Bitcoin Distribution Exposed: Few Holders Control the Majority

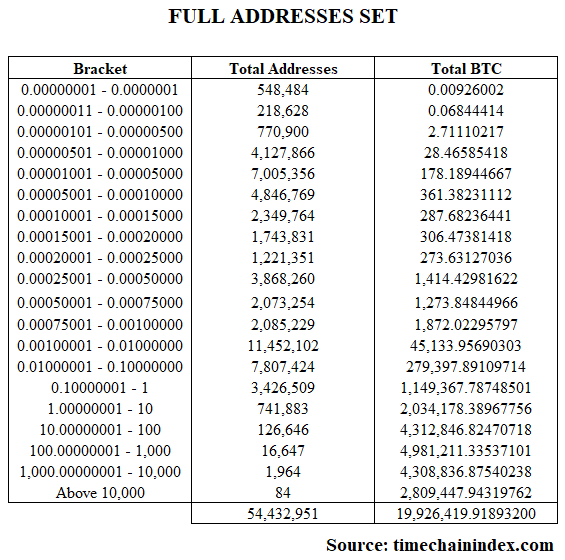

Bitcoin has become an increasingly prominent part of global finance. Some governments, companies, and funds now include it in their reserves, while many individuals continue to grow their holdings. On the surface, ownership appears widespread, with more than 54 million Bitcoin addresses recorded on the blockchain. However, a closer look shows that these numbers can be misleading, as they do not fully reflect who actually controls the asset.

In brief

- Fewer than 20,000 wallets hold over 60% of all Bitcoin, showing how concentrated ownership really is.

- Institutional wallets including exchanges, custodians, and miners control a large portion of Bitcoin on behalf of multiple clients.

- After filtering out tiny balances and pooled accounts, around 3.9 million active users remain who control the majority of Bitcoin outside institutions.

Whales and Institutions Dominate Bitcoin Ownership

Sani, founder of the analytics platform Time Chain Index, reviewed blockchain data to measure how ownership is distributed. His analysis revealed that most of the supply is concentrated in the hands of a very small group. Out of the total addresses, only 18,695 are classified as whale wallets, but together they control more than 60% of all Bitcoin in circulation.

A significant portion of addresses also belong to institutions rather than individual users. Of the 54.4 million addresses, about 271,883 are linked to exchanges, custodians, companies, ETFs, and miners. Together, these pooled wallets hold around 8,789,113 BTC, or roughly 44% of the total supply. Since they represent funds stored on behalf of many clients, they do not reflect individual ownership.

Image showing a few wallets hold most BTC, while millions own only tiny fractions.

Image showing a few wallets hold most BTC, while millions own only tiny fractions.

Filtering the Data Reveals the True Bitcoin User Base

After removing institutional and pooled wallets, the remaining addresses still reveal how Bitcoin is distributed and which holdings are significant

- The leftover addresses collectively held 11,137,306 Bitcoin, though many contained only very small fragments from earlier transactions.

- To focus on meaningful balances, Sani excluded wallets holding less than 0.001 Bitcoin and also removed those linked to companies and custodians.

- This refinement left 23.43 million addresses, which together controlled 11,131,336 Bitcoin, highlighting the bulk of holdings outside large pooled accounts.

Based on this filtered dataset, Sani noted that the total number of wallets does not reflect the number of individual users , since most people control multiple addresses. Taking an average of six addresses per person, he estimated the network likely has around 3.9 million active users, who collectively hold the majority of Bitcoin outside institutional wallets.

This shows that the raw figure of 54 million addresses creates a distorted picture of adoption. While whales hold a dominant share and custodians manage nearly half the supply, the filtered dataset gives a more accurate view of genuine network participation. Even then, the actual user base is far smaller than the headline address count suggests.

Market Trends Signal Caution Amid Price Gains

Meanwhile, Bitcoin is trading around $111,000, up about 2% in the past 24 hours. Glassnode recently reported that the Accumulation Trend Score has softened , reflecting a more cautious approach from larger holders.

If demand does not pick up, the market could face additional pressure from available Bitcoin supply, leaving prices exposed in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Korean Won Stablecoin Alliance Seeks to Disrupt US Dollar Dominance in Digital Finance

- WEMADE leads Korean won stablecoin alliance with CertiK, Chainalysis, and SentBe to challenge USD-dominated stablecoin markets. - CertiK provides security infrastructure for StableNet mainnet, while Chainalysis/SentBe enhance compliance and transparency. - South Korea's $10.3B Upbit-Naver merger and KakaoBank's initiatives reflect national strategy to assert monetary sovereignty via blockchain. - Regulatory hurdles persist, but alliance aims to navigate 51% bank ownership rules through security-complianc

Swiss Crypto Tax Postponement Highlights Challenges in International Cooperation

- Switzerland delays Crypto-Asset Reporting Framework (CARF) implementation to 2027 due to stalled international data-sharing negotiations. - The OECD-endorsed framework aims to combat tax evasion via cross-border crypto reporting, with 75 countries participating but uneven global adoption. - Swiss amendments to domestic crypto tax laws include transitional provisions to ease compliance burdens for local firms amid regulatory uncertainty. - Critics warn the delay risks deterring fintech innovation, while s

Strategic Collaborations Between Public and Private Sectors: Driving Real Estate and Industrial Expansion in Underdeveloped Areas

- Public-private partnerships (PPPs) are transforming underserved regions by bridging infrastructure gaps and driving real estate and industrial growth. - Projects like Madrid Nuevo Norte and Costa Rica's affordable housing initiatives demonstrate PPPs' ability to boost property values and create jobs through mixed-use development and public land utilization. - U.S. data reveals racial disparities in PPP benefits, with communities of color experiencing lower baseline home values despite similar growth rate

ICP's 30% Price Jump: Key Factors and What It Means for Web3 Investors

- ICP surged 30% in late 2025 due to upgraded on-chain governance and tokenomics, enhancing decentralized control and utility-driven demand. - Network Nervous System (NNS) reforms simplified neuron activation, boosted developer participation, and introduced periodic voting reaffirmations. - Caffeine AI integration and partnerships with Microsoft/Google drove TVL to $237B, though dApp usage declined 22.4% amid macroeconomic volatility. - Analysts project $11.15–$31.89 price range for 2026, contingent on sus