HBAR Traders May Face $35 Million Liquidations Thanks To Bitcoin

Hedera is stabilizing near $0.216, with a short squeeze above $0.230 potentially unlocking $35 million in liquidations and driving recovery

Hedera’s price decline appears to have reached a saturation point, and the altcoin is showing signs of potential recovery.

At $0.216, HBAR is attempting to stabilize after recent drawdowns. This recovery could trigger significant market liquidations, creating both opportunity and risk for traders.

Hedera Traders Should Be Worried

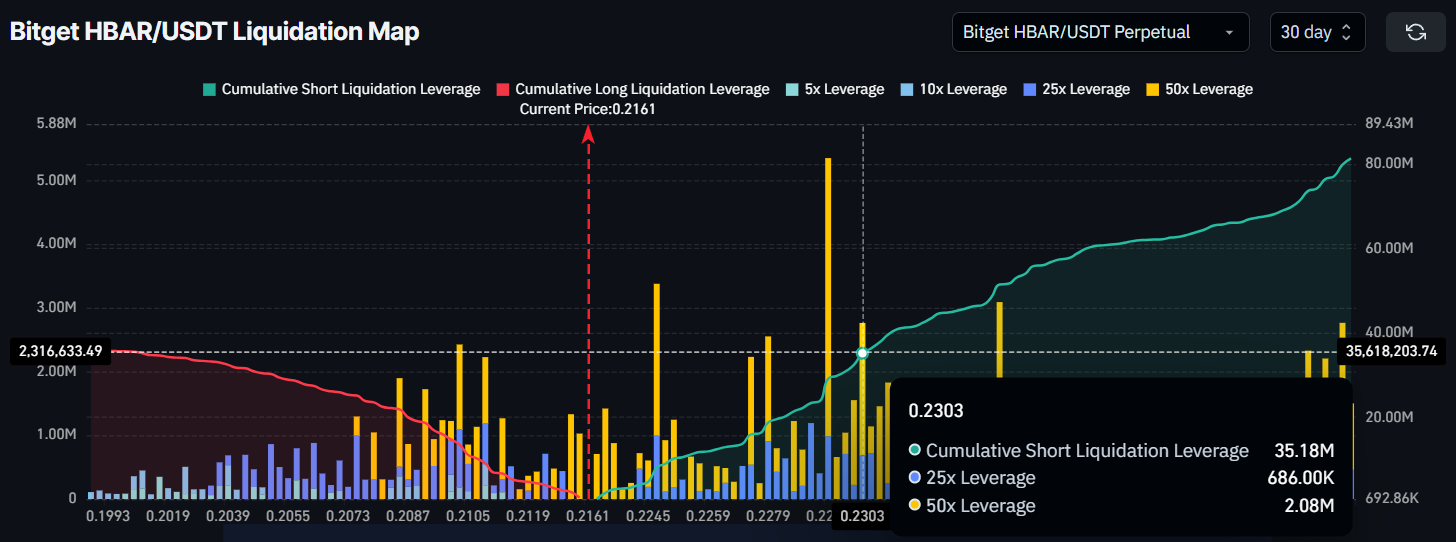

The liquidation map shows that more than $35 million in short positions could be liquidated if HBAR climbs to $0.230. Such a development would create a large-scale short squeeze, potentially driving further bullish momentum across the market. This would provide an opportunity for HBAR to extend its rebound.

For traders, this means that a move past $0.230 could bring heightened volatility. While liquidations would add fuel to upward momentum, they also represent a critical price zone.

A successful push through this level could increase capital inflows as bullish investors attempt to capture the upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Liquidation Map. Source:

HBAR Liquidation Map. Source:

