From ETF Buzz to Rising Network Activity: Why Litecoin Could Lead in Q4

Litecoin’s Q4 prospects strengthen as ETF optimism grows, large transaction volumes rise, and payment adoption surges, hinting at undervaluation.

Litecoin (LTC), an altcoin that uses the proof-of-work consensus mechanism and was once called “digital silver,” is working to regain its former glory. Fundamental factors strengthen the network’s resilience and utility, but the price does not reflect those underlying values.

A few signals suggest that Litecoin’s momentum is reviving and growing in the year’s final quarter.

Average Transaction Value, Litecoin ETF, and More

According to expert Nate Geraci, the US Securities and Exchange Commission (SEC) will soon issue final decisions on spot crypto ETF applications in the coming weeks.

The Canary Litecoin ETF application is the first in line. A decision is expected this week on October 2, followed by rulings on other altcoins such as SOL, DOGE, XRP, ADA, and HBAR.

Prediction platform Polymarket currently assigns a 90% probability that regulators will approve a Litecoin ETF in 2025. Investors show strong confidence in this outcome.

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

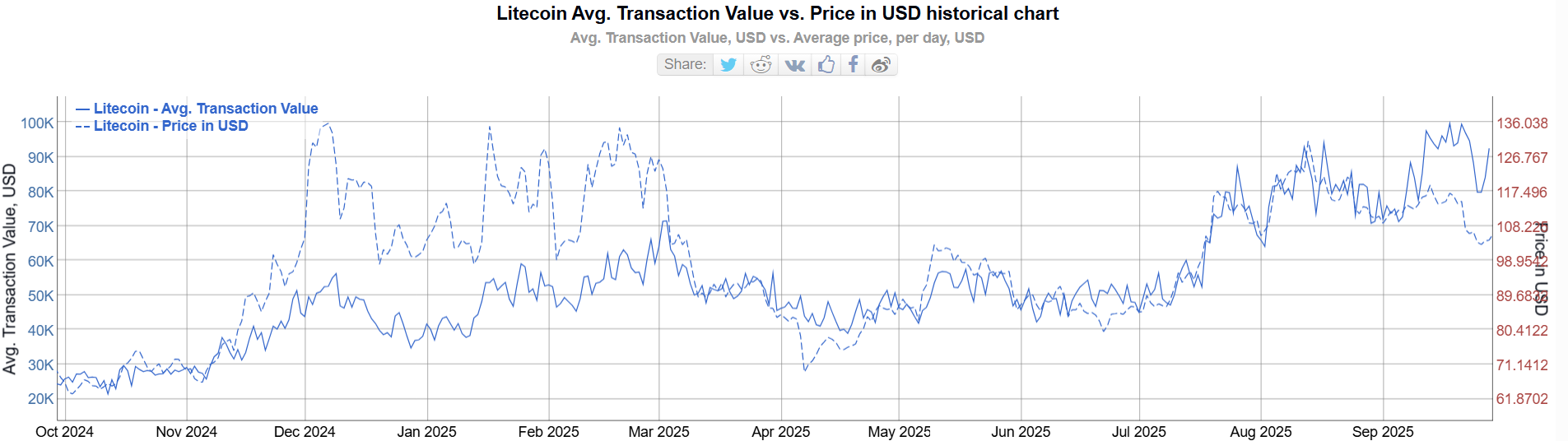

Second, Litecoin’s average transaction value has reached a two-year high, signaling a surge in large transactions across the network.

Data from BitInfoCharts shows that the average transaction value (solid line) climbed from $25,000 at the end of 2023 to nearly $100,000 in September 2025, four times higher and the highest level in two years.

Average LTC Transaction Value. Source:

Bitinfocharts

Average LTC Transaction Value. Source:

Bitinfocharts

The rise is noteworthy because LTC’s price remained stable at around $100 without hitting new highs. This suggests more LTC is moving across the network. These could be payment transactions or accumulation moves.

