Tokenized Gold Market Nears $3B as Bullion Blasts to Fresh Record Highs

Gold’s historic rally accelerated on Monday, with spot prices punching through $3,800 per ounce to set fresh all-time record, extending a torrid year in which bullion is up roughly almost 47% year-to-date.

That surge is echoing on across crypto rails, with gold-backed tokens climbing to an all-time high market capitalization of $2.88 billion, CoinGecko data shows. Tokenized versions of the metal are backed by physical reserves but settle on blockchain rails, offering round-the-clock trading and near-instant transfers.

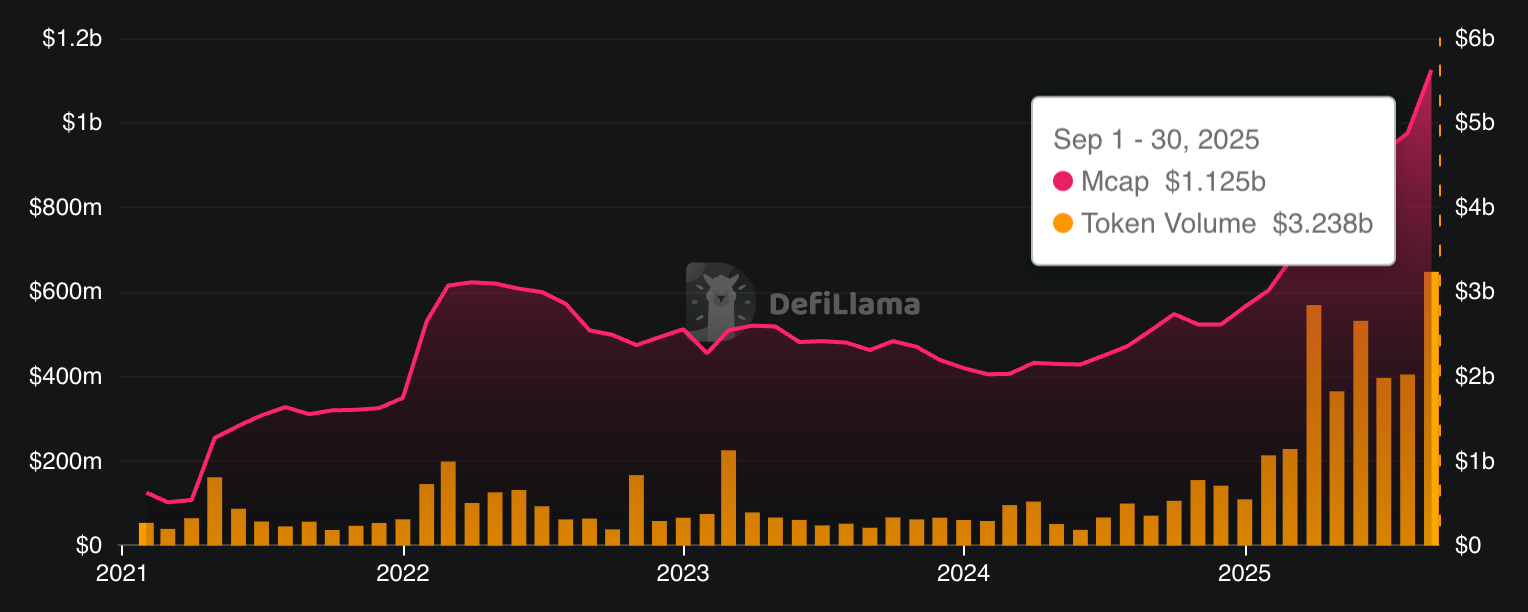

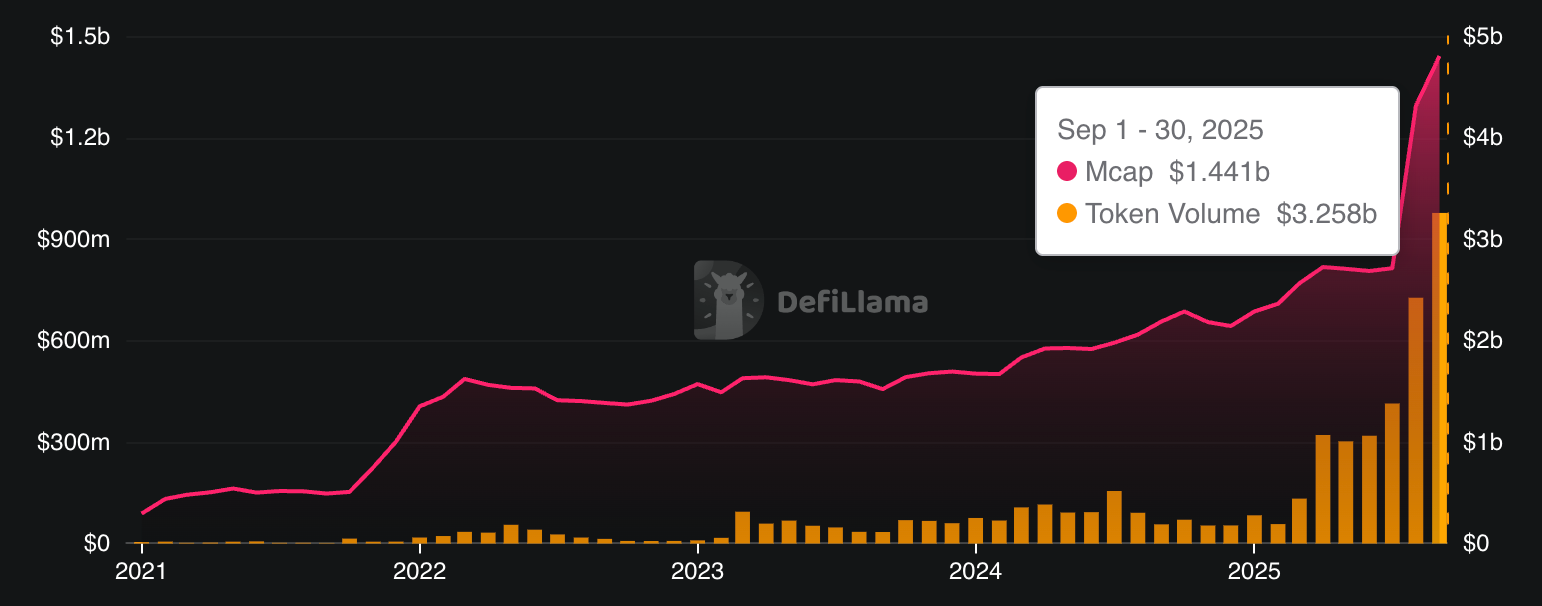

XAUT$3,832.05 and Paxos' PAXG$3,843.58, both tokens issued by firms predominantly known for their stablecoins, are dominating the category. XAUT’s capitalization stood near $1.43 billion and PAXG’s at roughly $1.12 billion, both at their respective all-time highs.

Liquidity has swelled alongside the rally, too. PAXG attracted more than $40 million in net inflows during September and set a fresh trading volume record surpassing $3.2 billion in monthly turnover.

XAUT also posted a record $3.25 billion in monthly volume, per DeFiLlama. Meanwhile, the token's market cap growth came solely from the underlying metal's appreciation, as no new token minting happened this month after August's $437 million jump.

The tokenized gold market could continue gaining as macro conditions remain supportive for the yellow metal. Investors expectations mount for more Federal Reserve rate cuts and a softer U.S. dollar, while anxiety builds over a possible government shutdown in the U.S. Meanwhile, BTC$114,362.81, often dubbed as "digital gold," is lagging behind gold with a 22% year-to-date return.

Read more: Bitcoin to Join Gold on Central Bank Reserve Balance Sheets by 2030: Deutsche Bank

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The KITE Listing Boom: Analyzing Investor Attitudes and Trust from Institutions

