3 Altcoins To Watch This Weekend | October 4 – 5

SPX, Zcash, and BNB are the top altcoins to watch this weekend. Each faces critical resistance levels that could define their next moves.

With Bitcoin closing in on the ATH, the market seems to be opening up to the altcoins as well. This makes the coming couple of days crucial for crypto tokens as they could be seeing some gains.

BInCrypto has analysed three such altcoins for the investors to watch over this weekend.

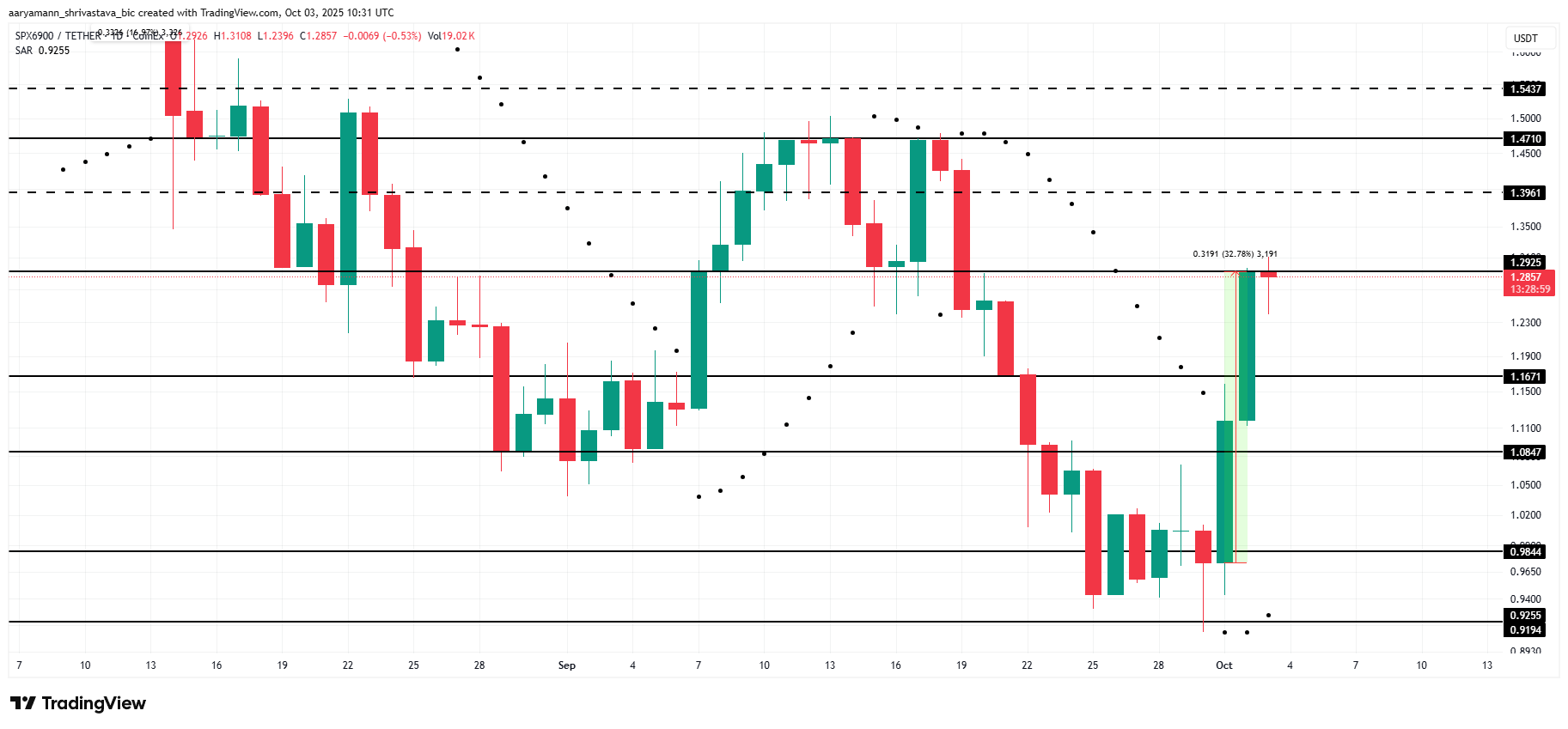

SPX6900 (SPX)

SPX price surged 32.7% in the last 48 hours, making it one of the best-performing meme coins of the week. The token is trading at $1.28, just under the $1.29 resistance level, as investors watch closely for confirmation of a sustained breakout.

