PUMP Tops Weekly Gainers With 40% Surge Amid Pump.fun Dominance

PUMP defies market weakness with a 40% weekly surge, driven by Pump.fun’s $4 billion volume. With RSI and BoP flashing bullish, traders eye a run to $0.00402.

PUMP has defied the broader crypto market’s lackluster performance, soaring nearly 40% in the past week. The rally comes as activity on Pump.fun has picked up, fueling optimism among traders betting on further upside.

On the technical front, indicators suggest that the bullish trend could extend if this momentum holds.

PUMP Climbs 40%, Outshines a Sideways Market

PUMP is one of the best-performing assets over the past week, climbing almost 40% despite the broader crypto market moving mostly sideways during the same period.

The token’s rally has been fueled by renewed activity on Pump.fun, the Solana-based meme coin launchpad that has regained dominance after briefly losing its spot to LetsBonk.

According to data from Solana decentralized exchange (DEX) aggregator Jupiter, Pump.fun’s trading volume has surpassed $4 billion in the past week alone, cementing its dominance as Solana’s leading meme coin launchpad.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

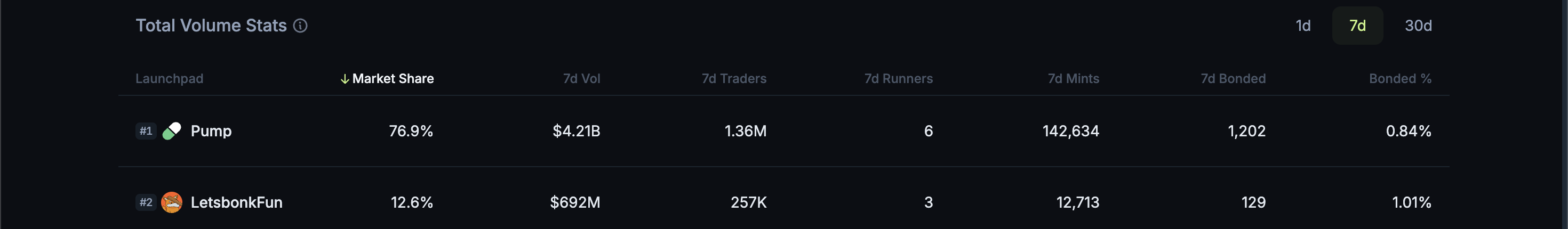

Solana Meme Coin Launchpads. Source:

Jupiter

Solana Meme Coin Launchpads. Source:

Jupiter

By comparison, LetsBonk registered just $692 million in trading volume over the same period.

