NFT sales double to $256m, Hypurrr tops the list

NFT sales volume more than doubled, surging by 103.11% to reach $256.9 million. This is a notable turnaround from last week’s $84.6 million in sales volume.

CryptoSlam data shows:

- The number of NFT buyers jumped by 18.25% to 694,348

- Sellers increased by 17.77% to 584,235.

- NFT transactions dipped by 8.67% to 1,874,619.

Bitcoin’s ( BTC ) rally to the $122,000 level has energized the entire crypto market. Ethereum ( ETH ) has followed suit, climbing to $4,500.

The global crypto market cap now stands at $4.2 trillion, up from last week’s $3.78 trillion. This bullish momentum has spilled over into the NFT sector, which has posted impressive gains.

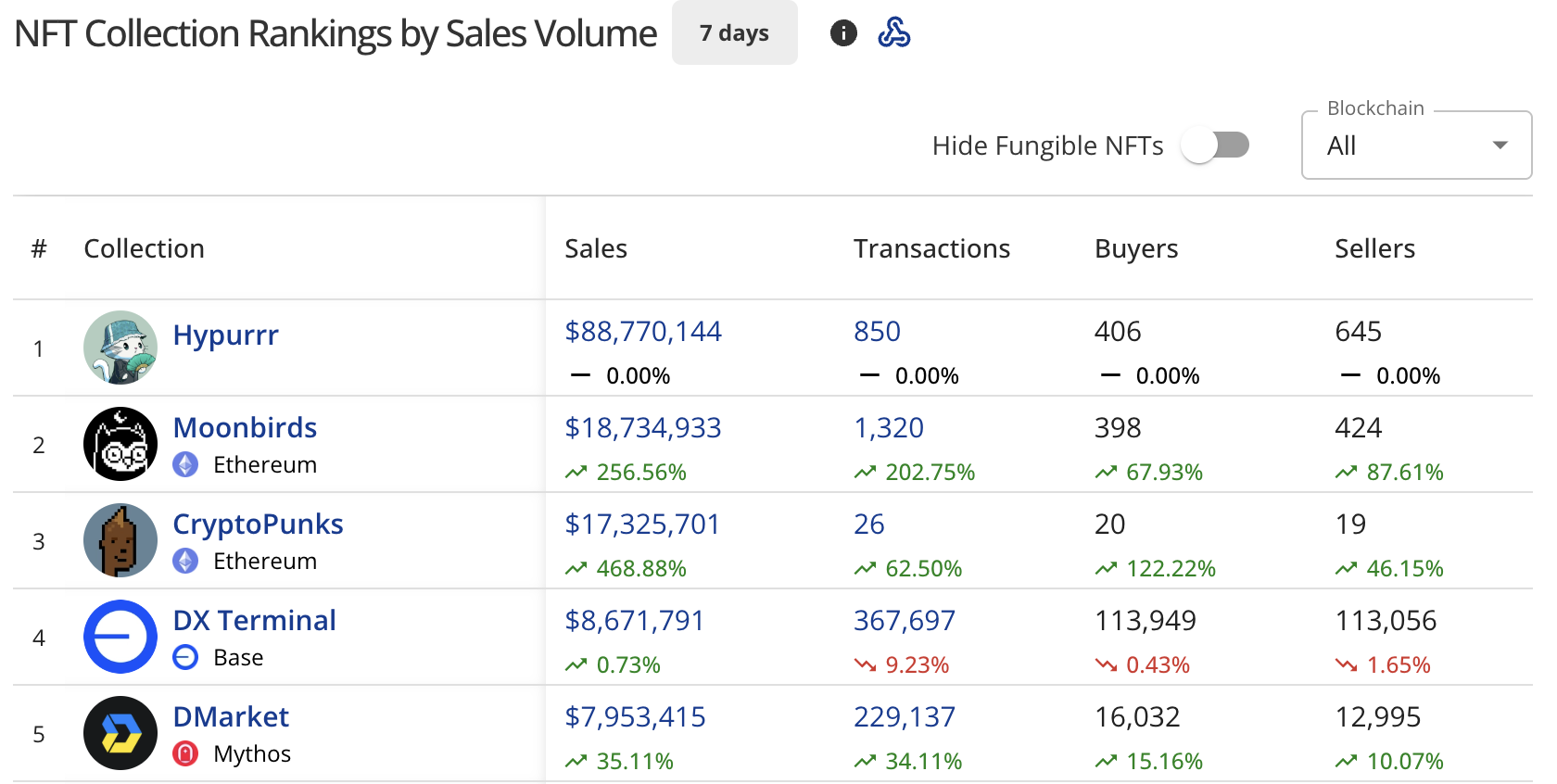

Hypurrr dominates NFT collections

The Hypurrr collection has emerged as the top performer this week, generating $88.77 million in sales across 850 transactions.