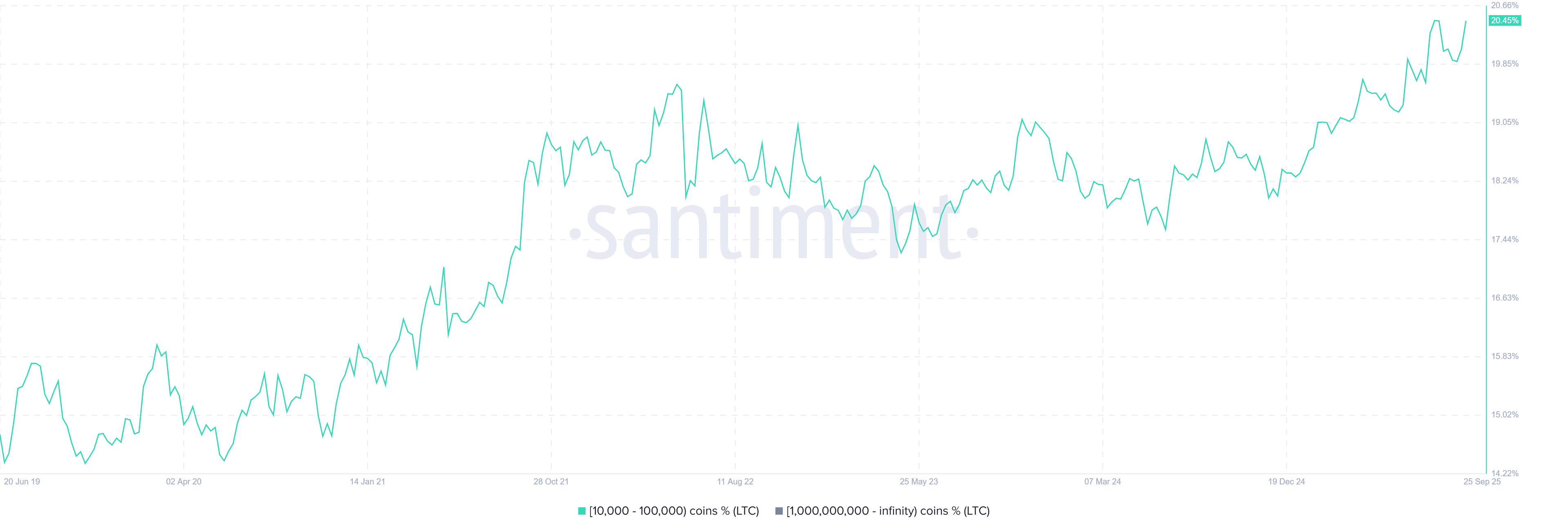

Recent Santiment data support the accumulation thesis. Wallet addresses holding between 10,000 and 100,000 LTC have grown steadily over the past five years, accounting for more than 20% of the supply.