PUMP Bulls Tighten Grip as Indicators Confirm Uptrend Potential

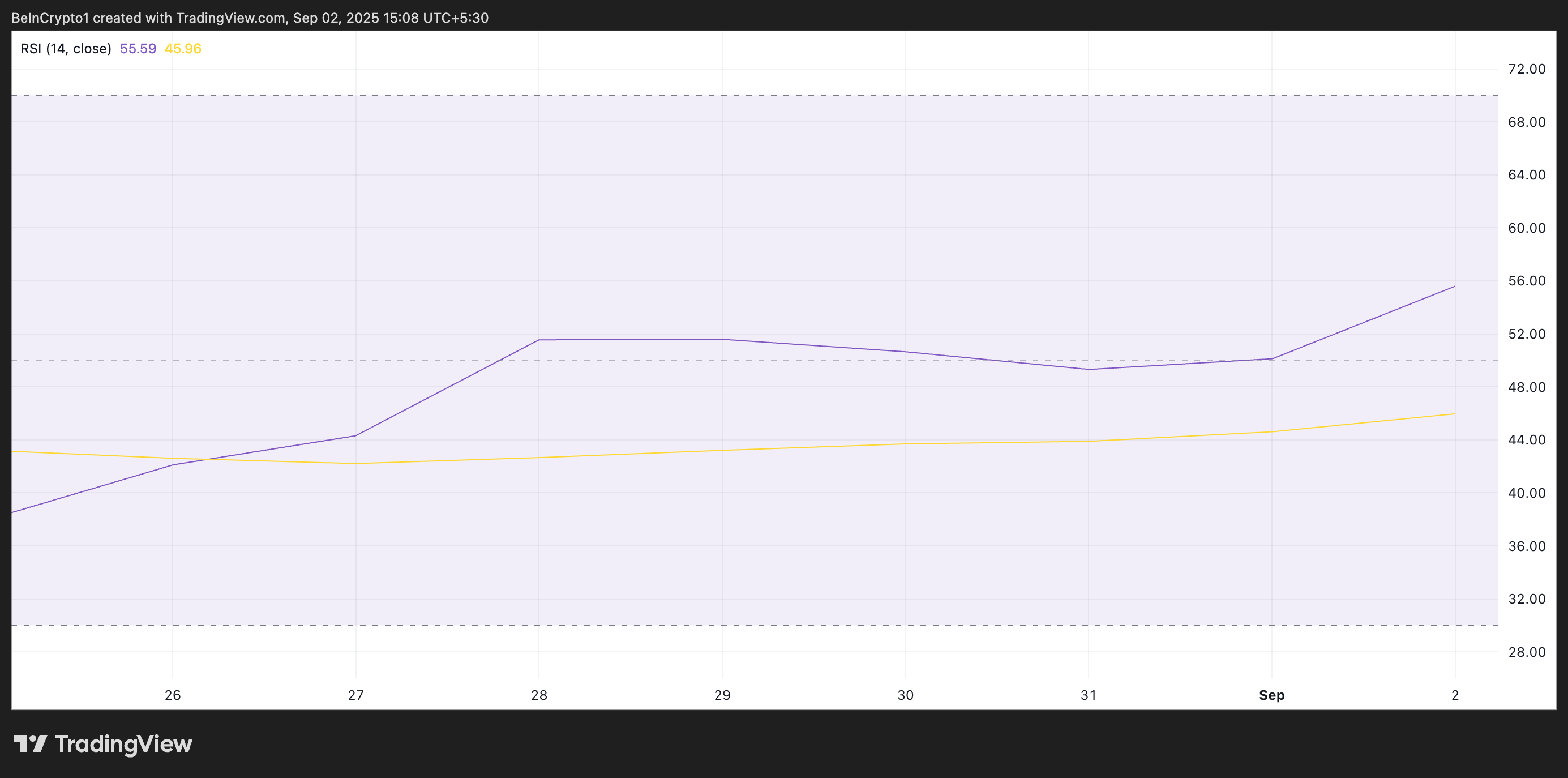

On the daily chart, PUMP’s climbing Relative Strength Index (RSI) confirms the stronger buy-side pressure. At press time, this momentum indicator is at 55.59 and is in an uptrend.

PUMP RSI. Source:

TradingView

PUMP RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 55.59, and rising, PUMP’s RSI signals strengthening bullish momentum. It suggests the token still has room to climb before entering overbought territory.

