Whales and Retail Trigger PUMP’s Bullish Reversal — How High Can The Price Pump?

PUMP has battled a three-month downtrend, but a breakout from an inverse head and shoulders signals a possible 40% reversal. With whales and retail piling in and BBP confirming buyer strength, the token’s next move hinges on holding above the $0.0032 support.

Pump.fun (PUMP) has struggled over the past three months, shedding nearly 30% despite a recent 31% bounce in August. That one-month uptick gave the illusion of recovery, but in reality, the PUMP price remains about 45% below its all-time high.

However, a clear bullish reversal pattern has now emerged, confirmed by a breakout fueled by heavy buying across whales and retail.

Whales and Retail Step In

At the current price of $0.0038, wallet flows show diverging trends. The top 100 addresses trimmed slightly, dropping 47 million PUMP tokens, equal to about $179,000. Smart money balances fell 5.33% (around 74 million tokens, or $281,000) and public-figure wallets slid nearly 38% (276 million tokens, or $1.05 million).

PUMP Buyers Remain Ahead:

PUMP Buyers Remain Ahead:

PUMP Buyers Remain Ahead:

PUMP Buyers Remain Ahead:

But on the other side, whales added 306 million tokens even , worth nearly $1.16 million, while exchange balances climbed by 3.91 billion tokens, worth close to $14.9 million — showing heavy retail accumulation. More so, as smart money and KOLs have dropped their stakes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This rare alignment of whales and retail buying together points to renewed confidence in the PUMP price action. Overall, the net inflows from whales and retail significantly outweigh the trimming by top 100 addresses and smart money wallets, leaving the market tilted toward strong buying pressure.

PUMP Bulls Get Stronger:

PUMP Bulls Get Stronger:

PUMP Bulls Get Stronger:

PUMP Bulls Get Stronger:

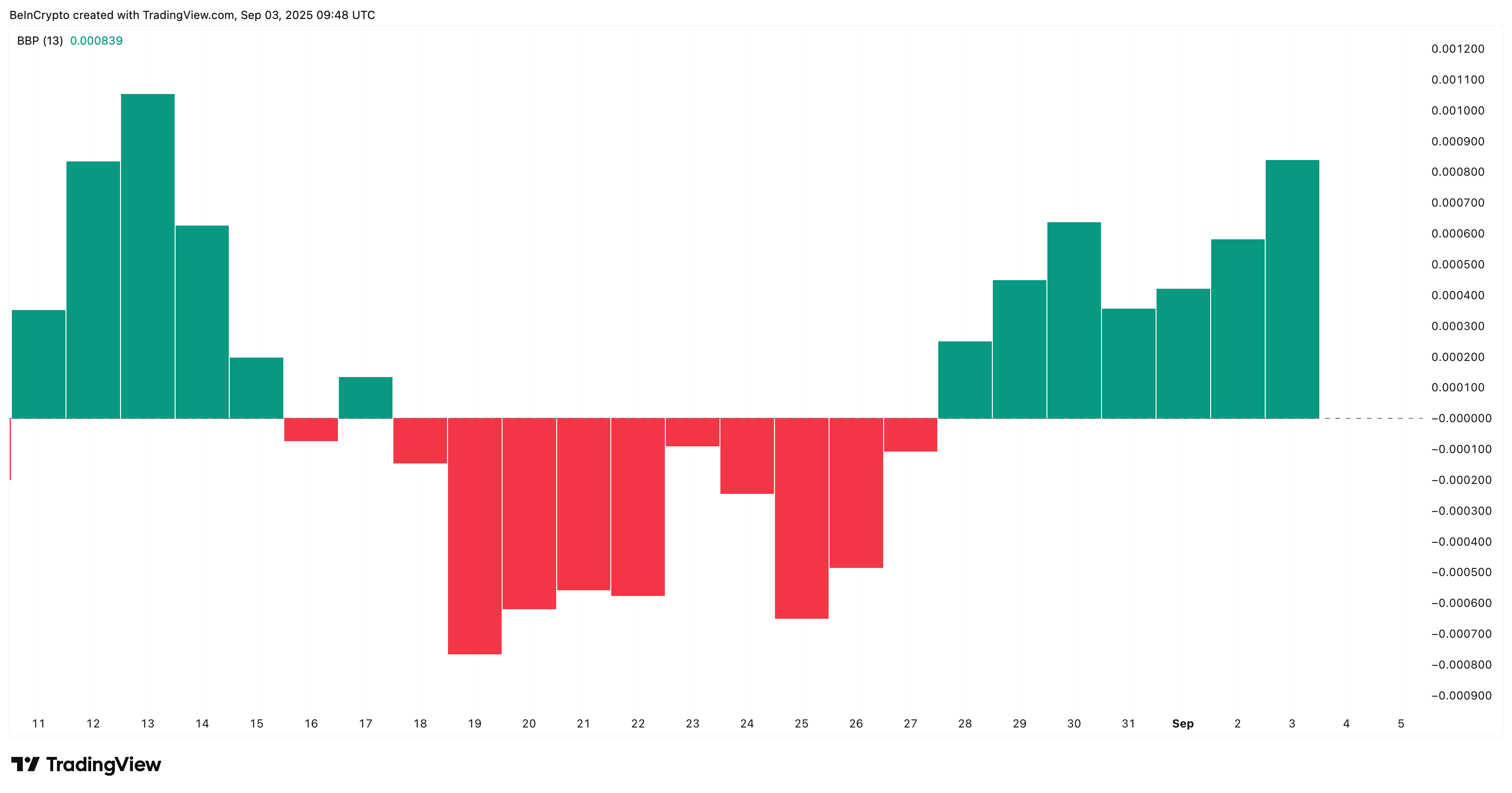

Momentum wasn’t just on-chain. The bull-bear power or BBP indicator flipped green exactly during the breakout, confirming that real-time buyers stepped in to validate the pattern. More on the pattern later in this piece.

Bull–Bear Power (BBP) is a momentum indicator that measures the strength of buyers (bulls) versus sellers (bears) by comparing the highest and lowest price levels with a moving average.

This crossover between technical confirmation and wallet activity strengthens the bullish case.

PUMP Price Chart Confirms Bullish Breakout

Technically, the PUMP price has broken out of an inverse head and shoulders, one of the strongest bullish reversal setups. The neckline breakout came near $0.0038, unlocking a measured target of $0.0053 (a 40% move). A more aggressive projection stretches to $0.0056.

PUMP Price Analysis:

PUMP Price Analysis:

PUMP Price Analysis:

PUMP Price Analysis:

Still, caution remains. A drop below $0.0032 (right shoulder) would weaken the pattern, and a breakdown under $0.0026 would invalidate the setup entirely.

With whales and retail aligned, on-chain flows supporting accumulation, and a confirmed breakout from a major bullish structure, PUMP looks set for a potential 40% upside. The final test will be whether buyers can defend the neckline and extend momentum toward $0.0053–$0.0056 in the coming sessions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.