XPL Rockets Over 100% as Plasma Mainnet Goes Live, $2 Ahead?

- XPL jumped 135% from lows to reach $1.61 before cooling with slight intraday losses.

- Plasma’s mainnet debut attracted $2B in stablecoin deposits during its first trading day.

- Open interest surged to $1.47B as funding rates signalled firm bullish conviction.

Plasma’s native token XPL has seized the spotlight, dominating market chatter in the past 24 hours. Against a backdrop of widespread uncertainty, the coin defied the red tide sweeping across crypto and rallied to a record high of $1.61. That leap marks a decisive 135% climb from its all-time low of $0.68.

By press time, XPL cooled slightly to $1.49, reflecting a modest 7.54% intraday slip. However, the rally’s timing is what makes it remarkable. While most altcoins faltered, Plasma surged ahead, lifting its market cap to $2.77 billion and clocking $3.56 billion in daily trading volume.

In a market desperate for momentum, the token’s strength has commanded full attention. The spark came from Plasma’s mainnet beta launch on September 25. Within the first hour, deposits of stablecoins surged past $250 million, swelling to nearly $2 billion by the end of the day.

Its zero-fee USDT transfers and Ethereum Virtual Machine compatibility offered traders instant utility and drove rapid uptake. Adding to the frenzy, every participant in the launch event was granted at least $10,000 worth of XPL. That generous distribution stoked optimism and pulled in a flood of new speculators eager to ride the wave.

Together, the potent mix of a high-profile mainnet debut, real-world functionality, and a bold airdrop has placed Plasma at the center of the market conversation. The question now is whether this momentum can carry XPL into the next phase of its breakout run.

Price Action: Can XPL Push Toward $2 After Recent Rally?

XPL’s chart is flashing signs of strength, with a decisive breakout catching traders’ attention. For the past two days, the token consolidated inside a symmetrical triangle before breaking upward in today’s early sessions. The move propelled XPL to a peak of $1.61, where it met fresh resistance.

Since then, momentum has cooled, with the 78.60% Fibonacci level at $1.41 now serving as short-term support. A clean hold above this zone could fuel a breakout-and-retest setup, often seen as a bullish entry point, with an upside target at the 127.20% Fib level at $1.86.

Source: TradingView

Additional key upside levels include 141.40% at $1.99 and 161.80% at $2.18. Still, caution lingers. If XPL loses $1.41, the price could fall back to retest its resistance trendline as new support. Failure to hold would expose the $1.15–$1.11 region, a zone aligning with the 50% retracement level and a potential base for another consolidation cycle.

On the other hand, technical signals suggest near-term cooling but not a collapse. The Relative Strength Index, for instance, sits at 66.81, easing from overbought territory and hinting at a pullback before possible continuation.

Meanwhile, the MACD shows slowing momentum as its histogram contracts and its line tilts downward. Even so, the MACD line remains elevated at +0.0795, signaling that bulls still carry an edge despite the pause.

Derivatives Market Signals Rising Trader Activity

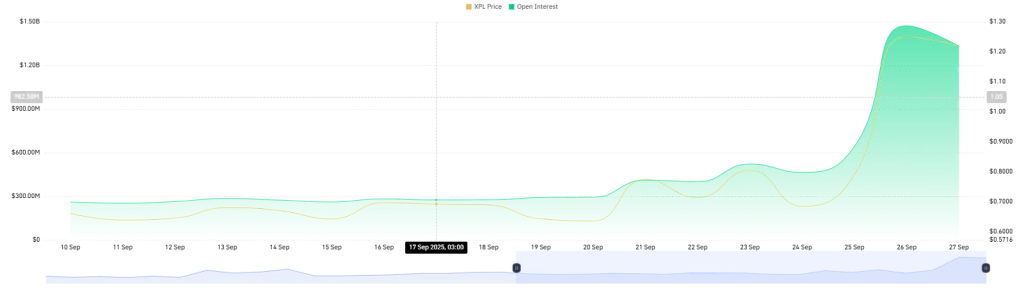

XPL’s surge has been mirrored in its derivatives market, where Open Interest (OI) spiked to $1.47 billion following the token’s expansion across top exchanges. The jump points to a wave of fresh capital entering the market, with traders quickly building positions around XPL.

