Date: Tue, March 18, 2025 | 09:48 AM GMT

The crypto market is showing some early signs of a rebound as Bitcoin (BTC) has bounced back from last week’s low of $76,000 and is now trading near $83,000—a promising shift after a choppy start to March. As sentiment gradually improves, altcoins like Cosmos (ATOM) and Avalanche (AVAX) are beginning to stir as well.

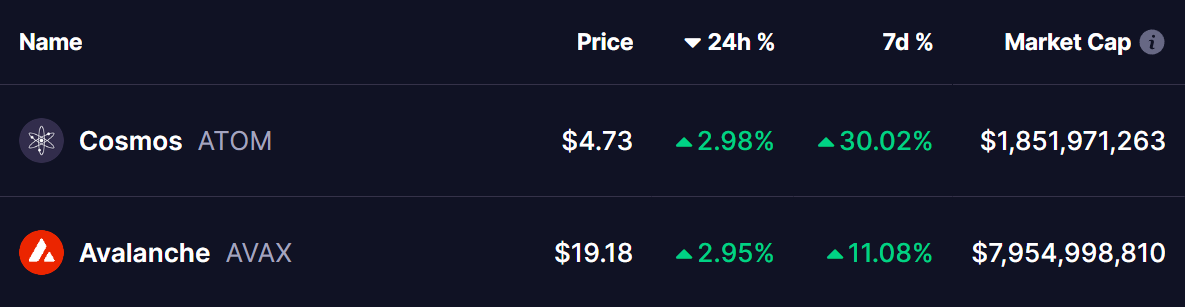

Both tokens have taken a heavy hit over the past few months, but recent price action suggests that a recovery may be underway. ATOM has kicked off its rebound with an impressive 30% weekly gain, while AVAX has surged by 11%, hinting at a similar trajectory.

Source: Coinmarketcap

Source: Coinmarketcap

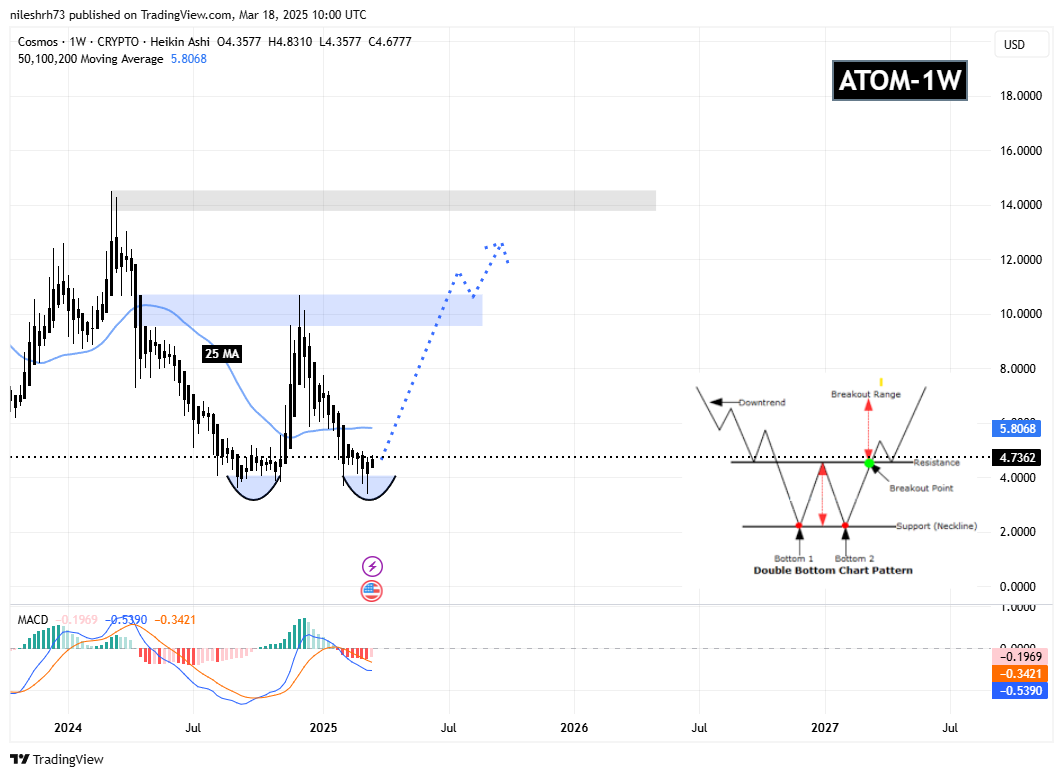

Cosmos (ATOM)

On the weekly chart, ATOM has formed a classic double-bottom pattern after experiencing a sharp downtrend that started when it failed to break the $10.67 resistance in early December 2024. Since then, ATOM has revisited the $3.75 support level, marking the second bottom of the pattern.

Cosmos (ATOM) Weekly Chart/Coinsprobe (Source: Tradingview)

Cosmos (ATOM) Weekly Chart/Coinsprobe (Source: Tradingview)

With this pattern forming, ATOM has now bounced to $4.73, indicating a potential shift in trend. The MACD indicator for ATOM is also hinting at a possible bullish crossover, suggesting that momentum could continue to build. If this recovery gains further strength, the next key resistance level is the 25-day moving average (MA). A decisive move above this level would confirm the uptrend and could pave the way for an attempt to reclaim the $10.67 neckline resistance in the near term.

A confirmed breakout above this resistance could trigger a bullish rally toward the $14+ range, offering significant upside potential for traders and investors alike.

Avalanche (AVAX)

AVAX appears to be mirroring ATOM’s pattern, forming a similar double-bottom structure after failing to break the $55.79 resistance in early December 2024. Since then, AVAX has revisited the $15.30 support level, marking the second bottom of the formation.

Avalanche (AVAX) Weekly Chart/Coinsprobe (Source: Tradingview)

Avalanche (AVAX) Weekly Chart/Coinsprobe (Source: Tradingview)

Buyers have stepped in to defend this level, leading to a bounce to $19, suggesting that selling pressure may be easing. If AVAX follows the same trajectory as ATOM, a continuation of this rebound could push it toward the key resistance levels ahead.

The MACD indicator for AVAX is also signaling a potential bullish crossover, aligning with the possibility of further upward movement. If this trend persists, AVAX could attempt to reclaim the $55.79 neckline resistance in the near term.

A successful breakout above this level could ignite a strong bullish rally toward the $65.55 range, providing traders with a promising upside opportunity.

What’s Ahead?

ATOM has already kicked off its recovery, showing strong bullish momentum after forming a double bottom pattern. With MACD hinting at a bullish crossover, further upside could be confirmed if it sustains its momentum above key resistance levels.

AVAX, on the other hand, is still in the early stages of its recovery. While it has started to bounce, it has yet to confirm a strong breakout. If it follows ATOM’s path, it could gain momentum and push higher in the coming weeks.

Both tokens are showing promising reversal patterns, but their next moves will largely depend on broader market sentiment and Bitcoin’s ability to sustain its recovery.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.