21Shares files updated S-1 for Solana ETF ahead of SEC decision

Solana ETF issuers are updating their proposals as the U.S. crypto market braces for a busy October, with the SEC set to rule on a wave of altcoin ETF applications.

- Solana ETF proposals gain traction as 21Shares updates S-1 filing, revising fund structure and operational details.

- Other issuers, including Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary, have also submitted similar updates.

- The SEC is expected to make final decisions on 16 crypto ETF applications in October, covering altcoins like Solana, XRP, Litecoin, Dogecoin, and Cardano.

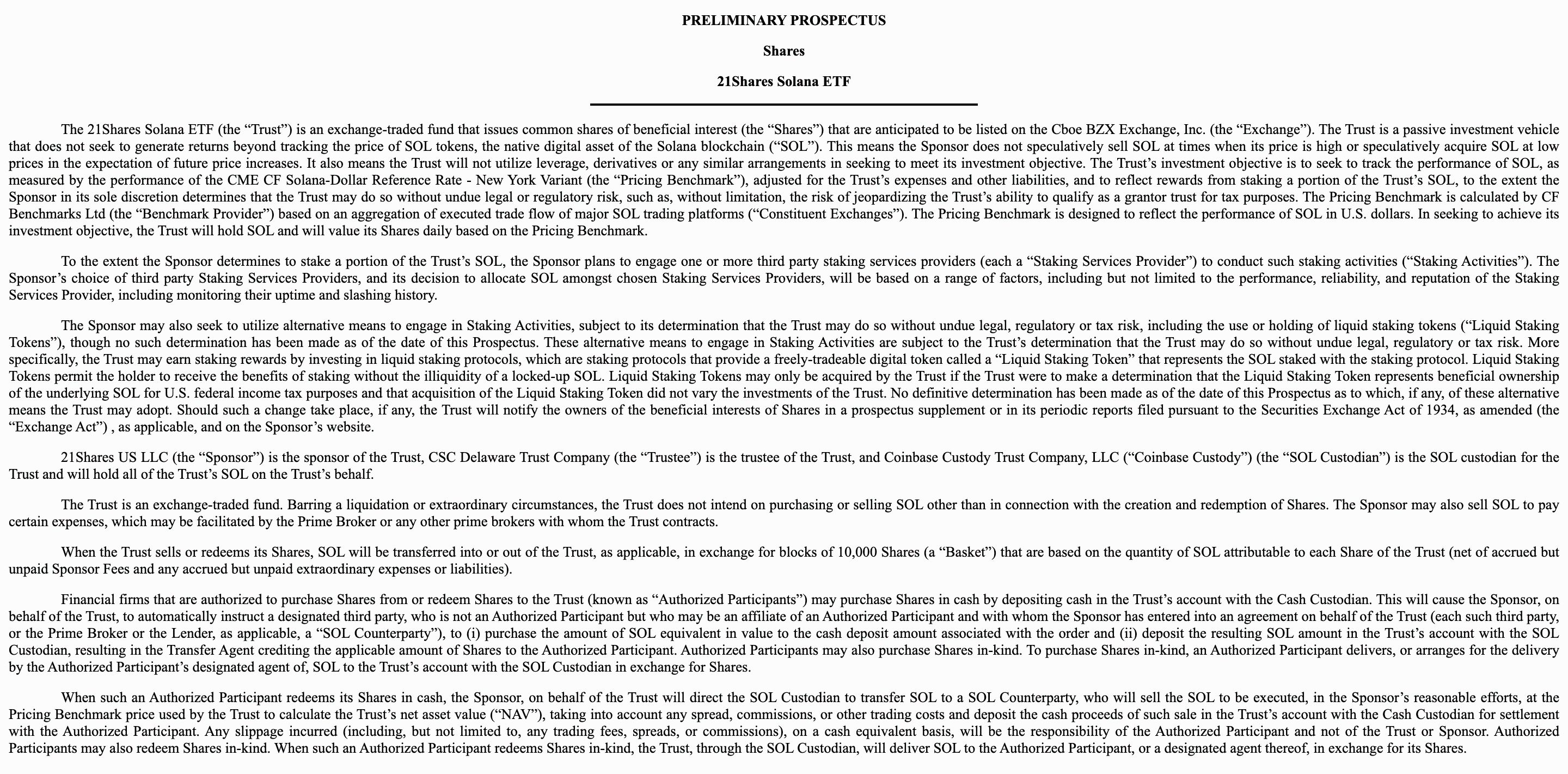

ETF issuer 21Shares has filed an updated S-1 for its proposed Solana ETF. In the amendment, the asset manager provided revised details on the structure and operations of the proposed fund. The update includes provisions around staking and clarifies how in-kind redemptions would be handled, addressing points that have drawn close scrutiny from regulators.