Source: CoinGlass

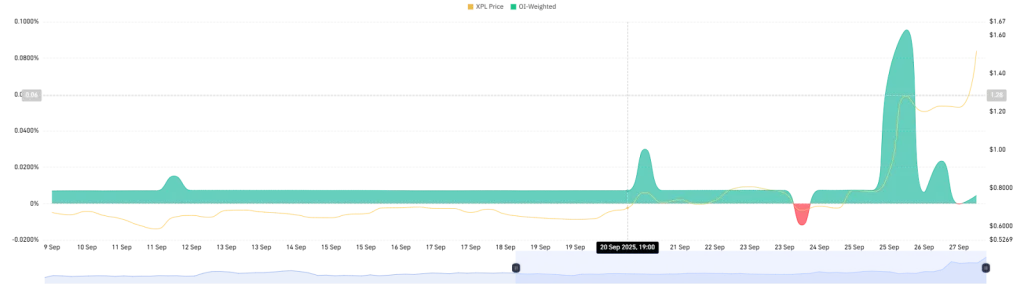

While the influx reflects growing confidence, it also sets the stage for sharper swings as leveraged bets accumulate on both sides. Adding to the narrative, funding rates remain firmly positive at +0.0044%.

Source: CoinGlass

This shows that long traders are paying a premium to keep positions open, underscoring their belief that momentum is far from over. The willingness to absorb that cost highlights a firm bullish conviction and signals that traders anticipate another leg higher for XPL in the near term.

Conclusion

XPL’s sharp rise has cemented its status as one of the most talked-about tokens in the market. A decisive breakout on the charts, rising open interest, and steady positive funding rates all point to strong investor confidence.

Though signals suggest the possibility of short-term cooling or sideways movement, overall momentum remains in favor of the bulls, with many expecting XPL to extend its climb in the sessions ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Transformation of Xerox Campus and Webster, NY’s Economic Revival: An Infrastructure-Led Model for Unlocking Value in Industrial Real Estate Markets

- New York's $9.8M FAST NY-funded upgrades transformed Webster's 300-acre Xerox brownfield into a 1M sq ft industrial hub by 2025. - Infrastructure improvements reduced industrial vacancy to 2%, attracting high-tech manufacturers and green energy firms. - The project boosted home prices by 10.1% annually and created 250 jobs via the $650M fairlife® dairy facility. - Public-private partnerships through BOA designation enabled risk-reduced development of contaminated sites. - Webster's model demonstrates inf

Ethereum News Update: ZKP’s Hardware-Centric Strategy Shakes Up Speculation-Fueled Crypto Presales

- ZKP launches with $17M pre-built Proof Pods, offering instant AI compute rewards via Wi-Fi-connected hardware. - Unlike speculative presales, ZKP's hardware-first model ensures operational readiness and decentralized network resilience. - Competitors like Blazpay and SpacePay focus on utility-driven crypto adoption, but ZKP's tiered, upgradable devices emphasize verifiable performance. - Ethereum's gas limit increase aligns with ZKP's distributed compute approach, addressing scalability challenges throug

Solana News Update: Investors Shift Toward XRP ETFs, Bringing Solana's 21-Day Inflow Streak to a Close

- Solana ETFs ended a 21-day inflow streak with a $8.1M net outflow on Nov 27, 2025, led by 21Shares TSOL's $34.37M redemptions. - This reversal contrasted with Bitcoin/Ethereum ETFs' $5.43B outflows and highlighted Solana's 7% staking yields and 70M daily transactions. - Analysts linked the shift to profit-taking, macroeconomic pressures, and investor rotation toward XRP ETFs with perfect inflow records. - Despite the outflow, Solana ETFs still hold $964M in assets, but face challenges as TVL dropped 32%

XRP News Today: Institutional ETFs Drive XRP to Compete with Bitcoin's Market Leadership

- XRP ETFs see $160M+ inflows as institutional demand surges, with Bitwise and Franklin Templeton leading the charge. - NYSE approves Grayscale and Franklin XRP/Dogecoin ETFs amid SEC easing altcoin fund approvals, signaling crypto normalization. - Altcoin Season Index at 25/100 shows Bitcoin dominance, but projects like Aster and Zcash outperform BTC by 1,000%+. - XRP rebounds to $2.06 with 48% volume spike, but 79M tokens absorbed by ETFs raise supply concerns. - Institutional-grade custody solutions fro