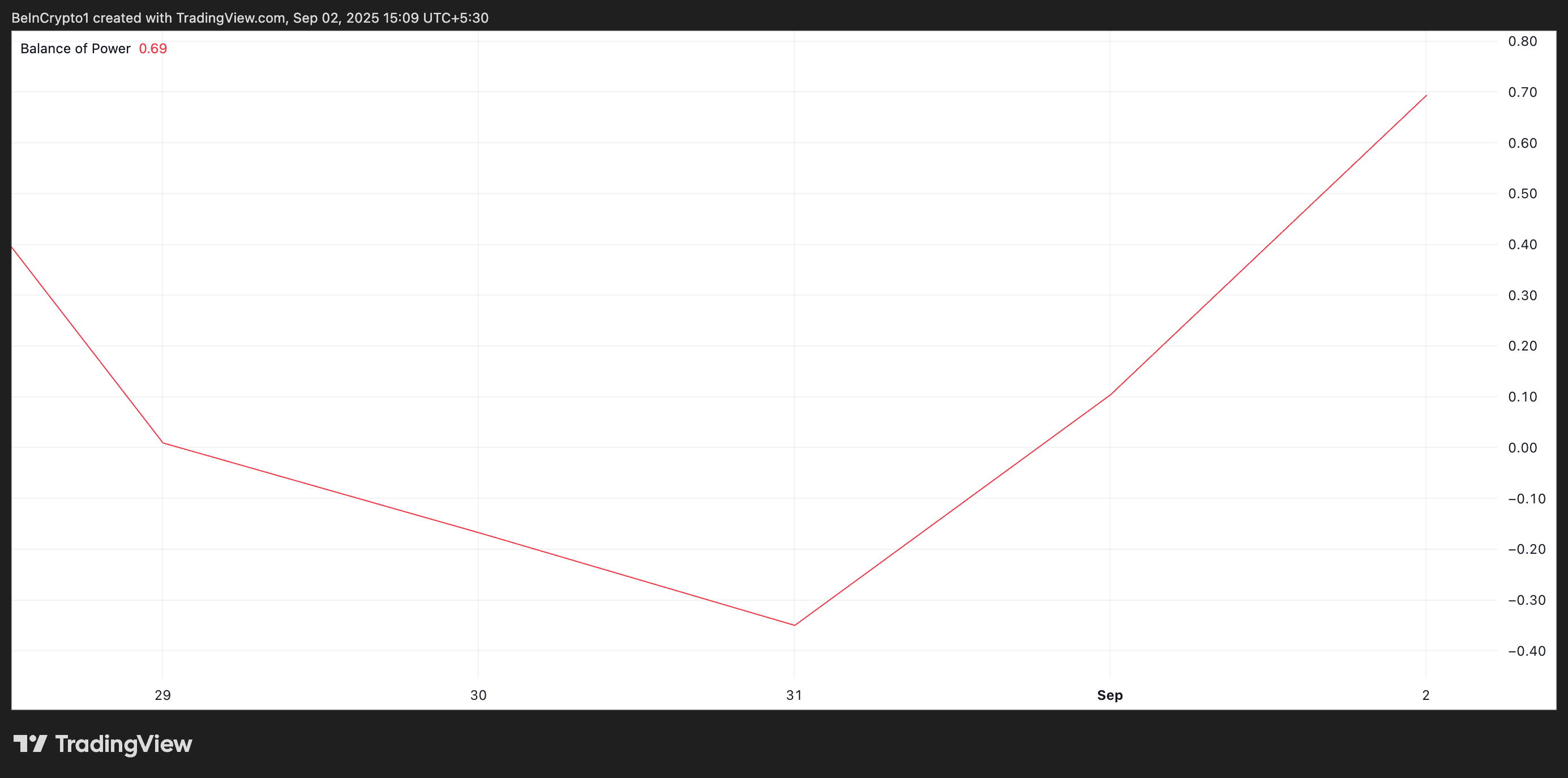

Readings from the token’s Balance of Power (BoP) also support this bullish outlook. At press time, this is positive at 0.66, reflecting the bullish tilt in market sentiment.

PUMP BoP. Source:

TradingView

PUMP BoP. Source:

TradingView

The BoP indicator measures the strength of buyers versus sellers in the market. When its value is positive, it suggests that buyers are in control, pushing prices higher. A negative BoP, on the other hand, indicates that sellers dominate, increasing the risk of downward pressure on price.

PUMP Rally Holds Firm, But Bears Could Drag It Back to $0.00325

PUMP’s positive BoP aligns with its rising RSI and recent surge in price. A combined reading of these indicators signals that bulls maintain the upper hand, supporting the case for a continued rally toward the $0.00402 target if momentum holds.

PUMP Price Analysis. Source:

TradingView

PUMP Price Analysis. Source:

TradingView

However, if bullish support weakens, the token’s price could plunge to $0.00325.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.