Quant’s Rally Draws Attention As Bulls Eye $103 Liquidity Zone

Quant’s 6% rally sparks bullish interest as traders target the $103 liquidity zone. Rising open interest and CMF strength back the case for more upside.

Quant’s native token, QNT, has emerged as one of today’s top-performing altcoins. Its price has climbed 6% even as the broader market struggles.

The move has sparked renewed bullish interest, with on-chain data pointing to more potential upside in the sessions ahead.

Quant Token Rallies With Growing Trader Confidence

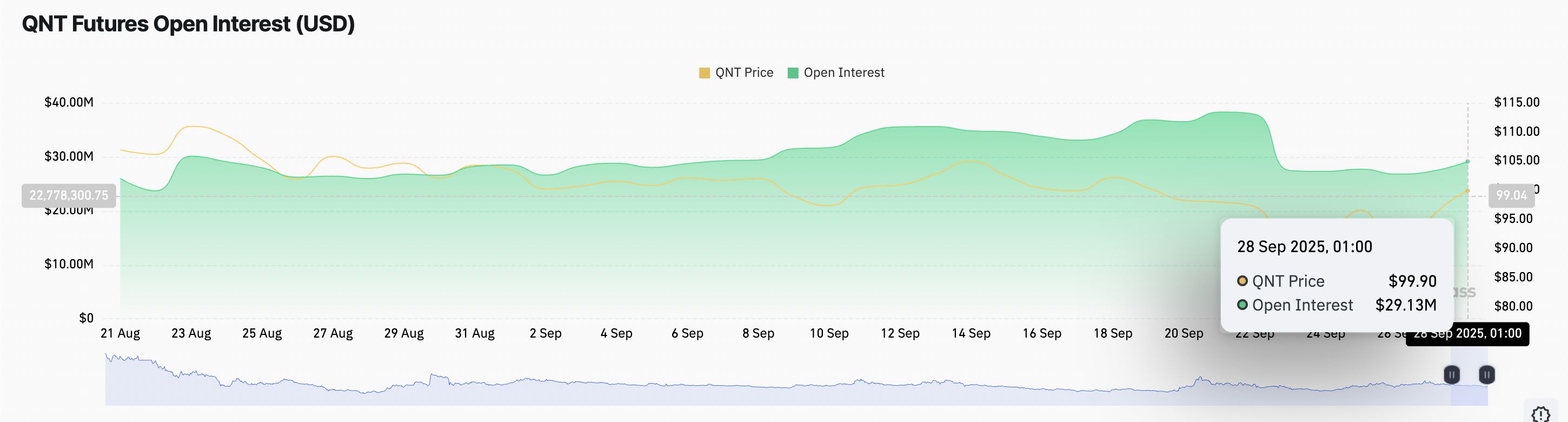

QNT’s gains over the day have been accompanied by an uptick in its futures open interest, signaling that traders are increasingly entering new positions rather than exiting existing ones. According to Coinglass, this currently stands at $29.13 million, up 7% in the past 24 hours.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

QNT Futures Open Interest. Source:

Coinglass

QNT Futures Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding futures contracts that have not yet been settled. It serves as a key gauge of market activity and trader participation, so when it rises alongside a price increase, it indicates that new money is flowing into the market, strengthening the trend.

For QNT, this indicates growing confidence among its traders that the current bullish momentum has room to continue.

