Korean Man Claiming to Have the Highest IQ Reveals His Bitcoin Price Prediction

South Korean YoungHoon Kim, who describes himself as the person with the highest IQ in the world with 276, made an intriguing prediction in the cryptocurrency world.

Kim predicted that Bitcoin would increase in value at least 100 times over the next 10 years and become a universal reserve asset. He also claimed that his company, “American Bitcoin (ABTC),” would become the world's largest company by market capitalization.

However, Kim's claim of having the “highest IQ” has long been disputed. No official, independent, or concrete evidence based on test results or academic documents has yet been made public. Some experts point out that standard IQ tests can only produce reliable results up to 160-200, while the scientific validity of extreme values like 276 is not well-founded.

There has been public criticism that there are connections between the institutions that document Kim's alleged high IQ.

The situation on ABTC's side is also uncertain. The company is known as a Bitcoin production and accumulation platform, largely supported by Hut 8. However, ABTC's shares fell by approximately 15% in the first few days after its listing on the Nasdaq exchange.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

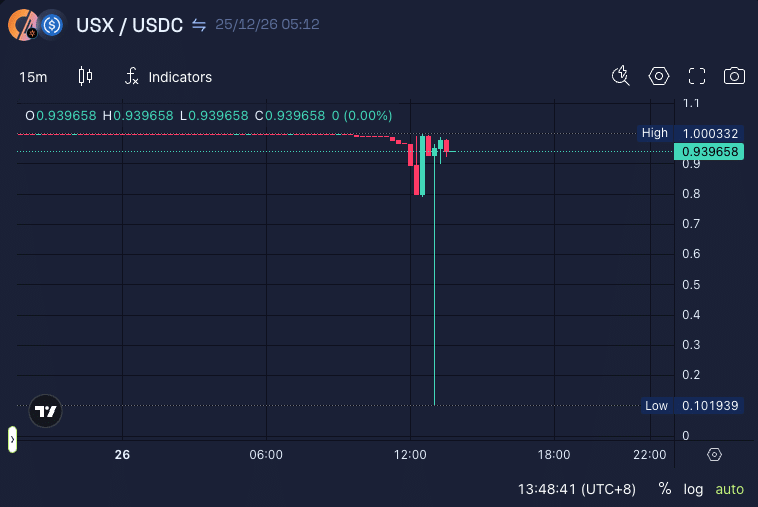

Solana’s USX Depeg Sparks Fresh Stablecoin Liquidity Fears

Bitcoin Cash Eyes $680 Breakout After Strong Support Hold

CYC Staking launches a brand-new staking model – AI-powered intelligent multi-chain service, with a reward of 68,890 upon participation.

Russia’s Sberbank eyes crypto-backed loans, says regulatory support will be key