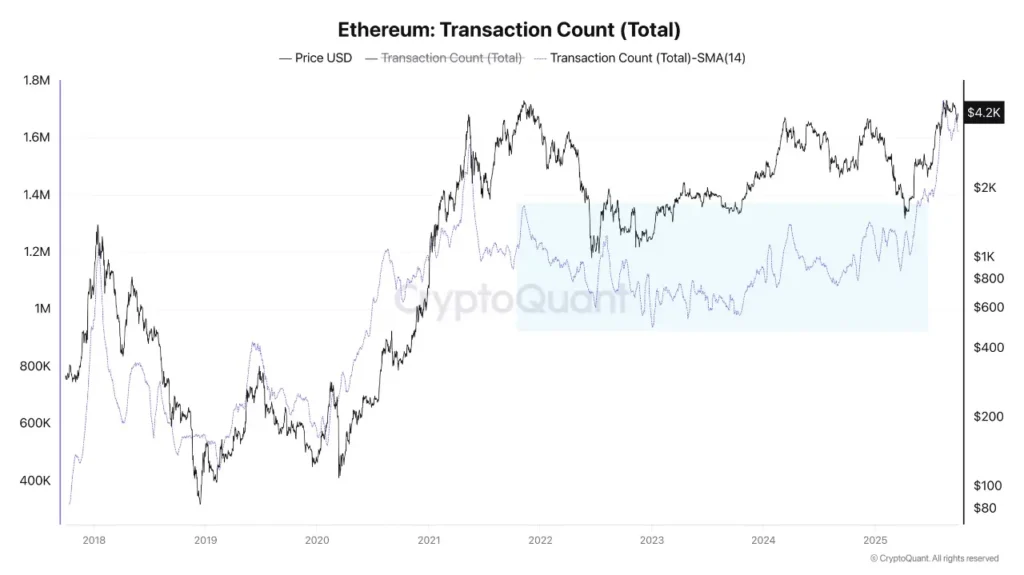

Ethereum breakout: ETH recorded its strongest quarterly close ever, cleared long-term resistance near $3,600 and hit roughly 1.6–1.7 million daily transactions, signaling renewed on-chain adoption and technical momentum that could support a measured extension toward a $6,400 target.

-

Strong quarterly close above $3,600 resistance

-

Daily transactions surged to 1.6–1.7M, surpassing a four‑year range and indicating rising DeFi activity

-

Technicals and network data together suggest a validated breakout with a measured extension target near $6,400

Ethereum posts its strongest quarterly close ever, breaks resistance at $3,600, and records 1.7M daily transactions, fueling momentum toward $6,400.

What is the significance of Ethereum’s quarterly close above $3,600?

Ethereum breakout significance: ETH’s highest quarterly close on record confirms a clean breakout above decade-long resistance near $3,600, reducing false-breakout risk and increasing the likelihood of a sustained rally. This technical validation, combined with rising on-chain activity, supports analyst projections toward a measured target near $6,400.

How many transactions has the Ethereum network reached and why does it matter?

Network activity has risen to an average of approximately 1.6–1.7 million transactions per day. That figure exceeds the four-year range of roughly 900,000–1.2M daily transactions and highlights increased decentralized finance (DeFi) usage and broader on-chain adoption. Higher throughput often precedes extended bullish phases.

#Ethereum is Insanely Bullish Right Now 🚀 #ETH just broke out with its strongest quarterly candle ever. Target could be $6,400. pic.twitter.com/cvOMiTFCT9

— Titan of Crypto (@Washigorira) October 1, 2025

Titan of Crypto called the quarterly structure “insanely bullish,” citing the breakout and a measured Fibonacci extension toward $6,400. Analysts note that the current quarterly pattern mirrors early stages of prior large rallies, which historically preceded accelerated price moves.

Why did on-chain metrics strengthen Ethereum’s breakout thesis?

On-chain metrics strengthen the breakout thesis because transaction volumes and active addresses are primary adoption indicators. Darkfost reported daily transactions climbing to new highs (~1.6–1.7M). Sustained growth in these metrics demonstrates expanding network utility rather than purely speculative positioning.

Source: Darkfost

Source: Darkfost

Even during earlier corrections this year, Ethereum maintained higher-than-historical daily transaction averages, underscoring resilient network demand. When price breakouts coincide with rising transactions, it increases the conviction that fundamentals support price action.

How could ETH reach the $6,400 projection?

Analysts calculate the $6,400 projection using measured move techniques and Fibonacci extensions from the consolidation range. Steps that support the path include: 1) sustained quarterly close above $3,600, 2) continued transaction and DeFi growth, 3) favorable market-leading cues from Bitcoin, and 4) expanding institutional and developer activity.

What risks could invalidate the breakout?

Key risks include a swift macro reversal, abrupt liquidity withdrawal, or a meaningful decline in on-chain activity. A failure to retest and hold the $3,600 area on shorter timeframes would raise the probability of a false breakout despite the strong quarterly candle.

Frequently Asked Questions

Has Ethereum ever rallied similarly after a quarterly breakout?

Yes. Historical cycles show ETH can accelerate after confirmed multi-quarter breakouts. Comparable setups preceded fast rallies when on-chain adoption metrics and market liquidity aligned.

How should traders use transaction data alongside price?

Traders should pair rising transaction counts with clean price structure. If both trend higher, the breakout gains credibility; if transactions fall while price rises, caution is warranted.

Key Takeaways

- Validated quarterly breakout: ETH closed above $3,600, reducing the probability of a false breakout.

- On-chain adoption rising: Daily transactions near 1.6–1.7M indicate expanding DeFi and network use.

- Measured target: Technical projections and Fibonacci extensions point to a potential $6,400 target if momentum continues.

Conclusion

Ethereum’s strongest quarterly close, combined with record daily transactions and supportive technical structure, creates a compelling case for continued upside. Analysts and on-chain commentators agree the measured move toward $6,400 is plausible if on-chain growth and broader market conditions persist. Monitor transaction trends and quarterly support levels for confirmation.