21Shares’ updated Solana ETF filing | Source: sec.gov

21Shares’ updated Solana ETF filing | Source: sec.gov

The filing builds on a flurry of similar amendments submitted in recent days by other issuers, including Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary.

Currently, around nine applications for Solana ( SOL ) ETFs are pending with the SEC. The recent wave of amendments signals that issuers are actively refining their filings in response to regulatory feedback, a common step ahead of final approval decisions.

Solana ETF amendments come ahead of October approval buzz

October is shaping up to be a big month for crypto ETFs, with the SEC set to decide on several altcoin-based applications, such as XRP ( XRP ), Litecoin ( LTC ), Cardano ( ADA ), alongside SOL.

Deadlines for the various proposals are spread throughout the month, and ongoing regulatory developments are fueling approval hopes across the industry. Official sources have recently revealed that the SEC has dropped delay notices for these applications, clearing the way for final decisions and a potential flood of new ETF releases hitting the market.

This follows the approval of updated listing standards for crypto ETFs by the commission earlier in the month, boosting expectations that the proposed funds are likely to receive regulatory approval.

Updated filings from 21Shares and other issuers now add to the growing chatter and anticipation around the proposed funds. Meanwhile, the ETF buzz is translating into strong price action for SOL, which is up nearly 4% on the day, trading at $207 at the time of writing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"From Initial Coin Offerings to Gaining Institutional Confidence: The Transformation of Crypto Tokenomics"

- Canton’s tokenomics strategy rejects ICOs, promoting structured, long-term crypto development models to enhance institutional credibility and sustainability. - Regulatory delays like Switzerland’s postponed CARF and U.S. ETF approvals highlight challenges in aligning innovation with compliance and cross-border legitimacy. - Grayscale’s Dogecoin and XRP ETFs signal growing institutional acceptance, though mixed market performance underscores crypto’s volatility and speculative risks. - Advocacy groups lik

ETPs Connect Speculative Tokens with Traditional Financial Markets

- Swiss firm Bitcoin Capital launched Europe's first Bonk ETP on SIX, enabling traditional investors to trade the Solana-based memecoin via conventional financial tools. - Physically-backed ETP eliminates crypto expertise requirements, aligning with global altcoin product surges and U.S. altcoin ETF trends. - Market shift toward speculative assets reflects regulatory clarity and institutional interest, with European regulators cautiously embracing crypto-ETP bridges. - Projects like Kuardun7.0 aim to merge

The transformation of the Xerox campus in Webster, NY: A calculated move in real estate and infrastructure development

- Webster , NY's Xerox campus redevelopment leverages a $9.8M FAST NY grant to upgrade 300 acres of brownfield infrastructure, creating shovel-ready industrial space by 2025. - Xerox's strategic divestiture aligns with infrastructure timelines, enabling private-sector repurposing of the site as a mixed-use hub with anchor projects like the $650M fairlife® dairy plant. - State-backed upgrades have already driven 10.1% annual home price growth and 2% industrial vacancy rates, positioning the site to capture

Ethereum News Update: Amundi’s Integrated Approach Connects Blockchain with Conventional Financial Regulations

- Amundi, Europe's largest asset manager, launched its first Ethereum-based tokenized money-market fund, enabling 24/7 settlements and transparent record-keeping via blockchain. - The hybrid model, developed with CACEIS, combines traditional fund operations with blockchain-based ownership, preserving regulatory compliance while expanding investor access. - Ethereum's dominance in stablecoin and RWA transfers ($105.94B in 30 days) underscores its role in accelerating tokenization, with Amundi positioning it