Justin Sun Reportedly Controls Over 60% Of Tron’s (TRX) Supply

A new report alleges that Justin Sun holds most TRX tokens, casting doubt on Tron's decentralization and fueling market uncertainty.

A new report claims that Justin Sun holds over 60% of all Tron tokens. Although the project ostensibly aims to promote decentralization, one man allegedly holds control over TRX.

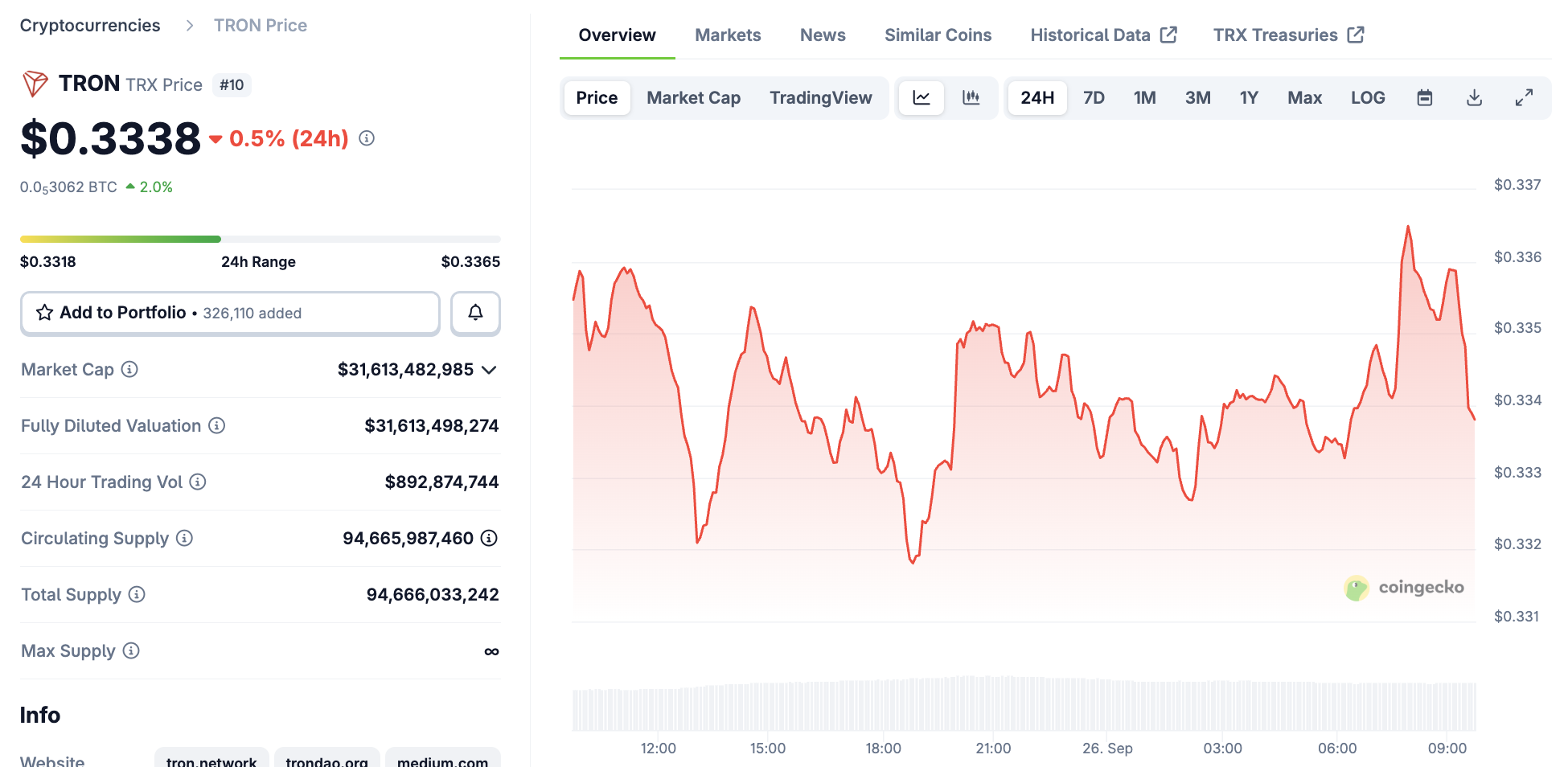

TRX price hasn’t wildly reacted to this rumor yet. The jury’s still out as to whether or not this scandal causes lasting reputational damage.

