Key Market Insights for September 25th, how much did you miss out on?

Top News

1. Plasma has transferred over 1 billion USDT to USDT0 to prepare for mainnet launch

2. XPL surges over 15% in pre-market trading, now trading at $0.8443

3. Cryptocurrency market continues to slump, with Ethereum flirting with the $4000 mark

4. Naver, South Korea's largest portal site subsidiary, is engaging in a comprehensive stock swap with Upbit's parent company Dunamu

5. GoPlus: GAIN's abnormal minting event bears resemblance to the Yala incident

Featured Articles

1.《Plasma, highly anticipated, goes live tonight. Can it change the landscape of on-chain payments?》

A funding news piece from stablecoin giant Tether is enough to hold the entire traditional financial industry's breath. According to Bloomberg, the "central bank of the crypto world" managing nearly $173 billion USDT is seeking a valuation of up to $500 billion in a round of $15-20 billion private funding. What does this number mean? It means that Tether's scale will directly rival global top-tier tech unicorns like OpenAI and SpaceX, while its staggering $4.9 billion net profit for a single quarter puts many traditional financial institutions to shame. This is not just funding; this is a "hidden whale" rising from the crypto world, making a formal value declaration to the traditional financial system.

2. "Plasma, Highly Anticipated, Goes Live Tonight, Can It Change the On-Chain Payment Landscape?"

We have all heard the classic business metaphor: "It is better to be the head of a chicken than the tail of a phoenix." Plasma embodies this in the world of on-chain payments and revenue opportunities. Rather than being another all-purpose chain, competing with impractical technical innovations, Plasma laser-focuses on becoming infrastructure for institutional use.

On-Chain Data

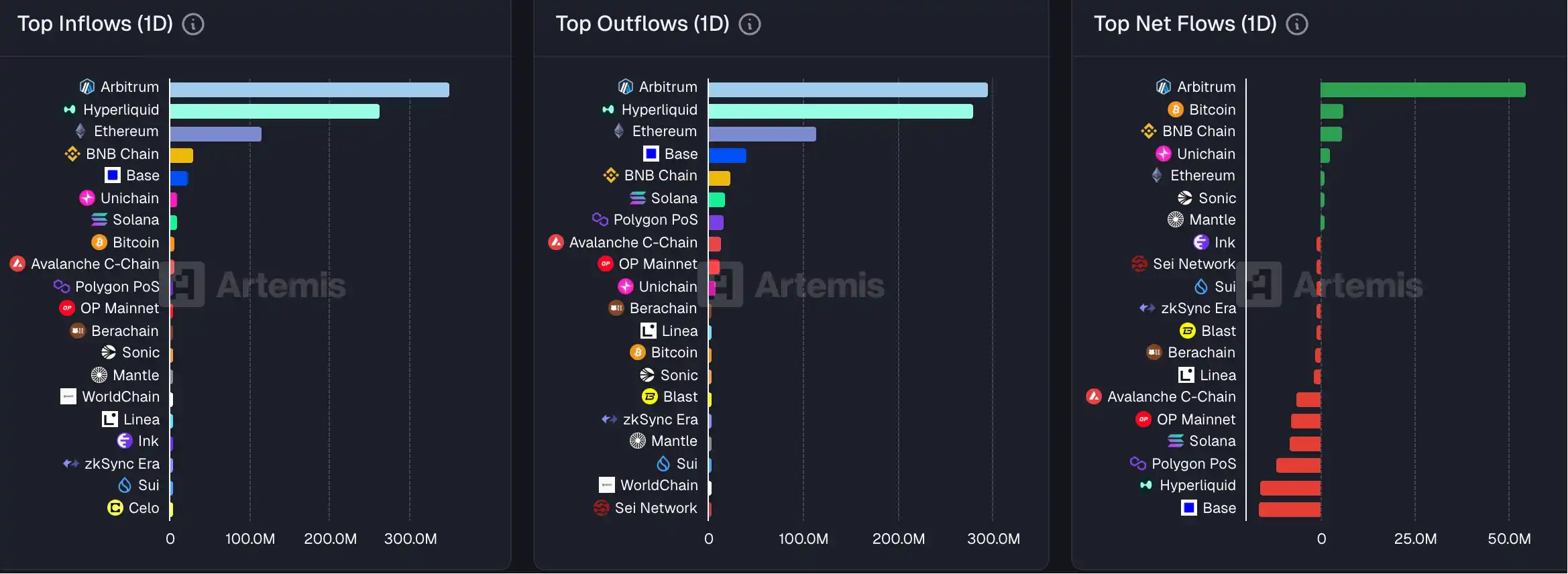

On-Chain Fund Flow on September 25th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Donald Trump’s Memecoin Raises Concerns Over Developer Sales – Here Are the Whale Movements

Monday open indicative forex prices, 19 Jan 2026. 'Risk' lower on Trump's latest trade war

BitMine Leadership Just Responded After Contentious Shareholder Meeting

Brandt Issues Extremely Bearish Altcoin Warning