Solana Sell-off Risk Fades as SOL Price Reclaims Key Resistance Level

Solana (SOL), the sixth-ranked cryptocurrency asset, has made significant progress amid a changing outlook on the crypto market. Notably, the coin has rebounded from a low of $145.66 as market sentiment shifted.

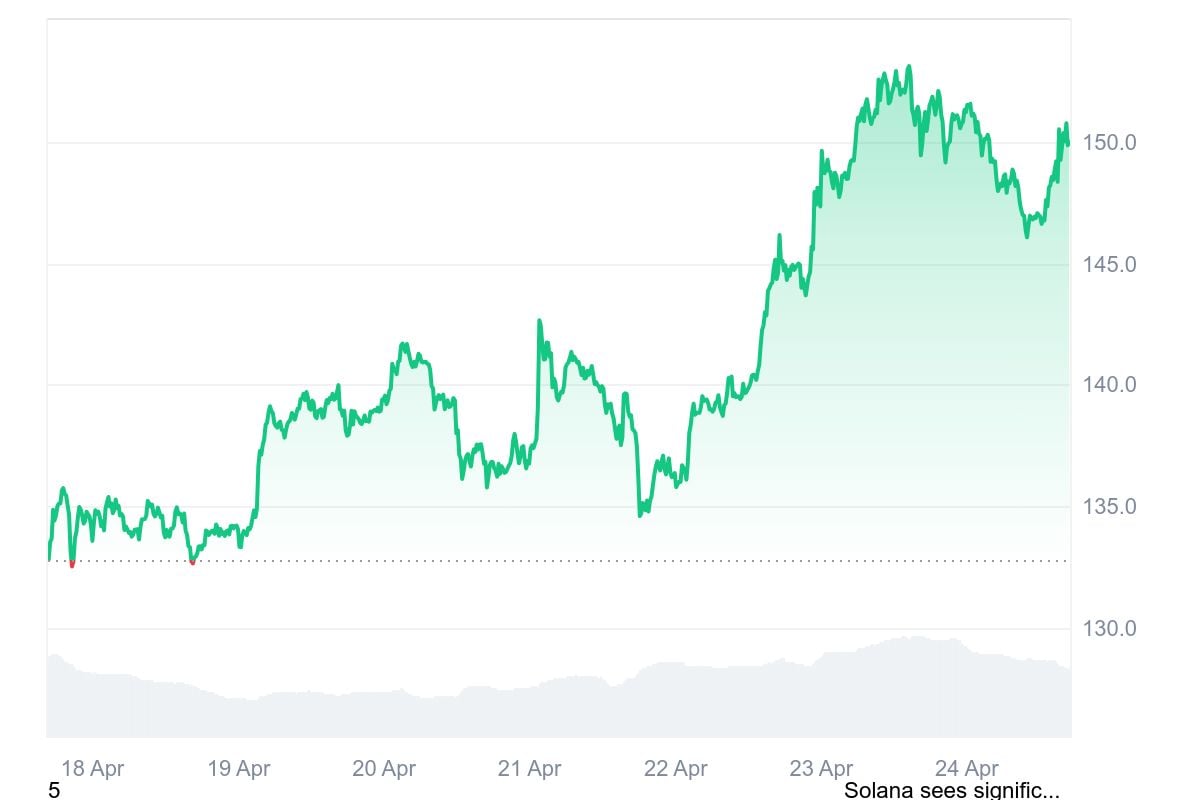

SOL price rebounds from weekly lows

According to CoinMarketCap data, SOL has reclaimed its key resistance level of $150 and has potential for a further rise. Solana's price was changing hands at $150.03 as of press time, representing a 0.98% increase in the last 24 hours.

The trading volume has not rebounded and is still down by 30.71% at $3.88 billion. This suggests investors remain cautious and monitor developments to see the price trajectory.

SOL has experienced significant growth in the last seven days. In its rebound move, the asset registered an uptick of 14.09%, climbing from $133.66 to its current level.

Despite the coin's currently low price level, renowned trader DonAlt has made a bold prediction. The trader’s prediction is significant, considering he is not a Solana enthusiast.

Per his prediction, Solana could hit $200 as the asset uses the U.S. trade tariff to attract willing investors.

ETF filings and regulatory momentum could boost Solana

Meanwhile, ecosystem development could support SOL’s recovery journey as the broader market anticipates regulatory approval for key institution-focused products.

Notably, Solana is among the leading assets with the highest number of exchange-traded fund (ETFs) filings with the Securities and Exchange Commission (SEC) awaiting its attention.

Some users believe that with the new U.S. SEC chair officially sworn into office, attention could shift to the pending filings acknowledged by the regulatory body. If the SEC grants the approvals as expected, the institutional adoption could drive prices further upward.

In a surprise comment, renowned trader Peter Brandt also believes that SOL could outperform Ethereum in the long run.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are undergoing a “purification” that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.