Bitcoin hits all-time high as USD on track for worst year since 1973: Analyst

Precious metals and Bitcoin (BTC) are rising to new all-time highs, alongside risk assets like stocks, as the US dollar (USD) is on track for its worst year since 1973, signaling a “generational” macroeconomic shift, according to market analysts at The Kobeissi Letter.

The S&P 500 stock market index is up over 40% in the last six months, BTC hit a new all-time high of over $125,000 on Saturday, and gold is also trading at all-time highs — $3,880 per ounce at the time of this writing — nearing $4,000, Kobeissi Letter wrote.

“The correlation coefficient between gold and the S&P 500 reached a record 0.91 in 2024,” the analysts wrote, adding that this unusual correlation between safe-haven assets and risk assets indicates that markets are now pricing in a “new monetary policy,” Kobeissi added:

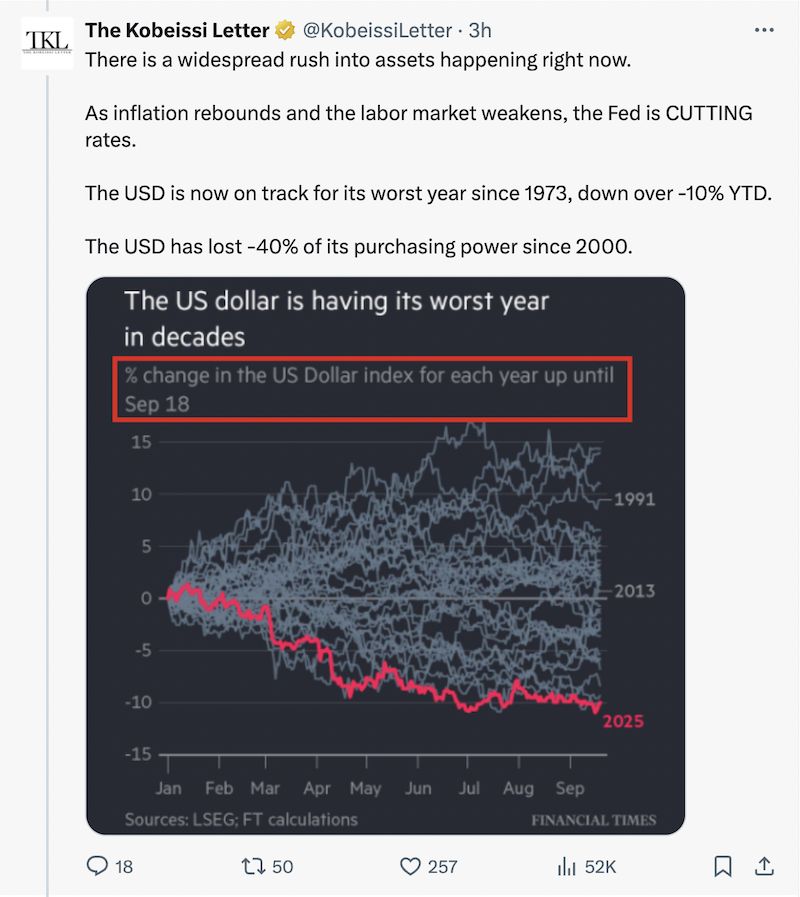

“There is a widespread rush into assets happening right now. As inflation rebounds and the labor market weakens, the Federal Reserve is cutting rates. The USD is now on track for its worst year since 1973, down over 10% year-to-date. The USD has lost 40% of its purchasing power since 2000.”

The analysis came amid a US government shutdown, massive downward revisions of US jobs numbers that signal a weakening labor market, interest rate cuts, and growing concern over the eroding value of the dollar, which are all positive price catalysts for BTC.

Related: Bitcoin corrects from $125K all-time high: Where will BTC price bottom?

Analysts agree new BTC all-time high is fueled by macroeconomic factors

BTC’s rally to a new all-time high was driven by macroeconomic factors, including the recent US government shutdown, according to Fabian Dori, chief investment officer at global digital asset bank Sygnum.

The US government shutdown that began on Wednesday closed down operations at regulatory agencies and bureaucracies entirely or forced them to operate on a bare bones budget and minimal staff.

The “political dysfunction” stemming from the shutdown has renewed investor interest in BTC as a store-of-value monetary technology, as faith in traditional institutions falters, Dori told Cointelegraph.

Magazine: Scottie Pippen says Michael Saylor warned him about Satoshi chatter

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.