The collection attracted 406 buyers and 645 sellers. Hypurrr also dominated the top individual NFT sales, occupying four of the top five spots.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Moonbirds secured second place with $18.72 million in sales, posting a 254.57% increase. The Ethereum-based collection saw 1,319 transactions, with 398 buyers and 424 sellers participating.

CryptoPunks claimed third position at $17.33 million, recording a 468.88% surge. The collection had 26 transactions, with 20 buyers and 19 sellers.

DX Terminal on the Base blockchain came in fourth with $8.67 million in sales, up 0.73%. The collection processed 367,697 transactions and attracted 113,948 buyers.

DMarket rounded out the top five with $7.95 million in sales on the Mythos blockchain, up 34.95% from the previous week.

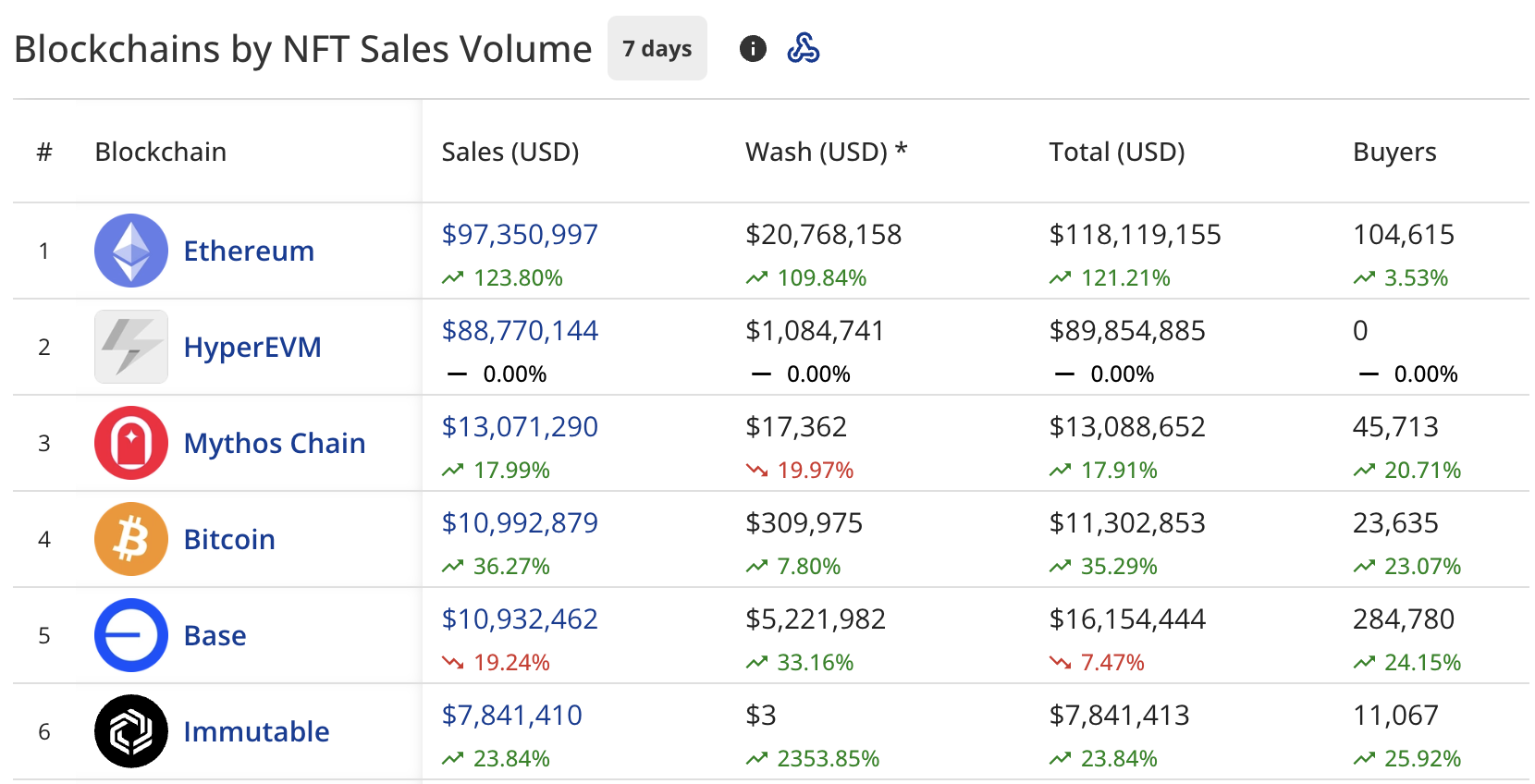

Ethereum leads blockchain rankings

Ethereum maintained its position as the leading blockchain for NFT sales, recording $97.4 million in volume, up 124.35% from last week’s $28.3 million.

