Key Notes

- Tether Gold (XAUt) crossed the $1 billion market cap milestone on October 1, becoming the second tokenized gold product to do so.

- The token's value surpassed the threshold with gold's recent rally to a new all-time high of over $3,800 per ounce.

- The market for tokenized gold now features a duopoly between Tether's XAUt and the NYDFS-regulated Paxos Gold (PAXG).

Tether Gold , a digital token backed by physical gold, has officially surpassed the $1 billion market capitalization mark. The milestone, reached on Oct. 1, 2025, highlights growing investor interest in tokenized real-world assets (RWA) and was largely driven by a historic rally in the price of gold, a sentiment recently echoed by Tether’s CEO.

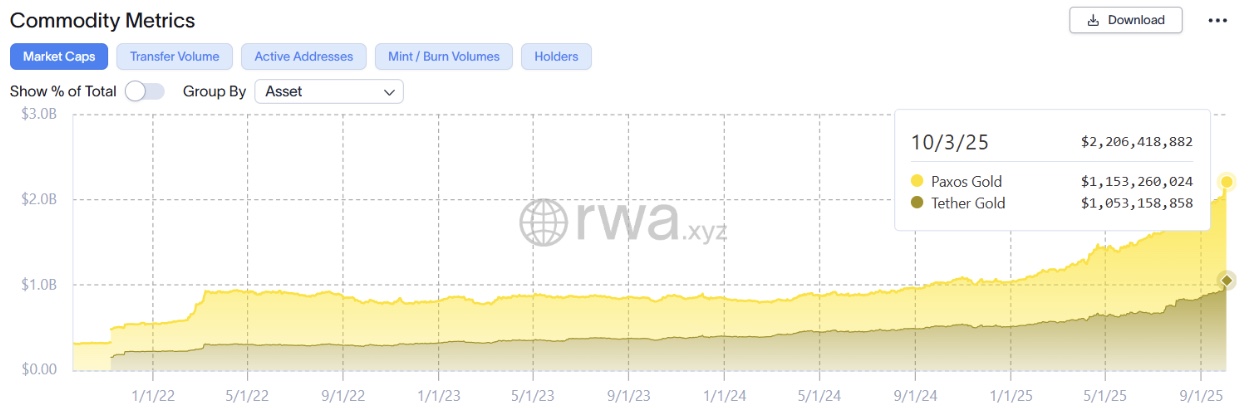

The token’s market value grew directly because of its underlying asset. According to market data aggregator RWA.xyz , the total value of XAUt officially crossed the billion-dollar line at the start of the month. This price surge directly increased the value of the physical gold held in reserve, pushing XAUt’s total value past the threshold. With this achievement, XAUt follows its main competitor, Paxos Gold, which reached the same milestone one month earlier, on September 3.

The success of both tokens solidifies a duopoly in the digital gold space. It also points to a maturing market where investors now have two distinct, billion-dollar options for gaining exposure to gold on the blockchain. The gold backing XAUt is held separately from Tether’s general reserves, which include an additional $8.7 billion in gold bars supporting its other stablecoins, according to its Q2 2025 attestation report.

Two Billion-Dollar Tokens, Two Different Strategies

Chart showing XAUT and PAXG overlaid on a timeline | Source: app.rwa.xyz

One of the most significant distinctions is regulatory oversight. PAXG is issued by Paxos Trust Company, a U.S.-based firm regulated by the New York Department of Financial Services (NYDFS). In contrast, XAUt is issued by a Tether subsidiary licensed in El Salvador, placing it under a different international regulatory framework. This has long been a key part of Tether’s gold strategy , which operates largely outside of the stringent U.S. financial system.

Transparency and reporting also differ. Paxos provides monthly reserve reports for PAXG, which are audited by major accounting firms. Tether provides quarterly attestations for its reserves, including XAUt, conducted by BDO Italia. This reflects the different compliance standards each company adheres to. The discussion around Tether’s reserve holdings has been a consistent topic within the crypto industry.

The two tokens also appear to serve different user bases. Data from RWA.xyz shows that PAXG has a much larger base of over 74,000 holders and a higher daily trading volume of around $67 million. XAUt has a more concentrated ownership, with just over 12,000 holders and a daily volume of about $23 million. This suggests PAXG has stronger adoption among retail users, while XAUt may be favored by larger, crypto-native holders or institutions. These trends are important to watch as record-high gold prices could attract new types of investors to the space.

The two tokens also diverge on a technical level. XAUt boasts significant multi-chain flexibility and now operates on at least six blockchains, including Ethereum, Tron, TON, Arbitrum, Polygon, and Hyperliquid. In contrast, PAXG remains exclusively on the Ethereum blockchain as an ERC-20 token and utilizes a variable fee structure based on transaction size.

next