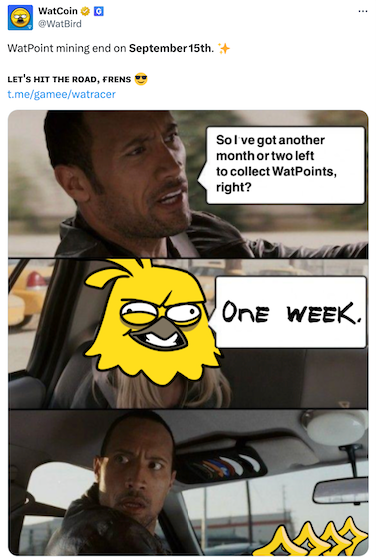

WatPoint mining will be ended on September 15th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Value of Including CFTC-Approved Clean Energy Marketplaces in Contemporary Investment Portfolios

- CFTC-approved clean energy platforms like CleanTrade enable institutional investors to hedge risks, diversify portfolios, and align with ESG goals through renewable energy derivatives. - CleanTrade's $16B in two-month notional value highlights urgent demand for scalable, transparent infrastructure to access low-carbon assets with real-time analytics and risk tools. - These platforms reduce market fragmentation by standardizing VPPAs, PPAs, and RECs, offering verifiable decarbonization pathways and dynami

The Influence of Educational Institutions on the Development of AI-Powered Industries

- Farmingdale State College (FSC) invests $75M in AI infrastructure , doubling tech enrollment and launching an AI Management degree blending technical and business skills. - Industry partnerships with Tesla and cybersecurity firms, plus 80% graduate employment rates, highlight FSC's success in aligning education with AI-driven workforce demands. - FSC's RAM mentorship program and NSF-funded AI ethics research foster interdisciplinary innovation, addressing supply chain and healthcare challenges through ap

Academic Programs Driving Growth in Green Energy Jobs and Investments Across the U.S.

- U.S. academic institutions drive renewable energy innovation through interdisciplinary programs and workforce training. - Policy frameworks like the Inflation Reduction Act (IRA) boost investments and job growth in solar, wind, and storage sectors. - Collaborations with industry and government address skills gaps, but workforce shortages and hybrid role demands persist. - Academic research influences green energy investments, though policy shifts risk project funding. - Case studies highlight universitie

The Emergence of MMT Token TGE and Its Impact on Institutional Embrace of Blockchain

- Momentum Finance's MMT token TGE on November 4, 2025, unlocked 20.41% of its supply, driving an 885% price surge to $0.8859 within hours due to a 376x oversubscribed Binance Prime Sale. - Institutional backing, including a $10M HashKey Capital investment and U.S. digital asset reserve inclusion, validated MMT's governance and incentive utility for its CLMM decentralized exchange. - MMT outperformed Solana and Ethereum in 2025 with rapid liquidity and regulatory clarity, leveraging deflationary tokenomics