Bitcoin’s 2021 Playbook Shows The Final Price Target For This Bull Cycle

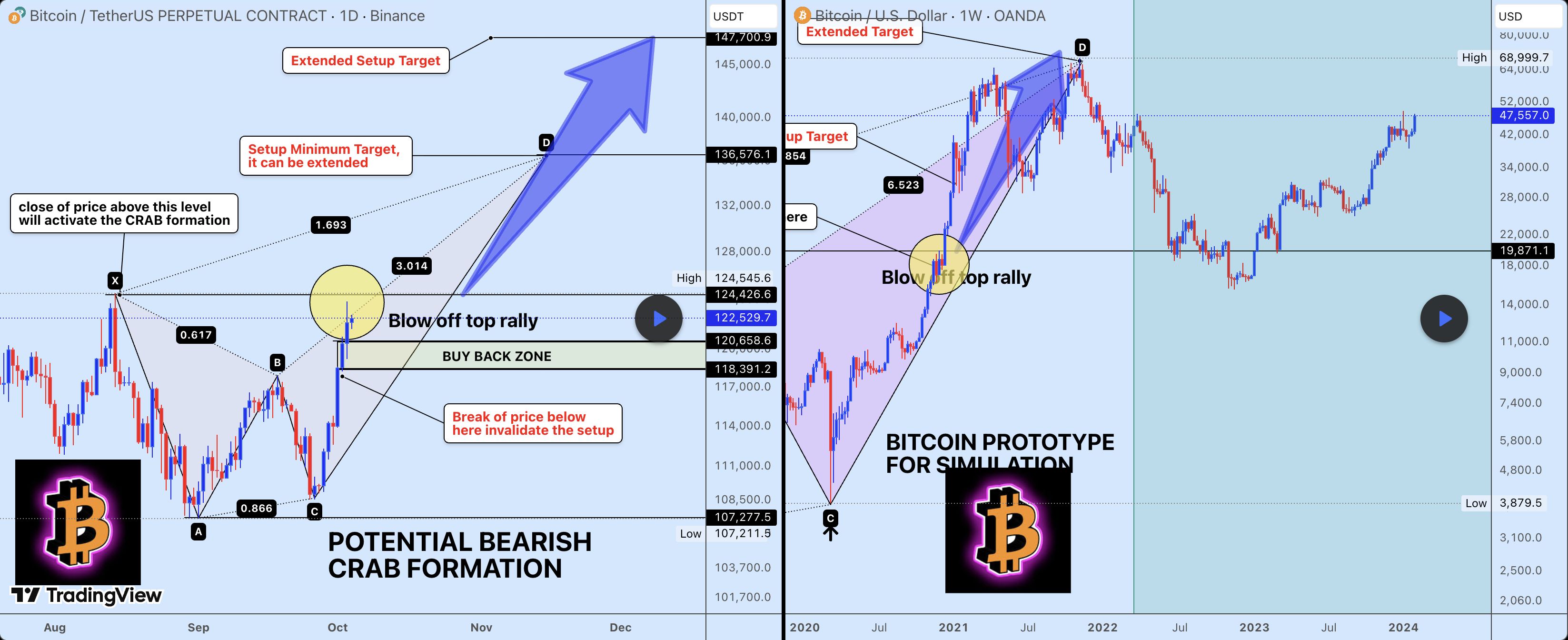

While the Bitcoin price seems to have deviated completely from the four-year cycle that dictated the previous bull and bear markets, there are still some similarities that remain that suggest that it could still play out in a similar way. The major similarity that has emerged is the formation of a bearish crab pattern back in 2021, and now, the same pattern has reappeared. Thus, taking a look at the direction of the 2021 formation could give an insight into where the Bitcoin price is headed next from here.

The Pattern That Triggered The Bitcoin Price Explosion

In an analysis, crypto analyst Weslad was the one who pointed out that the Bearish Crab Pattern had returned, and this was formed on the daily chart as well. Interestingly, the current formation looks eerily similar to the way it formed back in 2021, suggesting that the resulting trend could play out the same.

