-

The ongoing consolidation of Cardano (ADA) presents a critical moment for investors, as market pressure continues to dictate its trajectory amidst broader cryptocurrency trends.

-

Despite some whale accumulation recently, Cardano has experienced a notable lack of upward momentum, primarily influenced by Bitcoin’s sluggish performance.

-

“The accumulation patterns don’t yet paint a bullish picture for ADA,” analysts highlighted, emphasizing the need for bullish signals to support a potential recovery.

This article explores Cardano’s current market position and the key factors influencing its price movements, focusing on recent whale activity and the impact of Bitcoin trends.

Challenging Market Conditions Keeping Cardano in Check

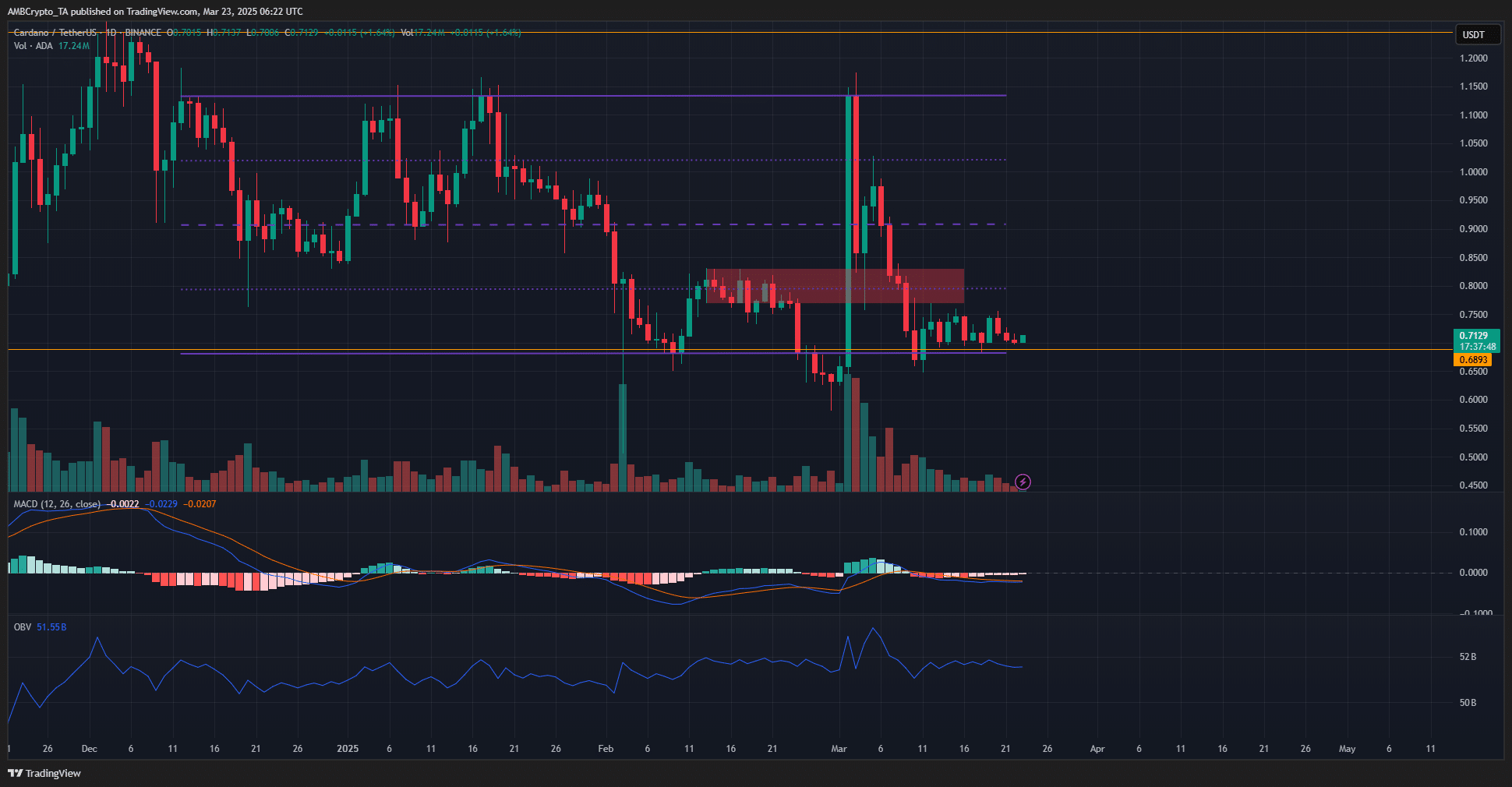

Cardano has been trapped within a narrow trading range, experiencing substantial consolidation near its established lows, particularly around the $0.7 support level. This price point has become pivotal, with bullish scenarios requiring a significant price rebound from these lows.

Impact of Bitcoin’s Performance on Cardano

The link between Bitcoin and Cardano’s price action cannot be overstated. As Bitcoin remains under pressure, its influence extends to altcoins like ADA. Traders are closely monitoring Bitcoin for signs of a bullish reversal, as any uptrend in BTC could spill over positively into ADA’s performance. However, the current market sentiment has been primarily bearish, characterized by low volatility and diminishing trading volume.

Technical Indicators and Market Sentiment

Technically, Cardano’s price action highlights the significance of the range defined between the $0.67 and $1.13 levels. You can see this illustrated in the  chart where the recent rally has barely shifted the overall bearish trend.

chart where the recent rally has barely shifted the overall bearish trend.

Open Interest Trends and Selling Pressure

Recent data from Coinalyze indicates that Open Interest (OI) has remained stagnant, hovering between $400 million and $450 million, which underscores a broader market hesitance from speculators. This stability in OI, coupled with a declining spot CVD, suggests that selling pressure has been robust, leaving Cardano in a challenging position. The ongoing decline in selling volume, while not ideal, has offered some relief, but the market is still skewed towards bearish sentiment.

Future Outlook for Cardano Investors

Looking ahead, Cardano’s path will heavily depend on broader market conditions, particularly Bitcoin’s performance. A decisive break above the $0.8 local resistance could signal a shift in sentiment and potentially initiate a bullish phase for Cardano. However, without substantial support from Bitcoin and increased buying activity, ADA risks slipping below its current range lows.

Conclusion

In summary, Cardano is currently navigating a complex market landscape characterized by strong competition from Bitcoin and weak buying signals. While the potential for a price resurgence exists, it remains contingent upon broader crypto market developments. Investors should remain cautiously optimistic while closely monitoring key trends and technical indicators. Should Bitcoin regain its footing, ADA may well follow suit, but caution is advised as the market sentiment remains largely bearish.