Technical indicators suggest bullish momentum is building. The Parabolic SAR is positioned below the candlesticks, signaling an uptrend. If the rally continues, SPX could push past $1.39 and test $1.47, marking a three-week high and erasing recent losses while boosting investor confidence in the token’s recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

SPX Price Analysis. Source:

SPX Price Analysis Source

SPX Price Analysis. Source:

SPX Price Analysis Source

However, downside risks remain. If weekend selling pressure builds, SPX could face a pullback. A decline below the $1.16 support level would weaken the bullish outlook and trigger further caution among traders. Such a drop could undo recent gains.

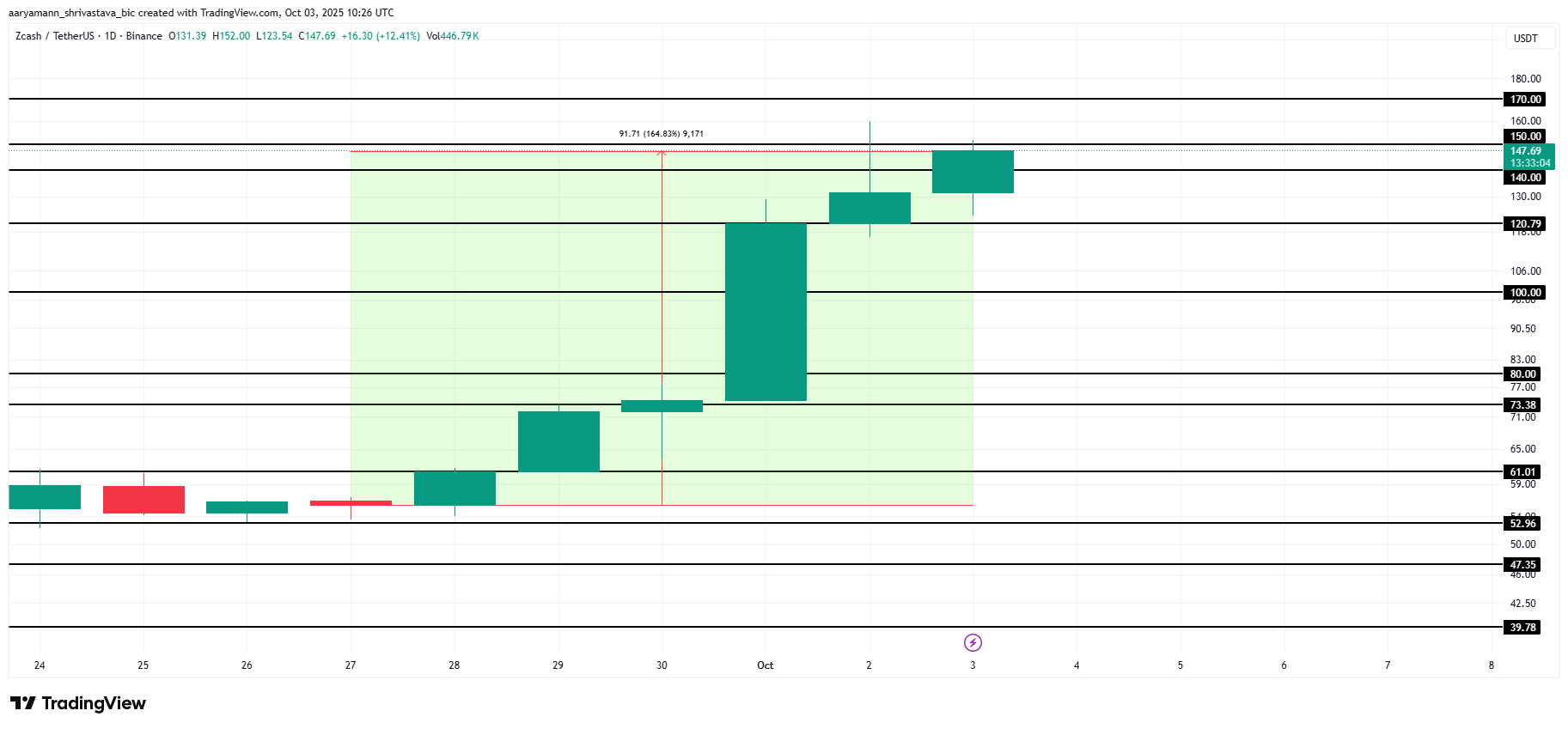

Zcash (ZEC)