- Kite Realty Group Trust (KRG) reported a $4.82M revenue shortfall but 2.1% same-property NOI growth in Q3 2025, driven by 79% grocery-anchored retail portfolio expansion. - Institutional ownership shows duality: Vanguard/JP Morgan hold $1.2B shares, while CEO John Kite sold 48% of holdings and Intech reduced stakes by 16.8%. - Analysts highlight KRG's 7.4% dividend growth and industrial real estate pivot amid AI/logistics trends, yet caution against retail REIT sector risks rated "F" for macroeconomic vu

Bitcoin News Today: Is Bitcoin Facing a Liquidity Gap? Could a Crash Like 2022 Be on the Horizon?

- Glassnode analysts warn Bitcoin's STH P/L ratio at 0.07x (lowest since 2022) signals liquidity vacuum risks, potentially forcing price below $81,000 "True Market Mean." - Historical patterns show LTH sell-offs (1.57M BTC in Q3) and compressed profit margins (7D-SMA at 408x) often precede major market tops, raising bearish concerns. - Institutional defensiveness and weak futures demand highlight fragile market structure, with $80,000-$85,000 consolidation critical for confirming bullish reversals. - While

Dogecoin News Today: Grayscale's DOGE ETF Seeks to Elevate Meme Coin to Blue-Chip Status

- Bitcoin stabilized on Thanksgiving while Ethereum , Dogecoin , and XRP declined, with analysts emphasizing BTC's critical support levels. - Grayscale's GDOG ETF and BitMine Immersion's $83M ETH purchase highlight crypto's financialization, with the latter holding 2.9% of circulating ETH. - Grayscale's DOGE ETF debuted with modest $1.8M inflows, reflecting DOGE's weaker institutional appeal compared to Bitcoin despite its 37% 30-day gain. - Tom Lee forecasts ETH to $7,500 by year-end, citing stablecoins a

Infrastructure-Focused Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to upgrade infrastructure, targeting industrial growth via Xerox campus redevelopment and blight removal. - Xerox's 300-acre brownfield site transforms into a $650M industrial hub by 2025, creating 250 jobs at fairlife® dairy facility with enhanced utilities. - Blight removal at 600 Ridge Road and $1.8M road realignment projects unlock 300 acres for development, improving logistics and downtown connectivity. - WEDA and municipal coordination streamline land sale