Back in 2021, when the Bearish Crab Pattern came up, the result was a price explosion that sent the Bitcoin price toward its $69,000 all-time high. This “Blow-off top” rally is usually the last rally in a bull market, and its end often signals the start of the next bear market.

With this pattern, though, there are a number of targets to watch out for that could show where the price is headed next. The first of these is that the Bitcoin price would need to complete a daily close above the $124,545 level, and this is known as the Activation Trigger.

Next in line is what Weslad refers to as the “Buy The Dip Zone”. This would be the ideal price range to enter Bitcoin in the case of a retrace, and this lies between $118,000 and $120,000. A dip toward these levels is nothing to worry about, as it means that the bulls are still in control.

Both of the zones outlined above, if held, would see the Bitcoin price continue its bullish rally. If the final, explosive leg does play out as it did back in 2017-2021, then the Crab pattern suggests that the Bitcoin price will at least go to $136,000, with an extended target of $147,000, and the possibility that it goes further toward $160,000.

However, the final target is the bearish one that could send the Bitcoin price crashing back downward, and it lies at $107,000. According to the crypto analyst, a break below this level would invalidate the entire bullish thesis, calling it the “line in the sand.” Weslad explains that “The invalidation level at $107K is crucial. A break below there means the setup is broken, and we must re-assess.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coins Achieve Recognition as Institutional Investors and ETFs Drive Market Changes for 2025

- WLFI's acquisition of Solana-based meme coin SPSC triggered a 139.8% price surge, highlighting institutional interest in meme tokens. - Binance's listing of Dank Penguin and BNBHolder boosted their market caps past $5 million, showcasing exchange-driven momentum in meme coin ecosystems. - Dogecoin's ETF debut via Bitwise's BWOW and Grayscale's GDOG signals growing institutional validation, despite mixed initial performance compared to Solana/XRP ETFs. - 2025 could solidify meme coins and altcoin ETFs as

Bitcoin News Today: Bitcoin Whale Bets $84 Million—Sign of Faith or Disaster Looming?

- A Bitcoin whale opened an $84.19M 3x leveraged long on Hyperliquid after securing $10M in profits, amplifying market volatility and liquidity risks. - Other whales added 20x-25x leveraged positions totaling $75M in BTC/ETH, reflecting heightened confidence in short-term price resilience amid December 2025's 3.64% BTC and 3.79% ETH gains. - Analysts debate the rally's sustainability, citing weak Sharpe ratios (-36% Bull-Bear Index), 30% drawdown from peaks, and structural liquidity challenges favoring ran

Hyperliquid News Today: Avici Soars 1,700%—Is It MoonPay Buzz or Genuine Market Movement?

- Avici (AVICI) surged 1,700% amid speculation of a MoonPay partnership, now valued at $90.7M with $2.5M liquidity. - Analysts highlight its neobank narrative, competing with projects like Cypher while facing $50–$500 price targets implying $1B–$5B valuations. - Security risks persist, exemplified by Upbit's $36M hack and Trezor CEO's warnings on exchange vulnerabilities. - Avici's success hinges on balancing innovation with compliance, regulatory clarity, and execution amid a crowded crypto debit card mar

Bitcoin News Today: Bitcoin Recognized as a Mainstream Asset as Nasdaq Lists IBIT Alongside Leading ETFs

- Nasdaq's ISE proposes tripling Bitcoin options limits for BlackRock's IBIT to 1 million contracts, aligning it with major ETFs like EEM and GLD . - The move reflects IBIT's dominance as the largest Bitcoin options market by open interest, driven by institutional demand for hedging and speculation. - Analysts highlight the normalization of Bitcoin as a tradable asset class, with unlimited FLEX options and JPMorgan's structured notes signaling broader institutional adoption. - Regulatory alignment with gol