PI Network’s 25% Drop Sparks Fears of Resuming Prolonged Downtrend

PI Network's price drop following its $100 million initiative highlights waning market confidence. With negative indicators, a deeper decline may be imminent.

PI’s price has plummeted by 25% over the past 24 hours, marking a sharp decline just one day after the launch of its $100 million startup fund, Pi Network Ventures.

Despite this major initiative, the market response has been lackluster, raising concerns about the PI token’s short-term price trajectory.

PI’s Rally at Risk Amid Growing Bearish Control

The PI/USD one-day chart readings suggest that this decline may not be over. As of this writing, PI’s price is on the verge of dipping below its 20-day Exponential Moving Average (EMA), an indicator of a sustained bearish trend.

PI 20-Day EMA. Source:

TradingView

PI 20-Day EMA. Source:

TradingView

The 20-day EMA measures an asset’s average price over the past 20 trading days, weighting recent prices. When an asset’s price is poised to break below this key moving average, it signals weakening short-term momentum and a potential shift to a bearish trend.

For PI, a break below its 20-day EMA could undermine its recent bullish climb between May 8 and May 13, and open the door for deeper price corrections.

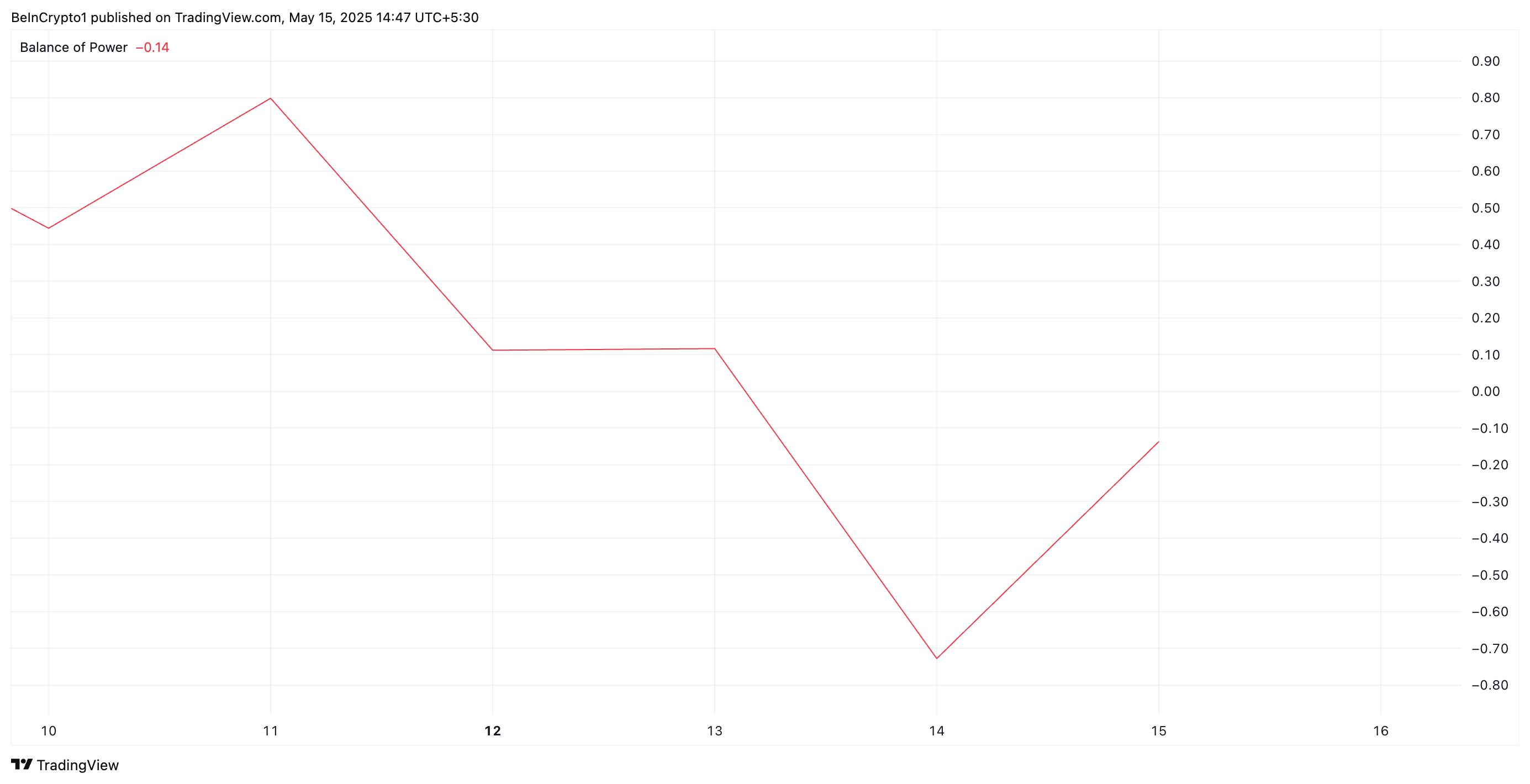

Moreover, PI’s Balance of Power (BoP) is currently negative, highlighting the selloff trend among market participants. As of this writing, it is at -0.14.

PI BoP. Source:

TradingView

PI BoP. Source:

TradingView

The BoP indicator measures the strength of buyers versus sellers by comparing closing prices to the trading range. When it is negative like this, sellers are dominating and pushing prices lower.

PI Risks Breakdown Toward $0.40

PI’s decisive break below its 20-day EMA would confirm the bearish shift in market sentiment. The 20-day EMA, currently acting as dynamic support at $0.80, has cushioned recent price pullbacks and attracted buying interest.

Therefore, a close below this level would invalidate that support and reinforce the prevailing bearish outlook. It would confirm the increased selling pressure among PI token holders and hint at the potential for a deeper correction soon.

In this scenario, PI could revisit its all-time low of $0.40.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

However, if the bulls regain market dominance, they could drive PI’s price toward $1.01.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.