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

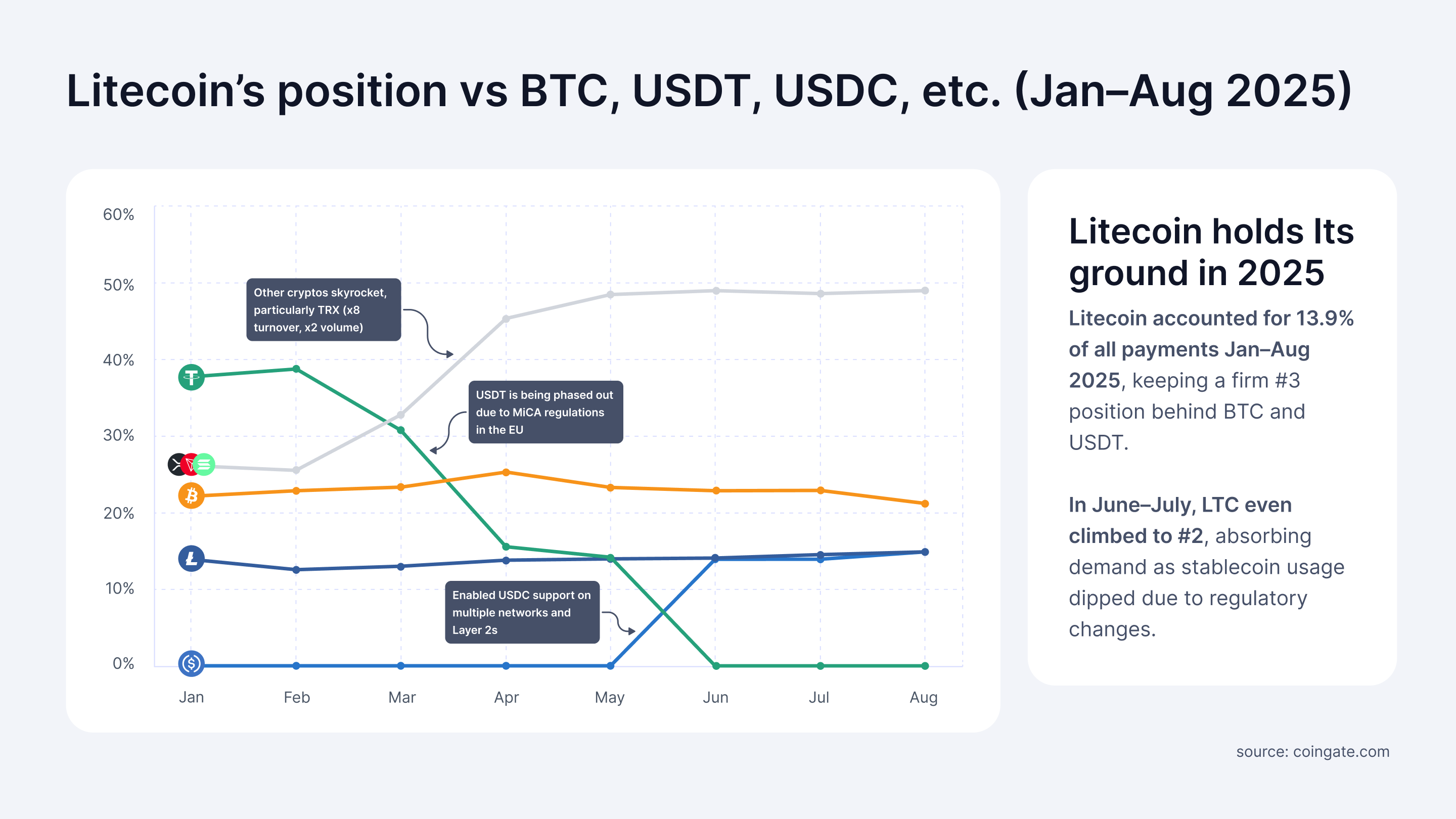

Third, a report from CoinGate highlights Litecoin’s dominance in consumer payments on its platform. From January to August 2025, LTC represented 13.9% of all transactions, ranking third behind Bitcoin (23%) and USDT (21.2%).

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

“Litecoin payments remain steady across the year, with higher usage when competing assets face headwinds. Rather than being a marginal alternative, Litecoin has proven it can capture meaningful share when circumstances change, which is a clear sign of resilience and user trust,” CoinGate reported.

These positive signs of adoption lead many analysts to argue that LTC is undervalued compared to the utility its network delivers.

“Litecoin is at least 50x undervalued… it’s actually more once price goes vertical and it catches the next wave of adoption, likely sending it another 10x… so 500x undervalued,” analyst Master predicted.

However, competition remains fierce. Other altcoins, such as ETH, SOL, XRP, and XLM, are also cementing their roles in the growth of DeFi and global payments. Investors, therefore, may find strong alternatives for their portfolios beyond LTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu’s Focus on Privacy Aims to Draw DeFi Interest Amid Price Challenges

- Shiba Inu (SHIB) stabilizes near $0.00000851, with traders monitoring $0.000008390 support and $0.000008840 resistance amid a descending channel pattern since early 2025. - A 1.7% weekly gain contrasts with a 17.4% drop from its 14-day high, while $132.8M trading volume highlights uncertainty despite a privacy-focused Shibarium upgrade integrating Zama's FHE technology. - Technical indicators show fragile equilibrium, with bearish EMAs and $380K net outflows reinforcing distribution trends, though analys

Bitcoin News Update: Greenidge Transitions to AI as Bitcoin Mining Faces Rising Expenses and Regulatory Challenges

- Greenidge Generation , a Bitcoin miner, shifts to AI/HPC amid industry cost and regulatory pressures. - Bitcoin mining profitability declines as hashrate hits 1.16 ZH/s and hash prices fall below $35. - Companies like Bitfarms abandon Bitcoin for AI/HPC, while CleanSpark reports $766M mining revenue surge. - Regulatory scrutiny intensifies over foreign mining hardware, with BlockQuarry promoting domestic alternatives. - Energy costs and debt disputes force Tether to halt Uruguayan mining, highlighting se

Bitcoin News Update: Institutions Favor Bitcoin's Reliability as Altcoin Growth Slows

- Bitcoin's market dominance exceeds 54%, driven by waning altcoin momentum and institutional preference for stability. - Altcoin Season Index at 23 signals Bitcoin-centric trends as macroeconomic pressures and regulatory uncertainty weaken alternative cryptocurrencies. - Institutional investors prioritize Bitcoin's scalability and infrastructure, exemplified by Bhutan's Ethereum integration and Bitcoin Munari's fixed-supply presale model. - Analysts highlight Bitcoin's role as a macroeconomic barometer, w

MMT Token TGE: Is This the Dawn of a New Era for Digital Asset Foundations?

- MMT Token's 2025 TGE secured $100M valuation from Coinbase Ventures, OKX, and Jump Crypto, with 1330% price surge post-launch. - Momentum DEX on Sui reported $13B trading volume and $320M TVL, leveraging CLMM architecture and cross-chain RWAs for institutional appeal. - 55% of hedge funds now hold digital assets, driven by U.S. CLARITY Act and EU MiCA 2.0, as MMT's RWA focus bridges traditional and blockchain finance. - Despite macroeconomic risks like 34.6% post-TGE volatility, MMT's governance model an