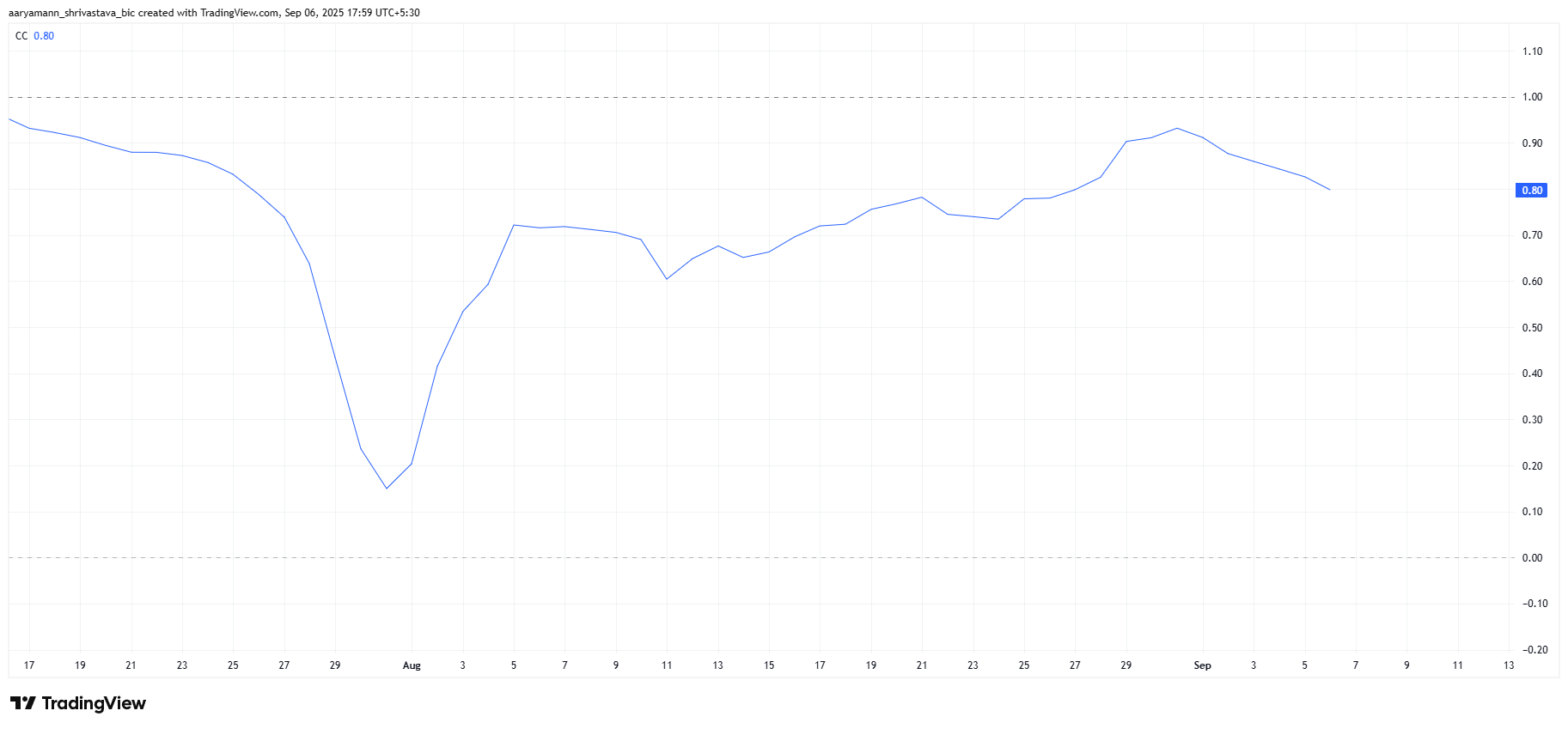

On a broader scale, Hedera’s trajectory is closely tied to Bitcoin. The altcoin shares a 0.80 correlation with BTC, indicating a strong price relationship.

As long as Bitcoin maintains support above $110,000, HBAR’s price is likely to benefit from positive spillover effects.

This correlation gives HBAR some cushion against downside risk. With Bitcoin stabilizing in the six-figure range, Hedera could leverage this momentum to test higher resistance zones. The BTC trend will play a crucial role in determining whether HBAR sustains recovery or remains rangebound.

