-

Solana (SOL) is currently experiencing a significant downturn, with traders and analysts concerned about its potential fall towards the $125-$130 support zone.

-

The recent bearish sentiment has been exacerbated by declining demand and lower network activity, impacting SOL’s value significantly.

-

As highlighted by analysts, “A drop in total value locked (TVL) paired with 38% reduced DEX activity indicates Solana’s struggle to regain upward momentum.”

This article delves into the recent challenges facing Solana (SOL), including market trends, technical patterns, and potential price targets for traders to watch.

Current Market Analysis of Solana (SOL): A Closer Look at Key Price Levels

The ongoing bearish pressures on Solana (SOL) have led to significant losses, as the cryptocurrency struggles to maintain momentum above crucial resistance levels. After a notable drop from around $180, many analysts are watching closely to see if SOL can hold the $135 support level, which appears to be pivotal for potential recovery.

Technical Indicators and Market Sentiment: Insights from Recent Trends

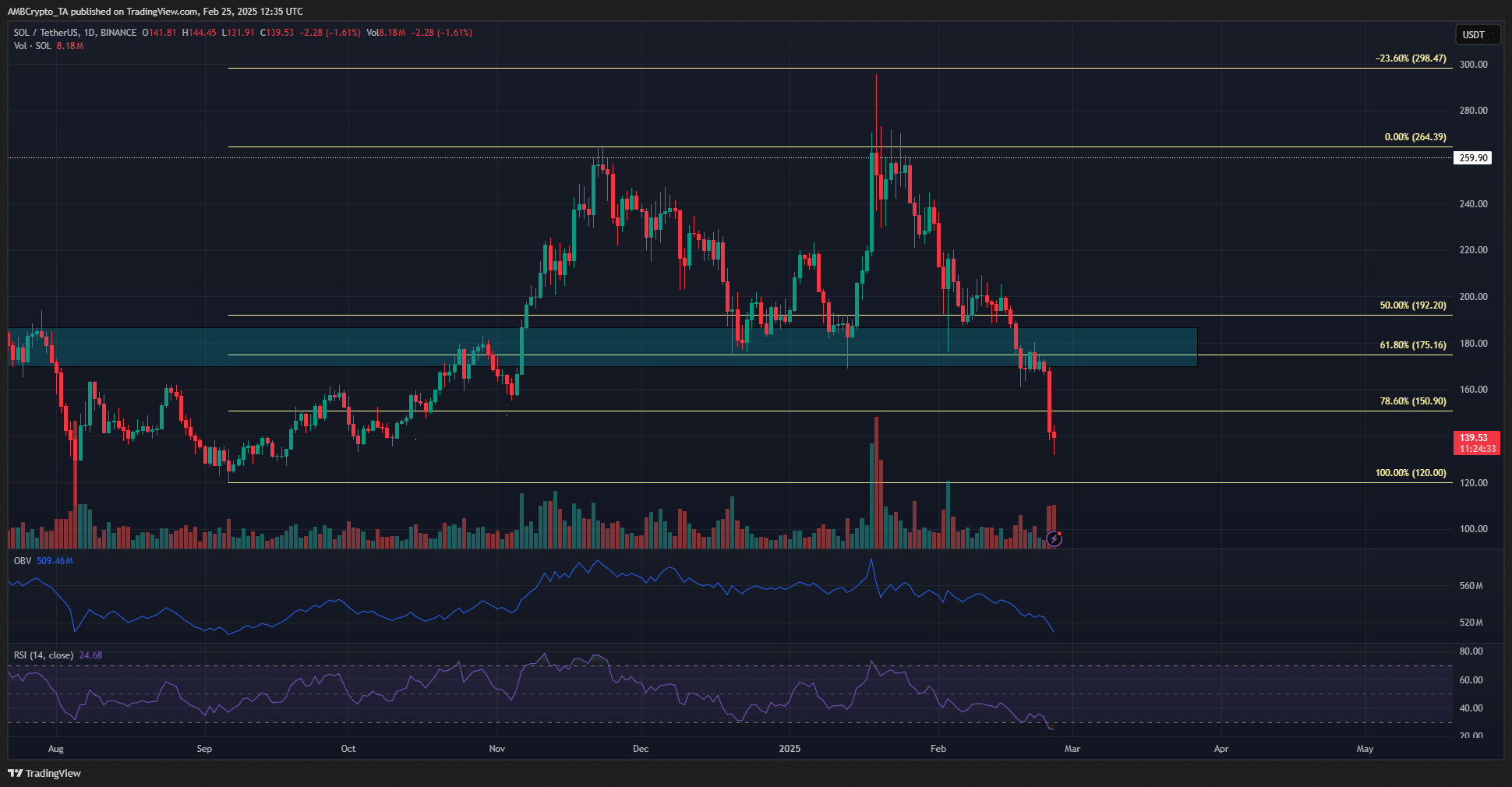

A deeper examination of the On-Balance Volume (OBV) indicates a consistent downtrend since January, raising concerns about further declines. Despite an oversold relative strength index (RSI), which generally suggests a potential rebound, the prevailing market sentiment remains cautious. The loss of key Fibonacci retracement levels indicates that traders should prepare for possible targets around the $120 region based on historical performance.

