Crypto Trader Says One Indicator Pointing to $139,000 Bitcoin Next, Outlines Path Forward for XRP, Solana and Chainlink

Cryptocurrency analyst and trader Ali Martinez says one indicator is signaling Bitcoin ( BTC ) will soon reach new all-time highs.

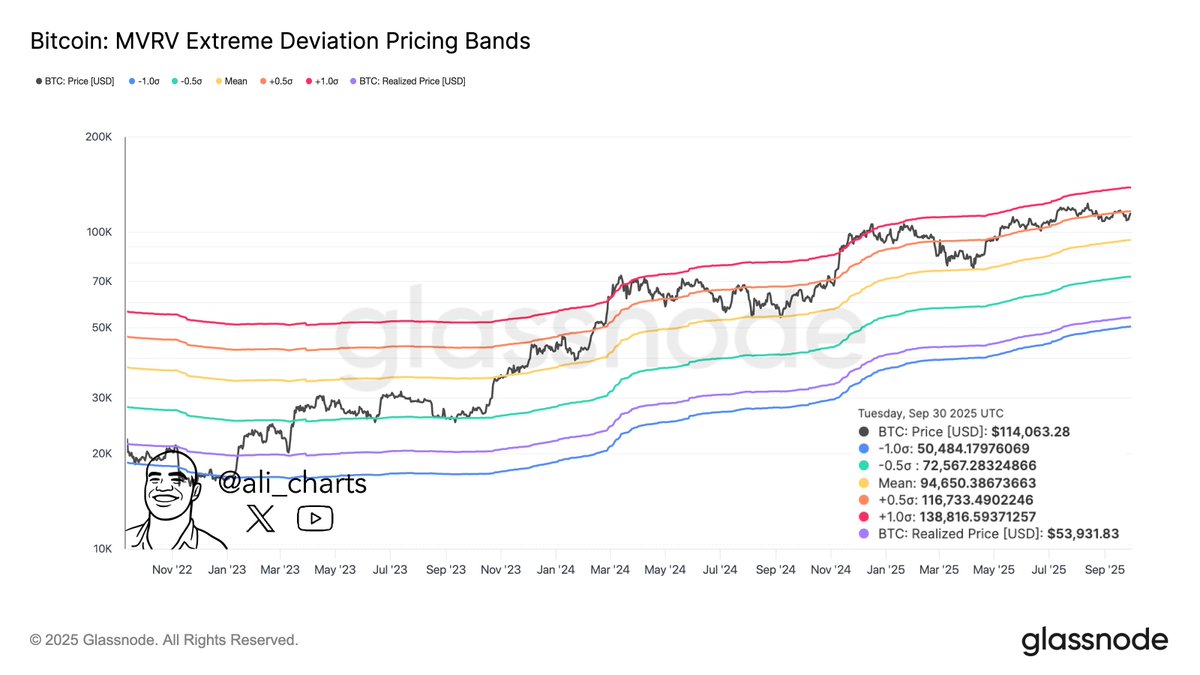

Martinez tells his 158,600 followers on X that Bitcoin may increase more than 16% from its current value based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands.

The MVRV Extreme Deviation Pricing Bands are used in on-chain analysis to identify potential market tops and bottoms.

“Bitcoin breaking past $117,000 points to $139,000 next, according to the Pricing Bands.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $119,252 at time of writing, up 1.5% in the last 24 hours.

