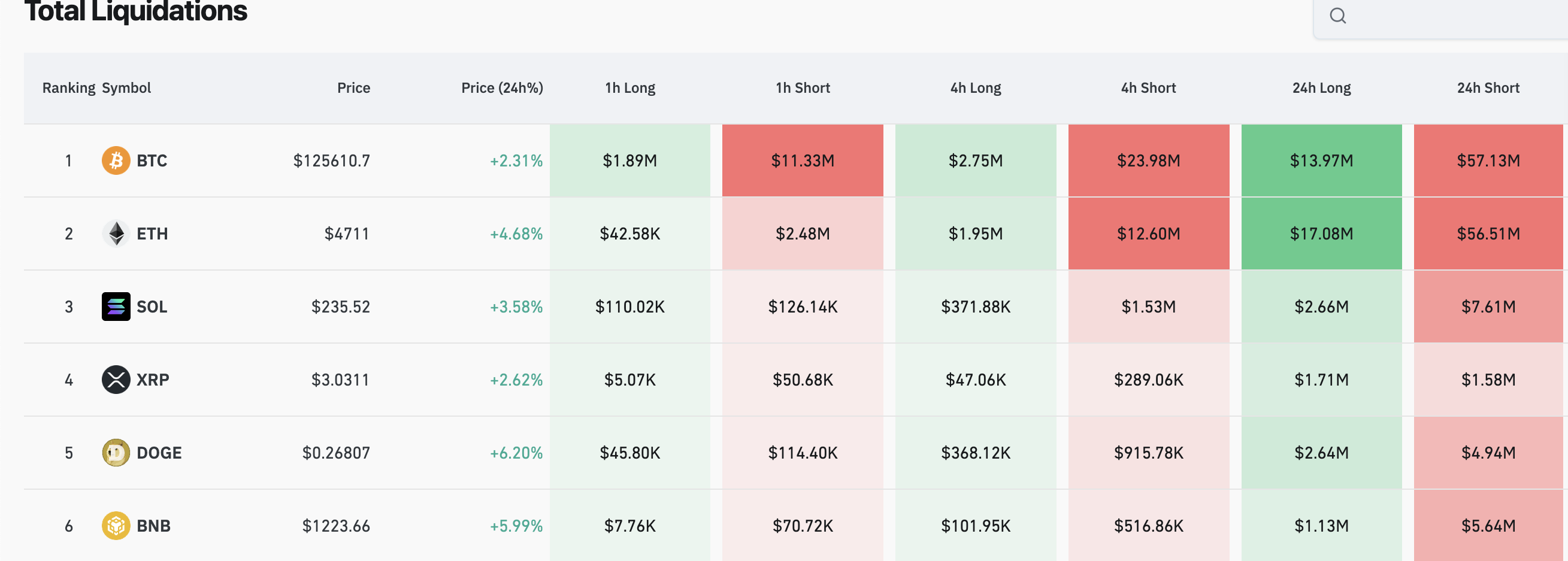

Today, however, has been a little different. BTC did recede a little after yesterday’s all-time high, but investment continued, causing massive liquidations among short positions.

Ethereum is also flirting with a new record price level, but Bitcoin’s rise to $126,000 is causing the biggest impact:

Bitcoin and Altcoin Liquidations. Source:

Bitcoin and Altcoin Liquidations. Source:

Although this should ostensibly be bullish, Bitcoin’s newest all-time high is causing a little consternation among analysts. Some experts have feared that corporate inflows are powering this growth, representing a broader narrative shift from expectation of future gains to monetary panic.

Today’s new data seems to further corroborate these concerns. Bitcoin ETF investment is flourishing, and digital asset treasuries reported $1.3 billion in acquisitions last week.

This impressive figure doesn’t even include MicroStrategy or Metaplanet. Meanwhile, how is retail sentiment reacting to Bitcoin’s new all-time high?

A New Price Cycle?

These pieces of information, especially when paired with the liquidation data, could present a concerning sign. “Concern” might be an overstatement; it’s hard to be outright bearish when Bitcoin hits an all-time high.

Still, today’s market raises an interesting question: how can we predict future price moves in these unprecedented circumstances?

Ever since the SEC approved BTC ETFs in 2024, analysts have been wondering if institutional inflows will permanently break well-established price dynamics.

Bitcoin hit two all-time highs in two days without much retail participation, which seems like an aberration if ever there was one. Where do we go from here?

If the rules really have changed forever, we’ll need to independently verify each time-tested industry truism to see if it still applies in 2025. Is Bitcoin actually a good inflation or recession hedge?

Can we continue trusting that crypto winters will always end, even if it takes multiple years? Your guess might be as good as mine.

That sort of chaos could be very unsettling and have deleterious impacts on investor confidence. Hopefully, we’ll get some answers soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: MUTM Soars by $19M While MegaETH Plummets: Real Performance Outshines Hype in the Evolving Crypto Landscape

- Mutuum Finance (MUTM) raised $19M in Phase 6 presale, with 250% price growth since 2025 launch and 90% allocation completed. - KuCoin secured AUSTRAC and MiCA licenses, expanding compliance reach across 29 EEA countries while acquiring payment firms to strengthen institutional credibility. - Bitcoin surged past $90K amid Fed rate cut speculation, contrasting MegaETH's $1B token sale collapse due to technical failures, highlighting execution risks in volatile markets. - Crypto exchanges pledged $3.19M for

Bitcoin News Update: Triple Bearish Divergence in Bitcoin Suggests ETF Rally May Be Unstable

- Bitcoin trades near $86.6K, down 31.3% from October peak amid $3.5B November ETF outflows and $2B liquidations. - Technical analysis flags "triple bearish divergence" as price hits higher highs while momentum indicators weaken. - Spot Bitcoin ETFs see $238M inflows but face $90K resistance; Ethereum ETFs gain $175M yet ETH remains below $3,000. - Key support at $85K risks accelerating sell-off to $80K, with 50–60% retracement targeting $34,409–$44,100 if bearish pattern completes.

CME Outage Highlights Cooling Systems as the Global Market’s Major Vulnerability

- CME's 2025 outage exposed cooling systems as critical vulnerability, halting 90% of global derivatives trading via CyrusOne data center failure. - Frozen prices in WTI, S&P 500 futures, and gold triggered erratic movements, with silver dropping $1 amid widened bid-ask spreads. - Despite robust financials ($1.54B revenue Q3 2025), CME faces infrastructure scrutiny as crypto futures growth plans clash with outage risks. - 24/7 crypto trading expansion scheduled for 2026 highlights need for resilient system

Gold Climbs as Fed Faces Uncertainty Over December Rate Cut Amid Limited Data

- Gold prices hit $4,120/oz as Fed rate cut expectations dropped to 33% due to delayed November jobs data, triggering market uncertainty. - JPMorgan and Goldman Sachs project gold to reach $5,055/oz by 2026, citing central bank demand and potential Fed policy neutrality. - Asian markets showed mixed performance while U.S. equity futures wavered, reflecting fragility amid geopolitical tensions and Fed leadership speculation. - Geopolitical risks, including U.S.-Ukraine peace talks and China's semiconductor