Crypto Analytics Firm Unveils Two Factors That Could Trigger ‘Historically Bullish Setup’ for Bitcoin – Here’s the Outlook

Crypto analytics platform Swissblock says two factors could combine to trigger a massive rally for Bitcoin ( BTC ).

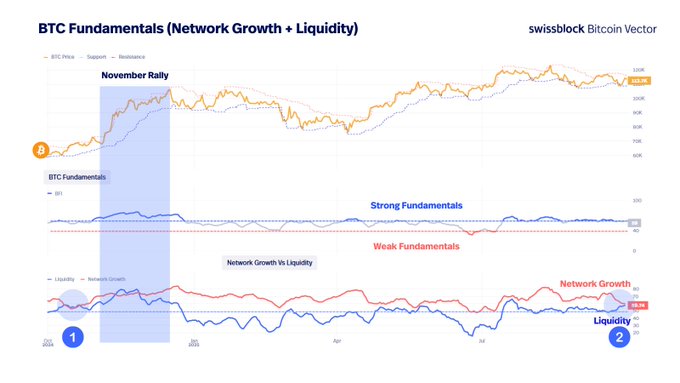

According to Swissblock, an increase in liquidity and the number of Bitcoin users are the ingredients necessary for the formation of a “historically bullish setup.”

“Liquidity remains strong. Unlike true bear markets, liquidity is not collapsing.

Network Growth dipped slightly while liquidity held up (2).

The last time this setup occurred? October 2024 (1), right before the big rally into November.”

Source: Swissblock

Source: Swissblock

According to Swissblock, Bitcoin is in the “process of finding a bottom,” a phenomenon which has historically been marked by the Aggregated Impulse Signal falling to zero.

The Aggregated Impulse Signal, an indicator calibrated from 0 to 100 that gauges market momentum and selling pressure, is used to identify potential bottoms.

“Markets move in cycles of stress and recovery.

When stress peaks, short-term traders are forced to sell at a loss.

Capitulation stress often mark the end of downside phases, setting the stage for recovery…

…At that exact point, the Impulse Signal collapses to zero.

That’s the moment panic exhausts and new buyers step in.

Since early 2024, this reset has only happened 3 times.

Each one marked a cycle bottom.

Each one was followed by a sustained recovery.

We are approaching that setup again.”

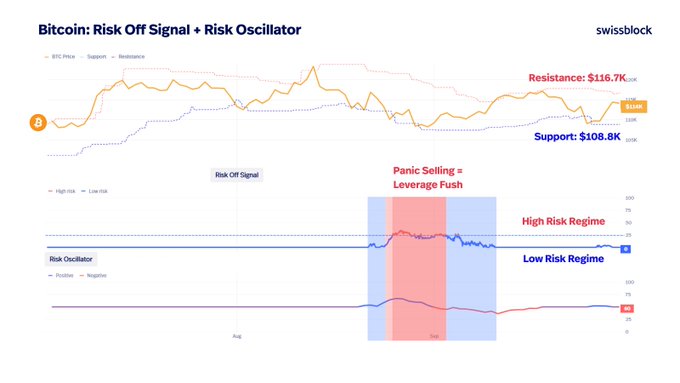

Swissblock further says that Bitcoin experienced the “sharpest wave of panic selling” this cycle from late August to early September.

“That flush cleared excess leverage and reset the market back to cost basis.

This is how bottoms are built.”

Source: Swissblock

Source: Swissblock

Bitcoin is trading at $116,592 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: ZKP’s Hardware-Centric Strategy Shakes Up Speculation-Fueled Crypto Presales

- ZKP launches with $17M pre-built Proof Pods, offering instant AI compute rewards via Wi-Fi-connected hardware. - Unlike speculative presales, ZKP's hardware-first model ensures operational readiness and decentralized network resilience. - Competitors like Blazpay and SpacePay focus on utility-driven crypto adoption, but ZKP's tiered, upgradable devices emphasize verifiable performance. - Ethereum's gas limit increase aligns with ZKP's distributed compute approach, addressing scalability challenges throug

Solana News Update: Investors Shift Toward XRP ETFs, Bringing Solana's 21-Day Inflow Streak to a Close

- Solana ETFs ended a 21-day inflow streak with a $8.1M net outflow on Nov 27, 2025, led by 21Shares TSOL's $34.37M redemptions. - This reversal contrasted with Bitcoin/Ethereum ETFs' $5.43B outflows and highlighted Solana's 7% staking yields and 70M daily transactions. - Analysts linked the shift to profit-taking, macroeconomic pressures, and investor rotation toward XRP ETFs with perfect inflow records. - Despite the outflow, Solana ETFs still hold $964M in assets, but face challenges as TVL dropped 32%

XRP News Today: Institutional ETFs Drive XRP to Compete with Bitcoin's Market Leadership

- XRP ETFs see $160M+ inflows as institutional demand surges, with Bitwise and Franklin Templeton leading the charge. - NYSE approves Grayscale and Franklin XRP/Dogecoin ETFs amid SEC easing altcoin fund approvals, signaling crypto normalization. - Altcoin Season Index at 25/100 shows Bitcoin dominance, but projects like Aster and Zcash outperform BTC by 1,000%+. - XRP rebounds to $2.06 with 48% volume spike, but 79M tokens absorbed by ETFs raise supply concerns. - Institutional-grade custody solutions fro

Public-Private Collaborations Driving Real Estate and Industrial Expansion in Webster, NY

- Webster , NY, leverages PPPs via FAST NY and NY Forward grants to boost infrastructure, real estate , and industrial investment. - Xerox campus upgrades and downtown revitalization projects enhance connectivity, attracting advanced manufacturing and logistics sectors. - $650M fairlife® facility creates 250 jobs, demonstrating how modernized infrastructure attracts high-value industries to secondary markets. - Websters model shows PPPs can drive sustainable growth by aligning public funding with private-s