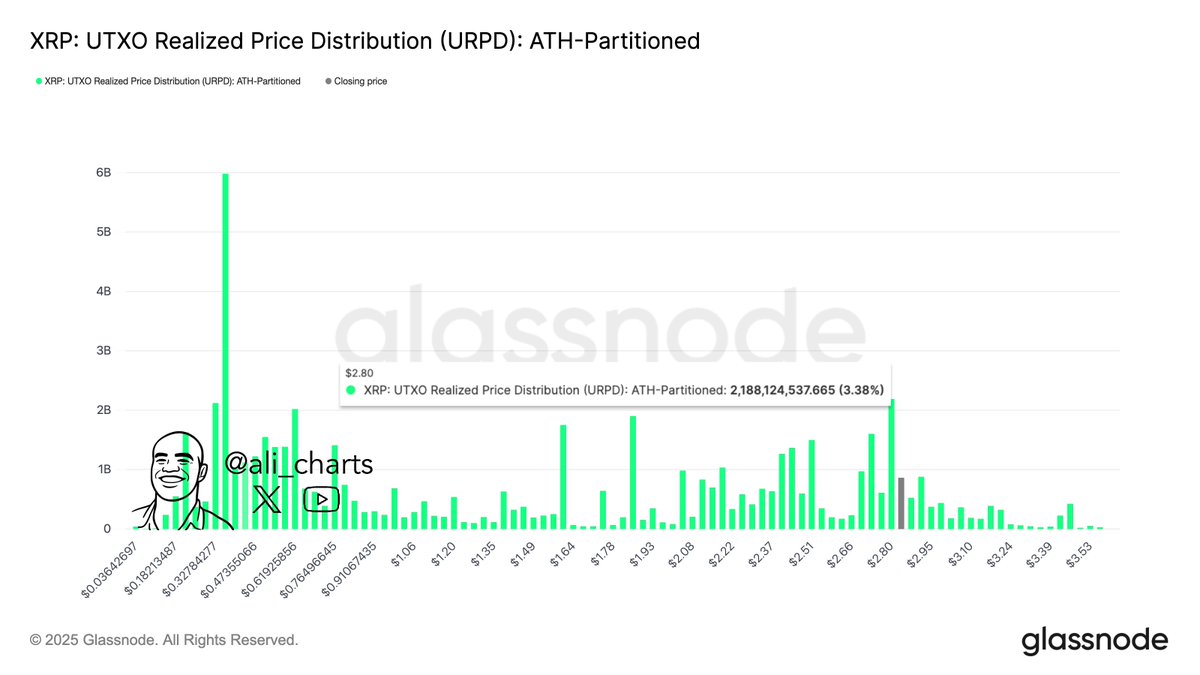

Next up, the analyst says that payments token XRP is looking bullish based on the Unspent Transaction Output (UTXO) Realized Price Distribution indicator, which shows the specific prices at which the current supply last moved.

“XRP held $2.80 as support. As long as it does, there are no major supply walls to block a rebound.”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading for $2.98 at time of writing, up 1.1% on the day.

Moving on to Ethereum ( ETH ) rival Solana, the analyst says that SOL may increase by 60% from its current value after holding the $205 level as support.

“With the bullish retest complete, Solana could now be ready for $320-$360.”

Source: Ali Martinez/X

Source: Ali Martinez/X

SOL is trading for $225 at time of writing, up 2.7% on the day.

Lastly, the analyst says that decentralized oracle Chainlink ( LINK ) is on the verge of a massive breakout after retesting a key Fibonacci retracement level at around $20.

“$47 could be next for Chainlink!”

Source: Ali Martinez/X

Source: Ali Martinez/X

LINK is trading for $22.24 at time of writing, down marginally in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coins Achieve Recognition as Institutional Investors and ETFs Drive Market Changes for 2025

- WLFI's acquisition of Solana-based meme coin SPSC triggered a 139.8% price surge, highlighting institutional interest in meme tokens. - Binance's listing of Dank Penguin and BNBHolder boosted their market caps past $5 million, showcasing exchange-driven momentum in meme coin ecosystems. - Dogecoin's ETF debut via Bitwise's BWOW and Grayscale's GDOG signals growing institutional validation, despite mixed initial performance compared to Solana/XRP ETFs. - 2025 could solidify meme coins and altcoin ETFs as

Bitcoin News Today: Bitcoin Whale Bets $84 Million—Sign of Faith or Disaster Looming?

- A Bitcoin whale opened an $84.19M 3x leveraged long on Hyperliquid after securing $10M in profits, amplifying market volatility and liquidity risks. - Other whales added 20x-25x leveraged positions totaling $75M in BTC/ETH, reflecting heightened confidence in short-term price resilience amid December 2025's 3.64% BTC and 3.79% ETH gains. - Analysts debate the rally's sustainability, citing weak Sharpe ratios (-36% Bull-Bear Index), 30% drawdown from peaks, and structural liquidity challenges favoring ran

Hyperliquid News Today: Avici Soars 1,700%—Is It MoonPay Buzz or Genuine Market Movement?

- Avici (AVICI) surged 1,700% amid speculation of a MoonPay partnership, now valued at $90.7M with $2.5M liquidity. - Analysts highlight its neobank narrative, competing with projects like Cypher while facing $50–$500 price targets implying $1B–$5B valuations. - Security risks persist, exemplified by Upbit's $36M hack and Trezor CEO's warnings on exchange vulnerabilities. - Avici's success hinges on balancing innovation with compliance, regulatory clarity, and execution amid a crowded crypto debit card mar

Bitcoin News Today: Bitcoin Recognized as a Mainstream Asset as Nasdaq Lists IBIT Alongside Leading ETFs

- Nasdaq's ISE proposes tripling Bitcoin options limits for BlackRock's IBIT to 1 million contracts, aligning it with major ETFs like EEM and GLD . - The move reflects IBIT's dominance as the largest Bitcoin options market by open interest, driven by institutional demand for hedging and speculation. - Analysts highlight the normalization of Bitcoin as a tradable asset class, with unlimited FLEX options and JPMorgan's structured notes signaling broader institutional adoption. - Regulatory alignment with gol