Block Surges 10% Pre-Market As Jack Dorsey’s Firm Extends Saylorization Trend

Jack Dorsey’s Block added 108 BTC in Q2, pushing its holdings past $1 billion and sparking a 10% pre-market stock surge.

Jack Dorsey’s Block saw its XYZ stock surge on Friday in pre-market trading following reports that the firm added more Bitcoin (BTC) to its stockpile in the second quarter (Q2).

Block is one of the firms accelerating the Saylorization flywheel as corporate Bitcoin adoption grows.

Block Increased Its Holdings By 108 Bitcoins In Q2

Filings with the US SEC (Securities and Exchange Commission) show Jack Dorsey’s Block Inc. bought 108 BTC in Q2. At the current rate, with Bitcoin trading for $116,554 as of this writing, this BTC buy alone is valued at $12.58 million.

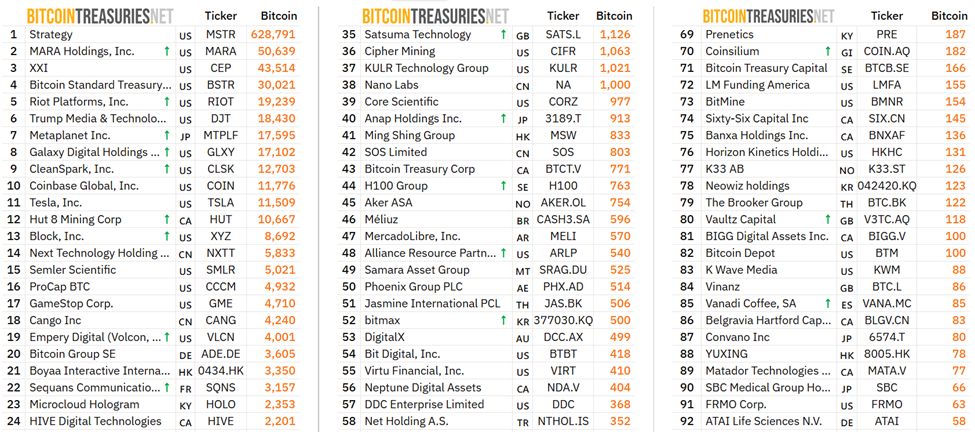

After the purchase, Block holds 8,692 BTC tokens, worth over $1 billion. With this, Block Inc. is effectively the 13th largest public company holding BTC.

The top 24 largest corporate BTC holders. Source:

Bitcoin Treasuries

The top 24 largest corporate BTC holders. Source:

Bitcoin Treasuries

The move positions Block Inc. among firms pushing the Saylorization trend, alongside Twenty One Capital and MicroStrategy.

Recently, Bitcoin pioneer Max Keiser told BeInCrypto that corporations must mimic Strategy’s process to accumulate BTC lest they be left behind.

“For corporations to survive, they must mimic the Strategy’s process, they must ‘Saylorize’ or die,” Keiser told BeInCrypto.

According to Max Keiser, corporations adopting this strategy could help drive Bitcoin to $2.2 million per coin.

Meanwhile, in line with investor enthusiasm about firms adopting Bitcoin treasury strategies, Block’s XYZ stock recorded a notable surge, rising almost 10% in pre-market trading.

Block Stock (XYZ) Pre-Market Trading. Source:

Google Finance

Block Stock (XYZ) Pre-Market Trading. Source:

Google Finance

Block’s Q2 Returns Exceed Wall Street Forecasts

Beyond optimism around Block acquiring Bitcoin, the surge in XYZ stock price pre-market follows a positive Q2 earnings report.

The report shows Block’s total revenue hit $6.05 billion in Q2, with gross profit rising more sharply. More closely, it climbed by 8.2% to $2.54 billion, attributed to Bitcoin-related revenue from Cash App.

Bloomberg reported that Block boosted its full-year profit outlook after its Q2 earnings exceeded Wall Street predictions.

Based on the report, strong growth in Block’s Cash App lending products and steady payment processing volumes through the firm’s Square merchant network contributed to the strong growth.

Therefore, the turnout points to continued confidence in Block’s fintech ecosystem and Bitcoin’s long-term value.

Meanwhile, though Block’s gross profit rose year-on-year (YoY), its Bitcoin holdings saw a revaluation loss of $212.17 million. Analysts ascribe this to a drop in Bitcoin’s fair value.

This means that as Bitcoin’s market price decreased, Block’s BTC holdings became worth less than before.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes