The Age of Perpetual DEXs: Growth Meets Clouds

According to sector research, perpetual DEXs processed more than $2.6 trillion in trades during 2025. These venues are gradually displacing centralized exchanges by offering custody-free leverage and faster execution. Yet, their rise also raises questions about transparency, token stability, and the long-term meaning of decentralization. As a result, the sector may evolve into a durable

According to sector research, perpetual DEXs processed more than $2.6 trillion in trades during 2025. These venues are gradually displacing centralized exchanges by offering custody-free leverage and faster execution.

Yet, their rise also raises questions about transparency, token stability, and the long-term meaning of decentralization. As a result, the sector may evolve into a durable pillar of DeFi or face challenges tied to its design.

Market Surges to Records

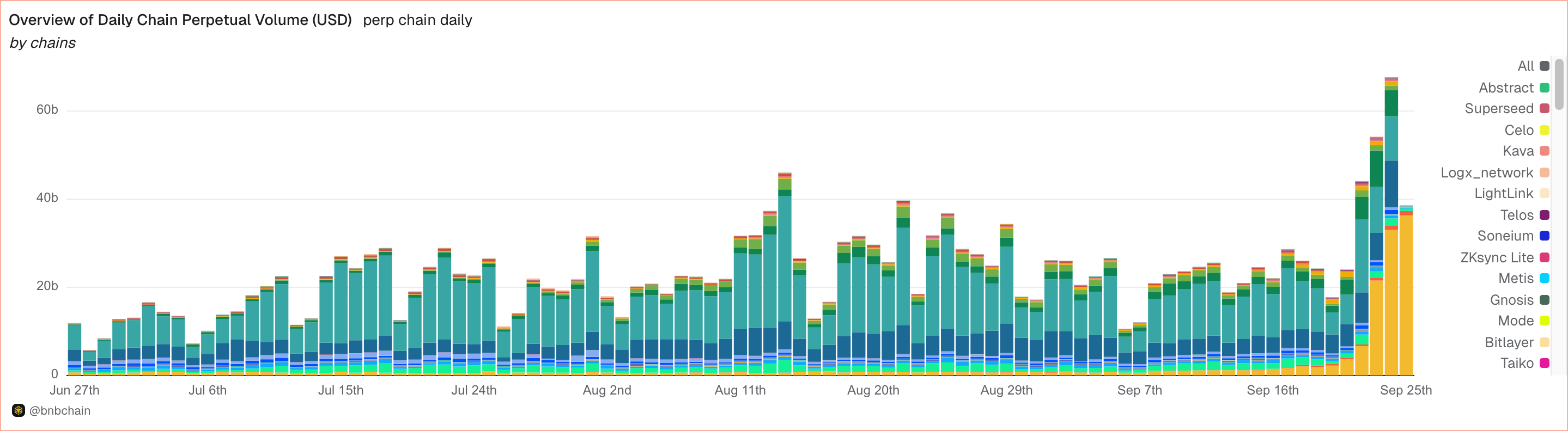

Latest UpdateDune dashboards showed daily perp volumes above $67B in September. Hyperliquid, Aster, and Lighter each cleared $10B, sparking debate on possible wash trading.

Overview of Daily Chain Perpetual Volume (USD)|Dune

Overview of Daily Chain Perpetual Volume (USD)|Dune

Background Context FTX’s collapse shattered trust in CEX custody. In addition, 21Shares likened perps to “renting a house”—flexible but costly—showing why they became DeFi’s core engine.

Deeper AnalysisCoinShares reported 210% growth in 2024, with Hyperliquid volumes up 25x. Jupiter rose 5,176% and Drift 628%. As 21Shares research noted, cumulative perp trades hit $2.6T in 2025, up 138%.

Behind the ScenesBybit compared Hyperliquid’s L1 to Aster’s BNB-first design. ASTER surged 300% post-launch, driven by CZ. Aster briefly overtook Hyperliquid. Consequently, analysts noted that decentralization is now often described as an “illusion”—speed is table stakes, story decisive.

Industry Faces Structural Shift

Wider ImpactPerp DEX share rose from <10% in 2023 to 26% in 2025. DefiLlama observed that the top four venues control 77% of the total. Moreover, traders are moving toward revenue protocols and away from empty meme tokens.

The top 4 Perp DEXs comprise 77% of all volume: pic.twitter.com/8pCkKZsyNv

— DefiLlama.com (@DefiLlama) September 23, 2025

Essential Facts

| Hyperliquid | ~$200B | ~$13.2B |

| Aster | ~$20B | ~$2.5B |

| dYdX | ~$7B monthly | $1.5T cumulative |

| Others | Smaller | Expanding |

Looking Forward OAK Research projected Hyperliquid’s share could stay at 4.5% bear, 6% base, and 8% bull. Messari even called it an “on-chain Binance.”

Bitwise’s Max Shannon told BeInCrypto that the addressable market could expand far beyond current levels. If decentralized perps keep capturing share from CEXs, annual volumes may reach $20–30 trillion within five years. He noted that leverage and trading churn amplify growth beyond spot volumes, with institutional adoption and regulatory clarity acting as further catalysts.

Clouds Over Rapid Expansion

Risks & Challenges DefiIgnas warned HYPE is not FTX or Luna but reflexivity persists. Hayes commented on Aster, while others predicted extreme HYPE upside. CZ said dark pools shield institutions from MEV and liquidation hunting but reduce transparency.

Shannon also warned that with daily volumes already surpassing $67B, regulators may view perp DEXs as systemic. He suggested future oversight could mandate registered interfaces, standardized oracles, audited insurance funds, and formalized risk controls—especially if loss-sharing events threaten stablecoins or if open interest rivals that of centralized exchanges.

Expert Opinions

Perp DEXs can fail, but not like FTX. Their weak points are structural rather than fraudulent, and the risks are transparent and on-chain.— Max Shannon, Bitwise, told BeInCrypto

“Hyperliquid has everything it takes to become the House of Finance,” analysts stated.— OAK Research

“More players will grow the market size faster. Rising tide lifts all boats,” said CZ on X.— Binance founder

Perp DEXs are proliferating, supported by advances in execution speed and liquidity depth. However, their future depends on whether participants balance incentives with consistent governance and credible token models. In addition, if execution continues to improve but trust weakens, adoption may slow.

By contrast, if projects combine strong infrastructure with sustainable economics, the sector could become a central engine of DeFi liquidity and a foundation for broader market integration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategic Collaborations Between Public and Private Sectors: Driving Real Estate and Industrial Expansion in Underdeveloped Areas

- Public-private partnerships (PPPs) are transforming underserved regions by bridging infrastructure gaps and driving real estate and industrial growth. - Projects like Madrid Nuevo Norte and Costa Rica's affordable housing initiatives demonstrate PPPs' ability to boost property values and create jobs through mixed-use development and public land utilization. - U.S. data reveals racial disparities in PPP benefits, with communities of color experiencing lower baseline home values despite similar growth rate

ICP's 30% Price Jump: Key Factors and What It Means for Web3 Investors

- ICP surged 30% in late 2025 due to upgraded on-chain governance and tokenomics, enhancing decentralized control and utility-driven demand. - Network Nervous System (NNS) reforms simplified neuron activation, boosted developer participation, and introduced periodic voting reaffirmations. - Caffeine AI integration and partnerships with Microsoft/Google drove TVL to $237B, though dApp usage declined 22.4% amid macroeconomic volatility. - Analysts project $11.15–$31.89 price range for 2026, contingent on sus

New Prospects in EdTech for STEM and Renewable Energy Sectors: Strategic Integration and Sustainable Investment Opportunities

- Global decarbonization and tech innovation drive surging demand for STEM and renewable energy skills, but talent shortages persist. - Universities modernize curricula with quantum computing, AI ethics, and sustainable engineering to align with industry needs and green job targets. - EdTech bridges gaps through AI-driven personalized learning, VR/AR simulations, and cloud-based hybrid models, enhancing accessibility and practical training. - EdTech market projected to grow at 13.3% CAGR to $348B by 2030,

AAVE Rises 1.13% as Weekly Increase Balances Out Monthly Decline During Market Fluctuations

- Aave (AAVE) rose 1.13% in 24 hours, rebounding from a 39.1% annual decline amid crypto market volatility. - The 12.3% weekly gain reflects speculative buying in DeFi, though broader trends show 17.68% monthly losses. - Analysts highlight DeFi's fragility due to regulatory uncertainty and shifting capital flows, despite short-term optimism. - Aave's future depends on innovation, macroeconomic stability, and competition from emerging lending platforms.