Foresight Ventures Launches $50M Industry-First Stablecoin Infrastructure Fund

Singapore, 1 October 2025 — Foresight Ventures, a leading global crypto VC investing in next-generation payment infrastructure, today announced the launch of a $50 million Stablecoin Infrastructure Fund, the industry’s first dedicated vehicle focused on the entire stablecoin value chain.

The fund will invest across the upstream and downstream ecosystem, targeting projects in stablecoin issuance, coordination, exchange, compliant on/off-ramps, and payment-focused blockchains, as well as innovative applications where stablecoins intersect with real-world assets (RWA), artificial intelligence (AI), on-chain foreign exchange (FX), and merchant acquiring.

Since 2023, Foresight Ventures has made stablecoin infrastructure a strategic focus, backing a number of representative projects including Ethena, Noble, Codex, Agora and WSPN. These investments reflect the firm’s conviction that stablecoins are not only the core conduit between traditional finance and Web3, but are also rapidly evolving into the settlement layer of global finance.

“Stablecoins are no longer peripheral — they are fast becoming the backbone of modern payments,” said Alice Li, Managing Partner of Foresight Ventures. “With this dedicated fund, we aim to accelerate their integration into the traditional financial framework in a way that is seamless, compliant, and scalable, enabling mass adoption worldwide.”

By combining targeted capital deployment with its global reach and media network, Foresight Ventures seeks to amplify adoption across both retail and institutional markets. The firm believes that building robust stablecoin infrastructure today will lay the foundation for the next phase of digital finance, where blockchain efficiency merges with the compliance and interoperability required by global commerce.

Earlier this month, Foresight Ventures also released its landmark research report, Stablecoin L1/L2: Defining the Next Era of Global Payments. The study profiles five representative stablecoin-native blockchains — Plasma, Stable, Codex, Noble, and 1Money — analyzing their strategies, technical progress, and market positioning.

Publishing the report ahead of the fund launch underscores Foresight’s research-driven approach, ensuring that rigorous, data-backed insights guide capital allocation in this fast-evolving sector.

About Foresight Ventures

Foresight Ventures is a top-tier crypto venture firm and one of the five most active investors globally in 2024. With our team in US and Asia, we are the first and only crypto VC truly bridging East and West. Our approach is research-driven and founder-focused: we back the infrastructure powering next-gen global payments — from stablecoins and on/off-ramps to real-world assets, while amplifying our portfolio through a strong media network. Our 150+ investments include Story , TON , Aptos , Morph , 0G Labs , Sentient AI , The Block , Foresight News , and many more.

For more information, please visit: Website | Twitter | LinkedIn

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PEPE Price Stays Range-Bound Near $0.054 as Support Holds

Polygon price forms bullish pattern; transactions, addresses jump

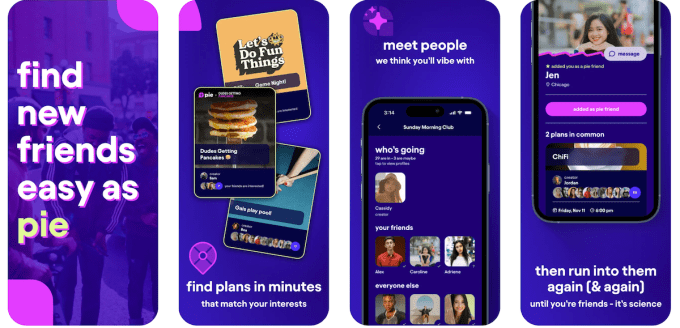

As people look for ways to make new friends, here are the apps promising to help

XRP’s Long-Term Breakout Narrative Builds Even As Short-Term Bears Linger