Expect a Strong Move Up for One BNB Chain Ecosystem Altcoin, According to Economist Alex Krüger

A popular economist believes that one altcoin project supported by the BNB Chain ecosystem is setting the stage for a massive breakout.

In a new X post to his 215,200 followers, Alex Krüger says that Plasma ( XPL ) is likely to have an explosive move to the upside once the token forms a local bottom.

Plasma is a proof-of-stake (PoS) layer-1 project optimized for large-scale stablecoin payments and compatible with Ethereum ( ETH ).

“Seeing widespread FUD (fear, uncertainty and doubt) around Plasma following its two-day ~40% price correction. Dump is driven by profit taking from unlocked participants who are/were up about 20x-30x in under four months, in size.

Abnormally high funding can be indicative of spot selling. Expect a strong move up as soon as indiscriminate spot selling subsides, whenever that may be.”

Source: Alex Krüger/X

Source: Alex Krüger/X

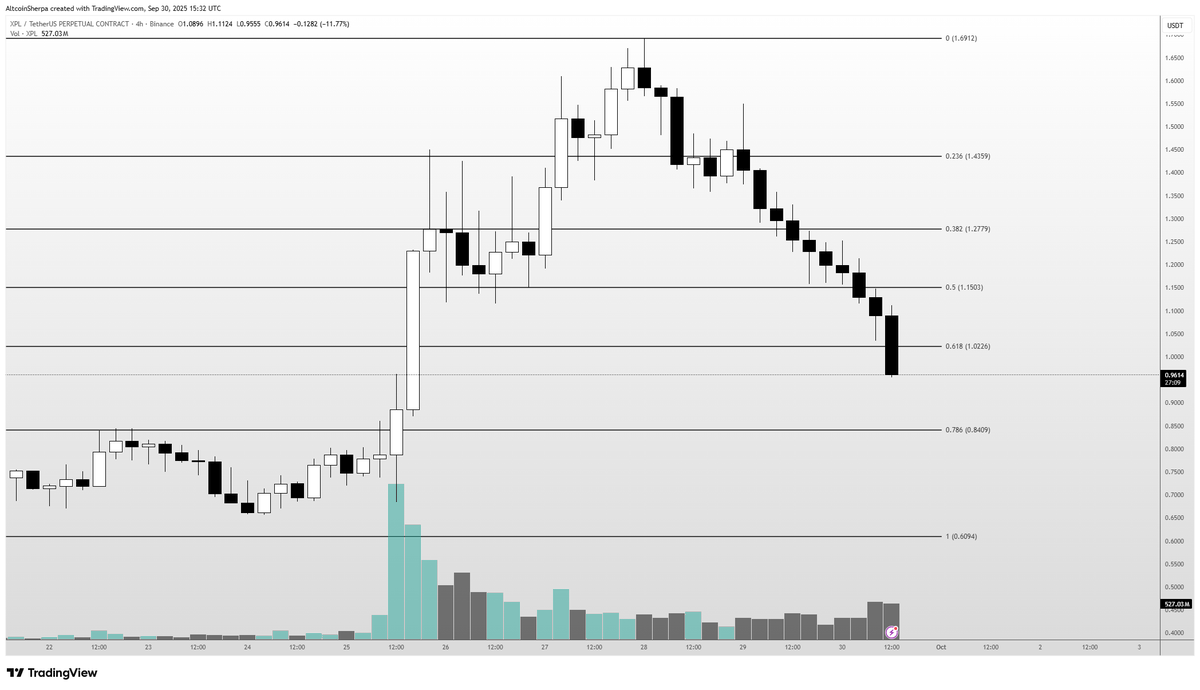

Popular analyst Altcoin Sherpa is also predicting an XPL bounce, but warns the altcoin may still have a deeper correction.

“This XPL chart is a sight to behold. Literally not one green four-hour candle and just vicious selling across the board. Seems like 90% of CT (crypto Twitter) is down on this coin, myself included.

My entry is around $1.15-$1.20 or so and I’m definitely feeling the pain. I keep thinking bounce is coming but I don’t know when/where/how it happens. I’ve already cut my perps position and just in spot at this point.”

Source: Altcoin Sherpa/X

Source: Altcoin Sherpa/X

XPL is trading for $0.95 at time of writing, down 8.2% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Silver Soars Amid Ideal Conditions of Policy Shifts and Tightening Supply

- Silver surged to $52.37/oz as Fed rate cut expectations (80% probability) and falling U.S. Treasury yields boosted demand for non-yielding assets. - China's record 660-ton silver exports and 2015-low Shanghai warehouse inventories intensified global supply constraints, pushing the market into backwardation. - Geopolitical risks (Ukraine war) and potential U.S. silver tariffs added volatility, while improved U.S.-China relations eased short-term trade concerns. - Prices face critical $52.50 resistance; Fe

XRP News Today: As XRP Declines, Retail Investors Turn to GeeFi's Practical Uses

- GeeFi's presale hits 80% of Phase 1 goal with $350K raised, targeting 3,900% price growth as XRP declines 20% monthly. - GEE's utility-driven features like crypto cards, multi-chain support, and 55% staking returns contrast with XRP's institutional dependency and shrinking retail base. - Deflationary tokenomics and 5% referral bonuses drive FOMO, positioning GeeFi as a 2026 crypto disruptor amid XRP's regulatory and adoption challenges.

Sloppy implementation derails MegaETH's billion-dollar stablecoin aspirations

- MegaETH abandoned its $1B USDm stablecoin pre-deposit plan after technical failures disrupted the launch, freezing deposits at $500M and issuing refunds. - A misconfigured Safe multisig transaction allowed early deposits, causing $400M inflows before the team scrapped the target, citing "sloppy execution" and operational misalignment. - Critics highlighted governance flaws, uneven access (79 wallets >$1M vs. 2,643 <$5K deposits), and 259 duplicate addresses, raising concerns about transparency and bot ac

XRP News Today: Institutional ETFs Drive XRP's Phase 4 Surge, Targeting a Break Above $2.60

- XRP enters Phase 4 of its multi-year cycle, mirroring 2014–2017 patterns with $2.00 retest and $6.618 target potential. - Six new XRP ETFs (Franklin Templeton, Grayscale) boost institutional demand, though performance varies significantly between products. - Technical analysis highlights $2.05–$2.07 support and $2.20 resistance, with $2.60 breakout critical for confirming Phase 4 bullish thesis. - Macroeconomic factors like Fed rate cuts and improved U.S.-China relations could reduce risk aversion, ampli