Justin Sun’s Tron Holdings

Justin Sun has been involved in a few controversies this month, apparently offering to invest in WLFI after World Liberty froze his wallets.

Today, however, a new report from Bloomberg made a bold claim that Justin Sun himself controls over 60% of all Tron (TRX) tokens.

This report, which allegedly sourced its Tron data from Justin Sun’s own team, would be a bombshell for the community. TRX is marketed as a decentralized blockchain smart contract system, aiming to advance decentralization across the Internet.

Simply put, there’s nothing decentralized about one man owning more than half of all circulating tokens. Tron’s price has been volatile througout the week, but it hasn’t reacted wildly to the latest rumors.

Tron Price Performance. Source:

CoinGecko

Tron Price Performance. Source:

CoinGecko

One Battle After Another

Justin Sun has been pursuing a legal battle against the publication over these Tron claims, although the courts ruled against him this week.

In past years, Sun has levied lawsuits towards a few media outlets regarding critical press coverage, but this effort has apparently been unsuccessful. If he wishes to sue Bloomberg for libel, that’ll force both parties to publicize their proof.

All things considered, social media chatter has been fairly tame, with most commentators acting unsurprised. To be clear, reactions have not been positive, but crypto analysts have been more likely to affectionately call Justin Sun “the second-biggest market manipulator in the game” over his Tron holdings than act indignant.

Justin Sun is the second best MM in the game behind senor CZ & https://t.co/kzzuPjGpUt

— woods.ai (@robw00ds) September 26, 2025

It’ll be interesting to see how these bold claims actually impact TRX’s market performance in the long run. Justin Sun already faced controversy when Trump’s SEC dropped its investigation after huge WLFI purchases.

Will one more round of bad press change the community’s opinion any further?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Latest Price Fluctuations: On-Chain System Vulnerabilities and Investor Sentiment in Advanced Blockchain Networks

- Solana's 2025 market volatility stems from technical vulnerabilities, validator instability, and shifting investor sentiment, with SOL experiencing a 150% drawdown from its peak. - Validator count dropped 68% since 2023, raising decentralization concerns as institutional participants adopt MPC solutions to mitigate downtime risks. - Institutional adoption grew via ETFs like SOEZ and BSOL , yet infrastructure risks prompted cautious on-chain behavior and diversified risk management strategies. - DeFi TVL

Bitcoin Leverage Wipeout: Systemic Threats in Cryptocurrency Derivatives Markets

- 2025 Bitcoin leverage liquidation events ($19B+ in October, $543M in December) exposed systemic risks in crypto derivatives markets, with Bitcoin short positions disproportionately affected. - Crisis revealed interconnectedness between crypto and traditional finance, as stablecoin de-pegging and liquidity shocks impacted U.S. Treasury markets and midcap tokens. - Regulators intensified oversight: FSB identified stablecoin/CASP gaps, Basel Committee adjusted prudential rules, and 70%+ jurisdictions advanc

Clean Energy Market Fluidity: How REsurety's CleanTrade Platform is Transforming Institutional Participation and Risk Strategies in Renewable Energy Trading

- REsurety's CleanTrade platform standardizes green energy trading, boosting institutional liquidity and risk management. - Launched in 2025, it facilitated $16B in trades, enabling transparent VPPA/PPA/REC trading and ESG-aligned hedging. - CFTC oversight reduces counterparty risk, aligning with decarbonization goals amid policy uncertainties. - Despite challenges like rising rates, CleanTrade bridges gaps by standardizing pricing and aggregating demand.

The Emergence of Clean Energy Derivatives: How CleanTrade is Transforming Institutional Investment in Renewable Resources

- CleanTrade's CFTC-approved SEF designation in 2025 revolutionizes clean energy derivatives by introducing institutional-grade liquidity and standardized trading for VPPAs, PPAs, and RECs. - The platform's $16B notional trading volume within two months demonstrates rapid institutional adoption, with major players like Cargill leveraging its transparent infrastructure to manage energy risks. - Integrated ESG analytics and automated compliance tools enable investors to align portfolios with sustainability g