Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

On-chain data back Uptober crypto market rally

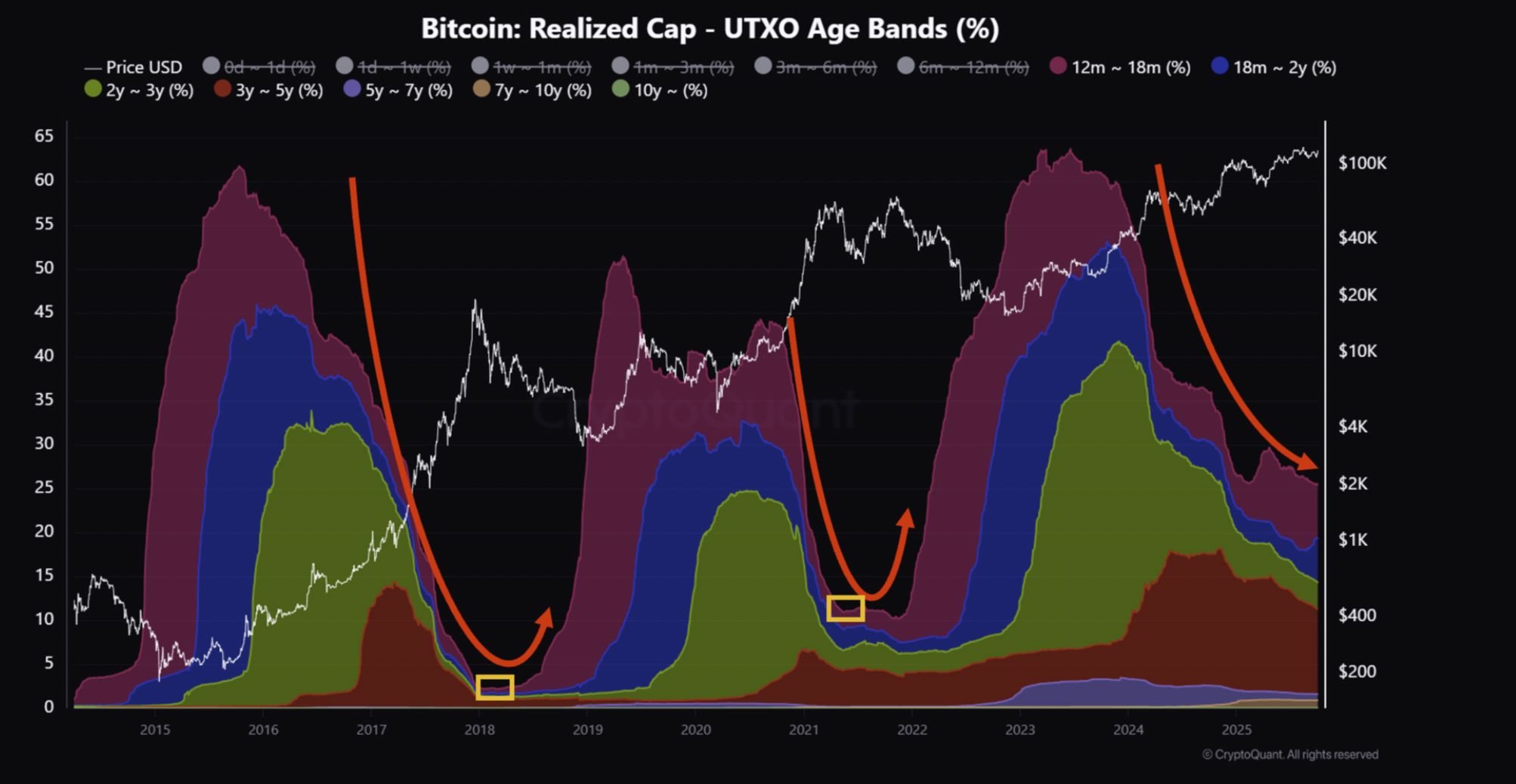

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Transformation of Xerox Campus and Webster, NY’s Economic Revival: An Infrastructure-Led Model for Unlocking Value in Industrial Real Estate Markets

- New York's $9.8M FAST NY-funded upgrades transformed Webster's 300-acre Xerox brownfield into a 1M sq ft industrial hub by 2025. - Infrastructure improvements reduced industrial vacancy to 2%, attracting high-tech manufacturers and green energy firms. - The project boosted home prices by 10.1% annually and created 250 jobs via the $650M fairlife® dairy facility. - Public-private partnerships through BOA designation enabled risk-reduced development of contaminated sites. - Webster's model demonstrates inf

Ethereum News Update: ZKP’s Hardware-Centric Strategy Shakes Up Speculation-Fueled Crypto Presales

- ZKP launches with $17M pre-built Proof Pods, offering instant AI compute rewards via Wi-Fi-connected hardware. - Unlike speculative presales, ZKP's hardware-first model ensures operational readiness and decentralized network resilience. - Competitors like Blazpay and SpacePay focus on utility-driven crypto adoption, but ZKP's tiered, upgradable devices emphasize verifiable performance. - Ethereum's gas limit increase aligns with ZKP's distributed compute approach, addressing scalability challenges throug

Solana News Update: Investors Shift Toward XRP ETFs, Bringing Solana's 21-Day Inflow Streak to a Close

- Solana ETFs ended a 21-day inflow streak with a $8.1M net outflow on Nov 27, 2025, led by 21Shares TSOL's $34.37M redemptions. - This reversal contrasted with Bitcoin/Ethereum ETFs' $5.43B outflows and highlighted Solana's 7% staking yields and 70M daily transactions. - Analysts linked the shift to profit-taking, macroeconomic pressures, and investor rotation toward XRP ETFs with perfect inflow records. - Despite the outflow, Solana ETFs still hold $964M in assets, but face challenges as TVL dropped 32%

XRP News Today: Institutional ETFs Drive XRP to Compete with Bitcoin's Market Leadership

- XRP ETFs see $160M+ inflows as institutional demand surges, with Bitwise and Franklin Templeton leading the charge. - NYSE approves Grayscale and Franklin XRP/Dogecoin ETFs amid SEC easing altcoin fund approvals, signaling crypto normalization. - Altcoin Season Index at 25/100 shows Bitcoin dominance, but projects like Aster and Zcash outperform BTC by 1,000%+. - XRP rebounds to $2.06 with 48% volume spike, but 79M tokens absorbed by ETFs raise supply concerns. - Institutional-grade custody solutions fro