Source: SOL/USDT on TradingView

Price Projections: Can Solana Bounce Back?

With SOL’s price dropping below the critical $180 mark, many investors are keen to determine whether it can reclaim stability. Current projections suggest that if SOL successfully breaks back above the $150 threshold, it may begin to solidify within the $140-$160 range, potentially attracting liquidity and interested buyers.

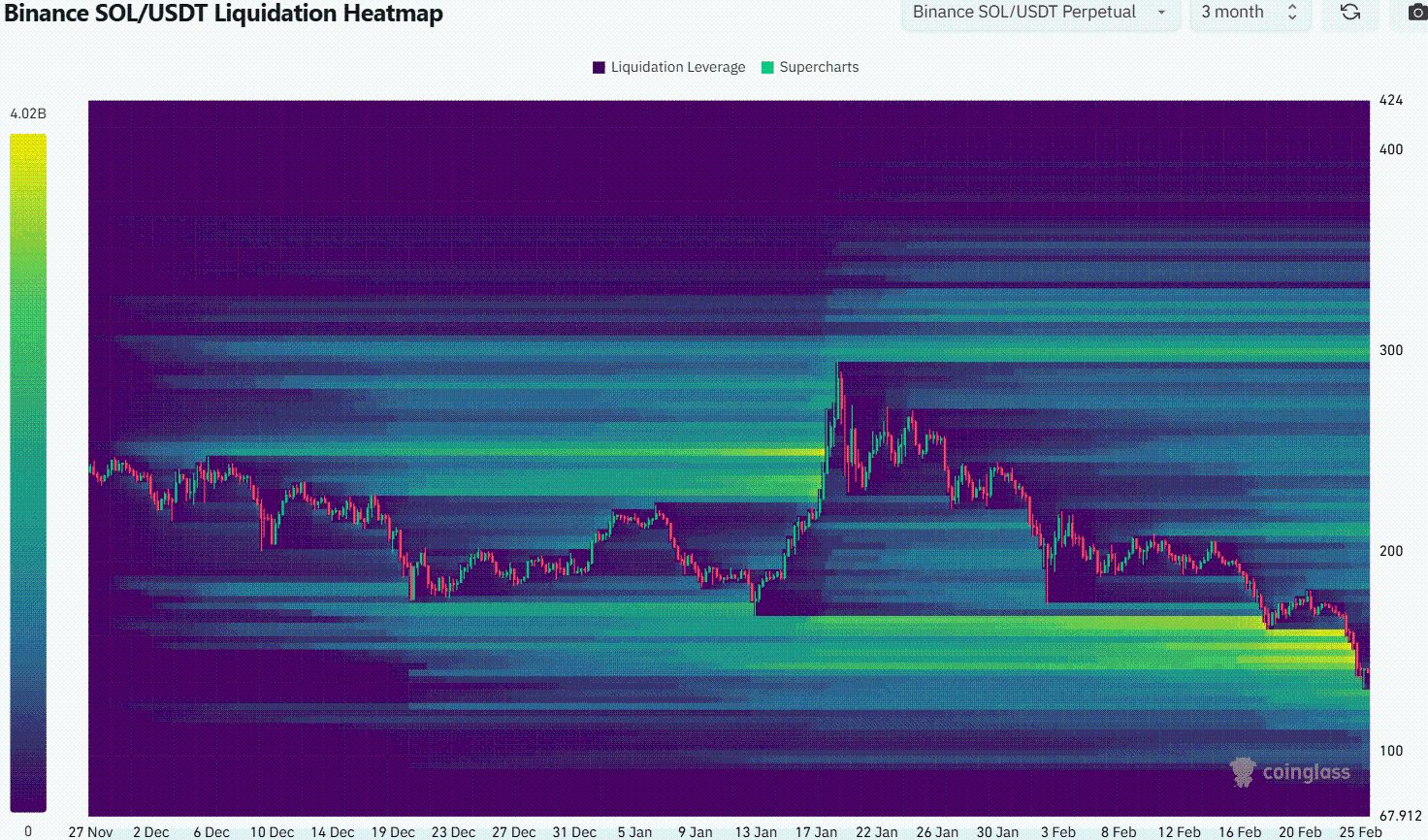

Liquidity Heatmap Analysis: Critical Levels of Interest

Reviewing the liquidation heatmap reveals a convergence of levels that traders should be mindful of. As several clusters of liquidation points are present between $165 and $135, the immediate targets seem to gravitate towards $125 should the bears maintain their grip. A cautious strategy is advised as volatility increases and market dynamics shift.