HBAR Correlation With Bitcoin. Source:

HBAR Correlation With Bitcoin. Source:

HBAR Price Is Facing Resistance

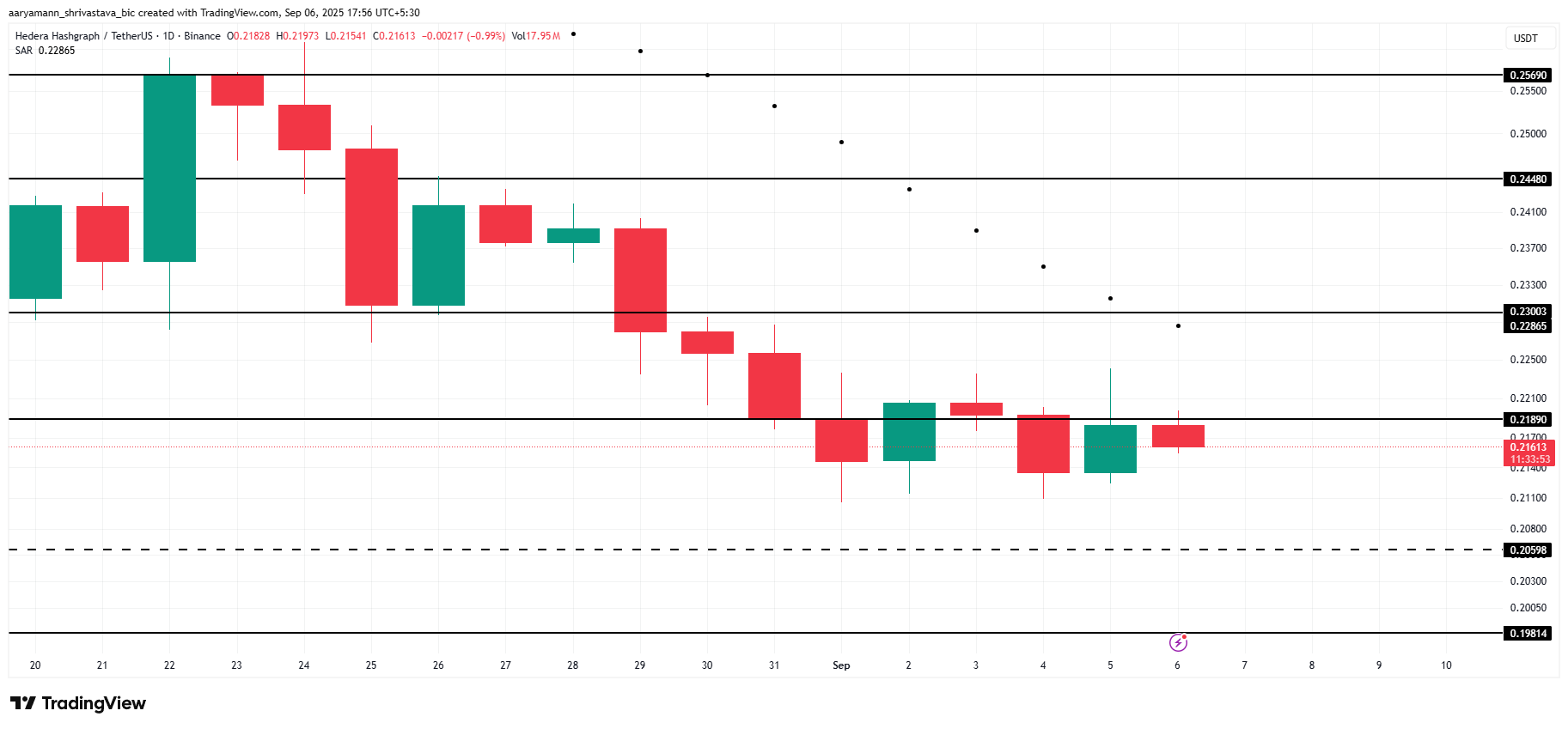

HBAR is trading at $0.216, sitting just below the $0.218 resistance level. This barrier has proven difficult to breach in recent days, but a breakout could allow HBAR to build momentum toward higher targets.

The next key resistance lies at $0.230. If HBAR manages to reach this level, the liquidation of short positions worth over $35 million could occur. This short squeeze scenario has the potential to drive the altcoin higher, pushing it toward $0.244.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if bullish momentum stalls, HBAR may consolidate within the $0.218 to $0.205 range. This sideways movement would invalidate the immediate bullish outlook and delay the potential breakout, leaving HBAR vulnerable to further stagnation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.