Another one of the altcoins to watch this weekend is ZEC, which has emerged as one of the top-performing altcoins in recent days, currently trading at $147. The token surged 164.8% over the past week, marking one of its strongest rallies in years. With momentum building, ZEC is now eyeing the $150 resistance level as its next target.

If ZEC breaches $150, the altcoin could extend its rally toward $170. The surge has already pushed the cryptocurrency to a three-and-a-half-year high, reinforcing bullish sentiment. This milestone positions ZEC for potential further gains, as market optimism grows around its role as a leading privacy-focused digital asset.

ZEC Price Analysis. Source:

ZEC Price Analysis Source

ZEC Price Analysis. Source:

ZEC Price Analysis Source

However, risks of a correction remain. If investors begin taking profits after the recent rally, ZEC could face sharp downside pressure. A drop through $120 would expose the token to further losses, potentially slipping below $100. Such a decline would invalidate the bullish thesis and trigger caution among traders.

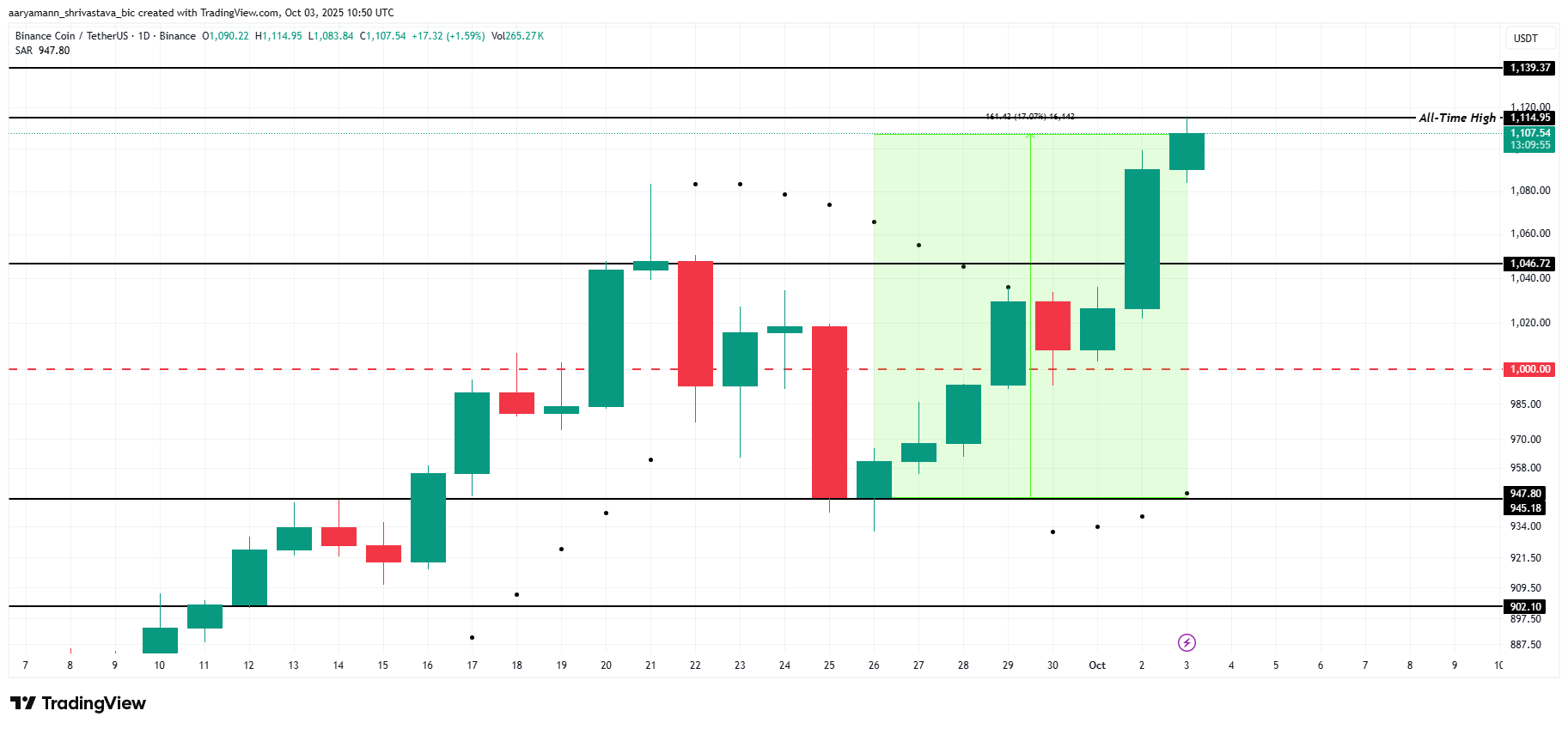

BNB

BNB is among the best-performing top altcoins this week, surging 17% in just seven days. The cryptocurrency is currently trading at $1,107, reflecting strong market demand. This performance reinforces its position as one of the leading assets.

The rally also saw BNB form a new all-time high at $1,114. Technical indicators such as the Parabolic SAR point to an active uptrend. If momentum holds, BNB could breach $1,139 and move even higher, potentially setting another ATH and attracting additional investor interest into the token.

BNB Price Analysis. Source:

BNB Price Analysis Source

BNB Price Analysis. Source:

BNB Price Analysis Source

Still, downside risks remain in play. If profit-taking or bearish market cues emerge, BNB may fall to its $1,046 support level. A breakdown below this floor would open the door to a decline toward $1,000. Any further drop under this level would invalidate the bullish thesis completely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: The 2025–2031 Battle for Bitcoin: Long-Term Confidence Faces Near-Term Uncertainty

