Date: Fri, Oct 03, 2025 | 03:45 PM GMT

The cryptocurrency market is showing strength as Bitcoin (BTC) and Ethereum (ETH) have surged over 11% and 13% respectively in the past 7 days. Riding this resilience, several altcoins are starting to flash bullish signals — and Ethereum Name Service (ENS) is one of them.

ENS is back in green with 9% weekly gains, but what makes it more interesting is its technical structure, which could be gearing up for a bullish breakout in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

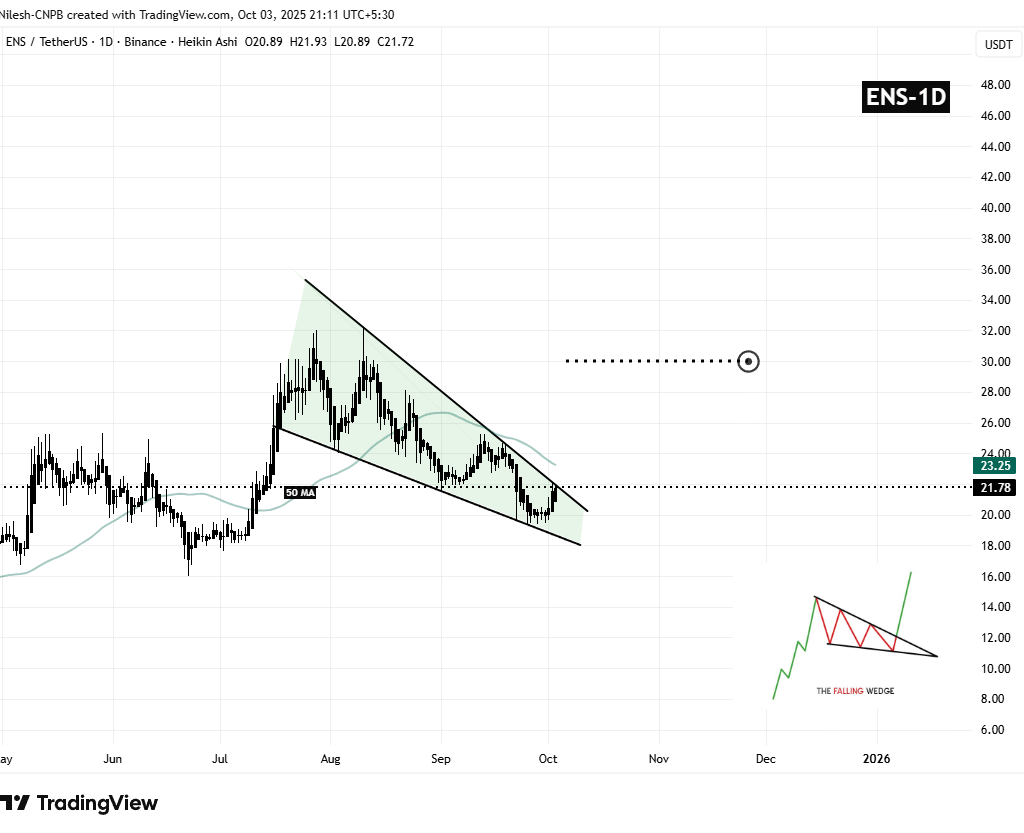

Falling Wedge in Play

On the daily chart, ENS is carving out a falling wedge — a pattern widely recognized as a bullish reversal setup, typically forming at the end of extended downtrends.

During the recent correction, ENS slipped toward $19.37 after facing resistance at the wedge’s upper boundary. Buyers, however, defended this key level strongly, sparking a rebound that has now pushed the token near $21.78.

Ethereum Name Service (ENS) Daily Chart/Coinsprobe (Source: Tradingview)

Ethereum Name Service (ENS) Daily Chart/Coinsprobe (Source: Tradingview)

The tightening wedge indicates that pressure is building, with a decisive move appearing imminent.

What’s Next for ENS?

If bulls manage to push ENS above the wedge resistance and reclaim the 50-day moving average at $23.25, it would likely confirm a bullish breakout. A successful move could set the stage for a rally toward the next major target near $30, aligning with the wedge’s projected move.

On the downside, if the breakout attempt fails, ENS could revisit its wedge support zone before mounting another attempt higher.

For now, momentum looks encouraging, and traders are closely watching as ENS approaches a potential turning point.