Source: Coinglass

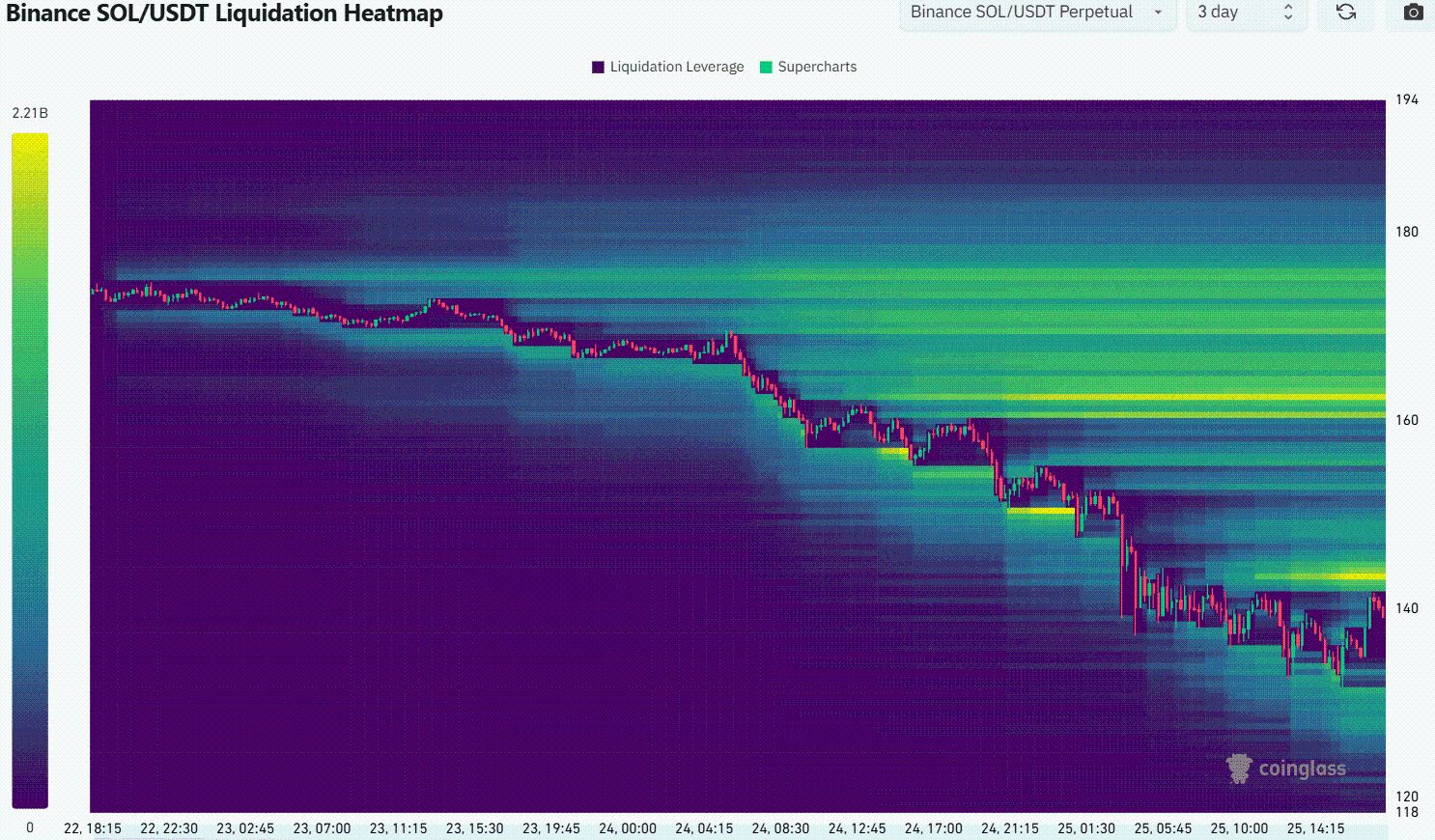

Traders’ Strategy: Navigating the Current Landscape

Given the current volatility and uncertainty surrounding SOL’s price action, traders are advised to remain vigilant. The potential for SOL to drop towards the $125-$130 range before any recovery is a scenario that investors need to prepare for. Developing risk management strategies will be essential as prices fluctuate and market conditions evolve.

Source: Coinglass

Conclusion

In summary, Solana (SOL) is currently navigating a challenging market environment, with critical support levels being tested. Should SOL succeed in bouncing back above the $150 mark, traders may see potential for stabilization within a wider trading range. However, a vigilant approach is advised, particularly with the looming possibility of further declines towards the $125 level.