The network processed wash trading worth $20.84 million, bringing its total to $118.24 million. The platform saw 104,625 buyers, up 3.55%.

HyperEVM took second place with $88.77 million in sales, driven entirely by the Hypurrr collection’s performance. Interestingly, the blockchain recorded zero buyers in the tracked period.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Mythos Chain ranked third with $13.07 million, up 17.69% from last week’s $10.9 million. The blockchain attracted 45,713 buyers, up 20.71%.

Bitcoin placed fourth at $10.97 million, which is a 36.20% increase from last week’s $14.12 million. The network saw 23,635 buyers, up 23.07%.

Base dropped to fifth position with $10.92 million, down 19.71% from the previous week. The blockchain had 284,780 buyers, up 24.15%.

Solana ( SOL ) landed in seventh place with $7.74 million, up 56.23% from last week’s $16.1 million. The blockchain recorded 56,811 buyers, up 18.33%.

Top individual sales

CryptoPunks #1563 led individual sales at $12.05 million (2745 ETH), sold two days ago.

Four Hypurrr NFTs followed:

- Hypurrr #3926 sold for $7.86 million

- Hypurrr #175 sold for $7.82 million

- Hypurrr #1131 sold for $7.63 million

- Hypurrr #3460 sold for $6.46 million

All four Hypurrr sales occurred five days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Japan's Bond Turmoil Triggers Worldwide Crypto Sell-Off Amid Yen Carry Trade Reversal

- Japan's $135.4B stimulus package triggered a 3.41% surge in 30-year bond yields, destabilizing the $20T yen carry trade and sparking global crypto/stock selloffs. - Rising yields threaten Japan's 230% GDP debt load with higher servicing costs, creating a "debt death spiral" risk as BOJ hesitates to tighten policy. - Forced deleveraging by financial institutions intensified Bitcoin's 26% drop, with Ethereum/XRP/Solana also falling 3-5.6% amid margin calls and capital repatriation. - Upcoming 40-year bond

Bitcoin News Today: Bitcoin ETFs See $523M Outflow as Investors Weigh Fear Against Long-Term Strategies

- BlackRock's IBIT ETF recorded a $1.26B net outflow in Nov 2025, its largest redemption since 2024 launch. - Bitcoin price fell 16% to $52, triggering $2.59B outflows across 11 spot ETFs as bearish options demand surged. - Put-call skew hit 3.1% (7-month high), reflecting heightened pessimism and capitulation pressures in Bitcoin's price action. - Gold ETFs gained $289M as investors sought safe havens, contrasting with $1B inflows to tech/healthcare sector funds. - Year-to-date Bitcoin ETF inflows ($27.4B

YFI Drops 1.7% After Subpar Weekly Results as Edgewater Showcases AI-Powered Wi-Fi at Canada’s Leading Semiconductor Conference

- Edgewater Wireless will showcase AI-powered Wi-Fi 8 solutions at Canada’s premier semiconductor symposium in November 2025. - The company’s CEO will highlight ultra-reliable wireless roadmaps and a $2.4M commercialization initiative supported by $921K in government grants. - Its patented Spectrum Slicing technology claims 10x performance gains and 50% latency reduction, aligning with Canada’s semiconductor self-sufficiency goals. - Despite a 11.85% monthly stock decline, Edgewater positions itself at the

Ethereum Updates Today: Ethereum Transforms into Digital Bonds, Soaring Above $3,000 Driven by Institutional Interest

- Ethereum surged past $3,000 in late 2025 driven by institutional demand, ETF approvals, and technical upgrades like the Fusaka upgrade. - BlackRock's staked Ethereum ETF attracted $13.1B inflows since 2024, reclassifying staked ETH as "digital bonds" for institutional investors. - Over 69 corporations now hold 4.1M ETH in treasuries, but ETF outflows highlight ongoing market differentiation from Bitcoin . - Fusaka's focus on layer-1 scalability aims to redirect economic activity to Ethereum's base layer