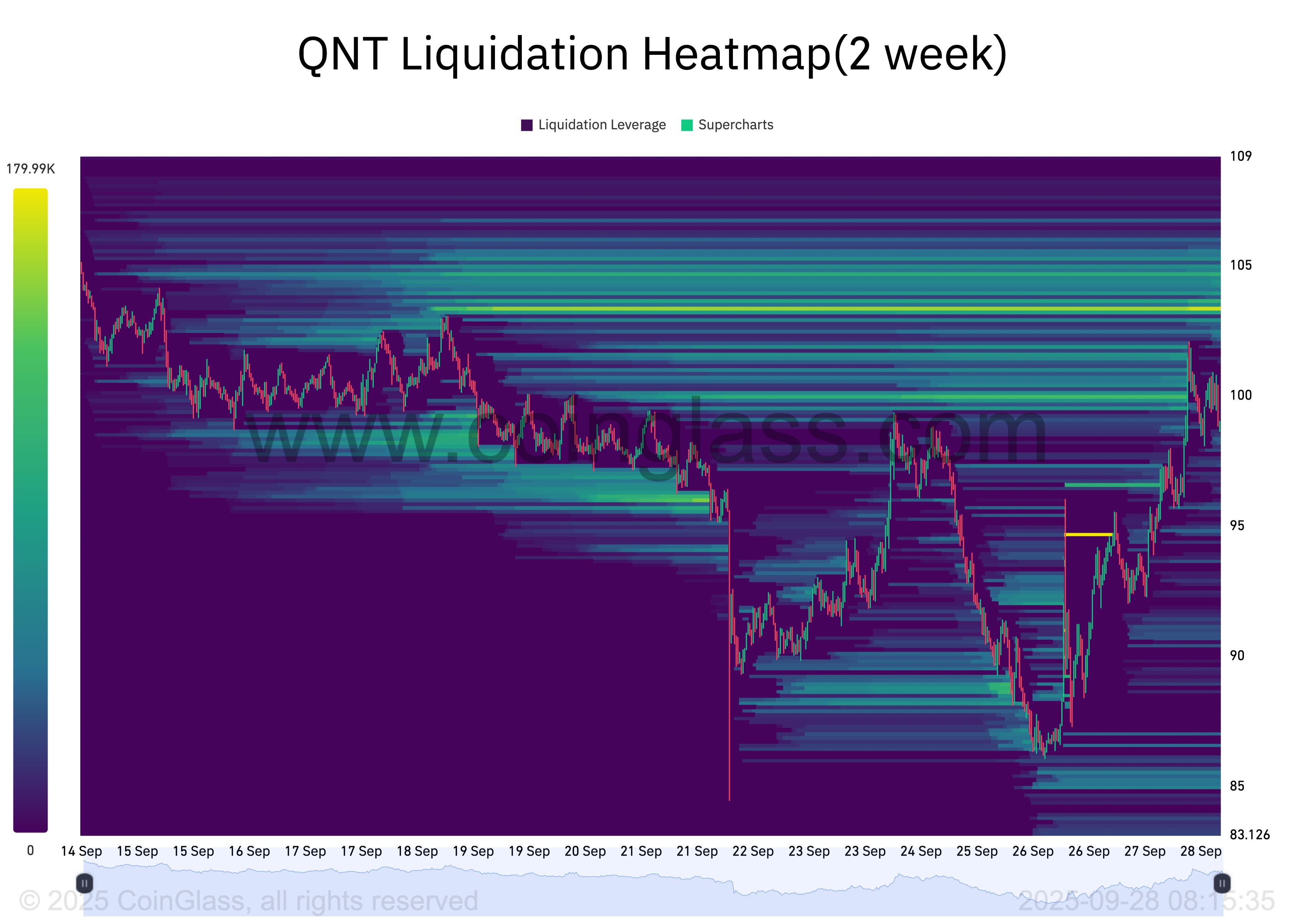

Further, QNT’s liquidation heatmap highlights a concentration of liquidity sitting above current levels at around $103.

QNT Liquidation Heatmap. Source:

Coinglass

QNT Liquidation Heatmap. Source:

Coinglass

Liquidation heatmaps are visual tools traders use to identify price levels where large clusters of leveraged positions are likely to be liquidated. These maps highlight areas of high liquidity, often color-coded to show intensity, with brighter zones representing larger liquidation potential.

Such zones are often described as “price magnets,” drawing spot and derivatives activity toward them as traders seek to exploit potential squeezes. This setup suggests that QNT may continue its upward trend toward the liquidity cluster, provided market momentum holds.

QNT’s Uptrend Gains Steam

On the daily chart, QNT’s Chaikin Money Flow (CMF) indicator is trending upward, supporting the case for a sustained rally. As of this writing, this momentum indicator is at 0.02.

The CMF measures the flow of capital into and out of an asset by analyzing price and volume. A surging CMF like this reflects increasing buy-side pressure, strengthening the case for sustained bullish action for QNT.

If demand remains high, it could trigger a breach of the resistance at $101.87 and climb toward $107.68.

QNT Price Analysis. Source:

TradingView

QNT Price Analysis. Source:

TradingView

However, failure to sustain momentum may leave QNT’s price vulnerable to profit-taking, especially if broader market weakness deepens. In this scenario, it could reverse its current trend and fall to $85.37.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are undergoing a “purification” that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.