- Bitcoin's 2025 price dropped 30% to $85,000 amid Fed policy shifts and ETF outflows, triggering market recalibration. - Institutional investors like Harvard and Japan's Metaplanet are accumulating BTC, signaling potential 2026–2031 bull phases. - Analysts project $160,000–$350,548 targets by 2026–2031, but warn of $53,489–$58,000 bear risks amid macroeconomic uncertainties. - Long-term bullish sentiment persists despite short-term volatility, with on-chain data showing whale accumulation at discounted le

Spain’s Revamp of Crypto Tax Laws May Spark Market Turmoil, Opponents Caution

- Spain's Sumar group proposed crypto tax hikes to 47% and a risk "traffic light" system for platforms in November 2025. - The plan introduces dual taxation for individuals/businesses and expands seizable crypto assets beyond EU MiCA rules. - Experts warn of legal challenges, market instability, and "absolute chaos" if the reforms create compliance burdens for investors. - Critics argue the measures could deter crypto adoption, drive activity underground, and destabilize Spain's emerging crypto sector.

Solana News Today: "November's Investor Challenge: Support Struggling Solana or Chase Profits with Mutuum's Surge?"

- November 2025 crypto markets show Solana (SOL) down 22% amid macroeconomic uncertainty, while Mutuum Finance (MUTM) raises $18.9M in presale with 18,200 holders. - Solana faces declining confidence ($134 price, $7.3B flat open interest) as Fed rate uncertainty and bearish derivatives sentiment weaken its position. - Mutuum's Phase 6 presale (95% sold at $0.035) gains momentum through direct debit access, security audits, and a 20% price jump to $0.06 in Phase 7. - Analysts highlight Mutuum's dual DeFi mo

XRP News Today: XRP ETFs Draw $58M Investments During Price Fluctuations, Prompting Concerns

- Canary Capital’s XRPC ETF sees $26.5M inflows, contrasting Bitcoin ETF outflows. - Franklin Templeton/Bitwise XRP ETFs launch Nov 18-20, signaling institutional interest. - XRP stabilizes near $2 support but faces pressure from mixed technical indicators. - $15.8M ETF inflow amid volatility highlights uncertain market dynamics for altcoins.