USD1 stablecoin is set to make debut on Aptos network

USD1 will be launched on the Aptos blockchain following a partnership with World Liberty Financial. The USD1 stablecoin is expected to go live on October 6.

- USD1 will be launched on the Aptos network on Oct. 6, marking its first integration into a Move-based blockchain.

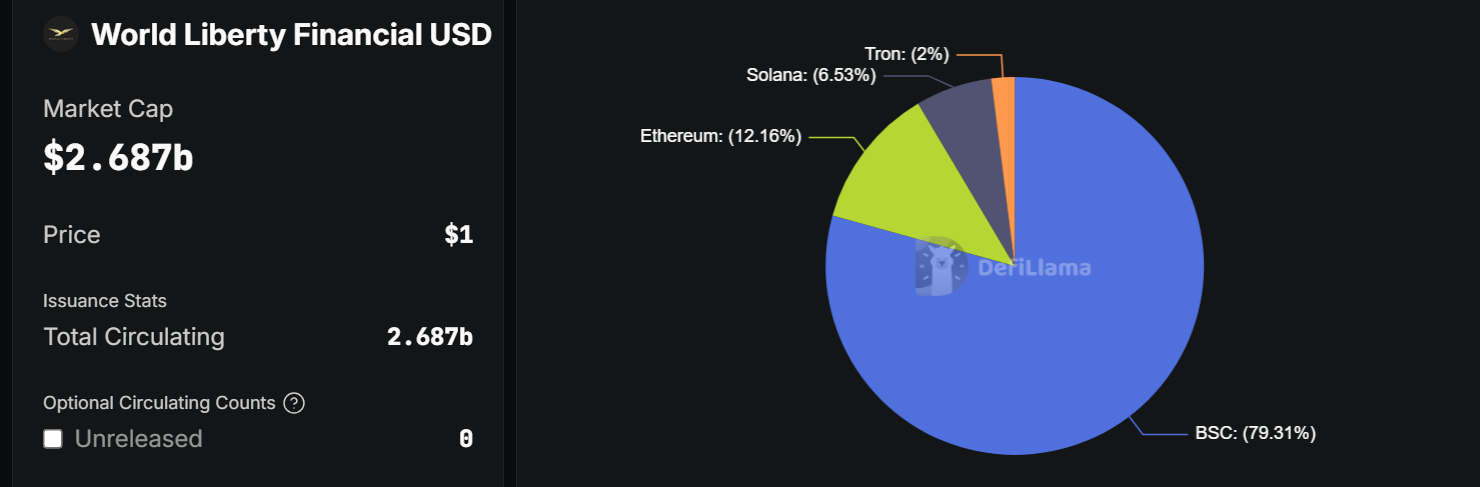

- Since its launch in March 2025, USD1 has grown to a market cap of around $2.68B, with most of its supply on BNB Chain.

On Oct. 1, Donald Trump Jr. and World Liberty Financial CEO Zach Witkoff announced that the USD1 stablecoin will be launching on the Aptos network on October 6. The launch will mark the first time that WLFI’s stablecoin will be hosted on a Move-based blockchain.

“The list grows of those choosing the fastest, cheapest, & most efficient rails in the world,” wrote Aptos ( APT ) in its latest post

Based on information from the official post, multiple wallets and exchanges will provide support for the launch on the Aptos ecosystem, including Petra Wallet, Bitget Wallet, OKX, Gate group and many more.

The stablecoin will be available for trading once it completes integration into Aptos on October 6. The integration will include Aptos DeFi protocols on-chain, such as Echelon Market, Hyperion, Thala Labs, Panora Exchange and Tapp Exchange.

The Aptos network becomes the latest crypto project to support WLFI’s stablecoin integration; other projects in the past have included Justin Sun’s Tron ( TRX ), Ethereum ( ETH ), Solana ( SOL ), Plume Network as well as BNB Chain ( BNB ).

USD1’s web3 expansion

Ever since it was launched in March 2025, World Liberty Financial’s stablecoin USD1 has accumulated a market cap of $2.68 billion based on data fron DeFi Llama. The largest share of the stablecoin is deployed on the Binance Smart Chain, approximately 79.3% of the total circulating supply.

Meanwhile, Tron accounts for 2% of the total supply, meanwhile at least 12.16% of the stablecoins have been deployed on Ethereum. Lastly, Solana has hosted 6.53% of the WLFI stablecoin supply on-chain.

Entering as a new contender, Aptos already hosts a number of stablecoins on-chain. Aptos runs Tether, USD Coin, USDE and PYUSD and has a monthly volume of $60 billion. According to data from RWA.xyz, Aptos has a stablecoin market share of just 0.35% of the total stablecoin market.

USD1 is mostly deployed on Binance Smart Chain | Source: DeFi Llama

USD1 is mostly deployed on Binance Smart Chain | Source: DeFi Llama

Most recently, World Liberty Financial announced that it would launch a debit card. The card will reportedly allow users to link USD1 and WLFI wallet to Apple Pay, allowing for seamless crypto-to-fiat integration. In addition, the debit card will also be made compatible with the platform’s upcoming app.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of Tokens Supported by MMT and Their Influence on Financial Systems in Developing Markets

- MMT-backed tokens leverage blockchain to tokenize sovereign debt, real estate , and carbon credits, reshaping emerging market fiscal strategies. - Tokenized bonds enable local-currency issuance with smaller denominations, as demonstrated by Hong Kong's 2025 digital green bonds and OCBC's commercial paper program. - Central banks integrate blockchain tools for real-time liquidity adjustments, while programmable features like inflation-linked coupons enhance fiscal flexibility in volatile economies. - Chal

KITE Price Forecast Post-Listing: Understanding Market Reactions and Institutional Strategies Amidst a Fluctuating IPO Environment

- Vyome Holdings (KITE) adopts a dual-listing strategy on Nasdaq and SGX-Nasdaq bridge to diversify investors and liquidity, aligning with high-growth tech IPO trends. - Institutional ownership remains fragmented (0.43% held by major banks as of Nov 2025), reflecting cautious hedging amid regulatory and economic uncertainties. - While tech IPOs thrive on AI-driven narratives, KITE faces retail real estate sector challenges including $0.07/share Q3 losses and anchor tenant bankruptcies. - Clinical progress

Sony launches USDSC stablecoin for Soneium blockchain

XRP Compresses in a Tight Range as Major Liquidity Builds Above $2.10