Bitcoin’s price has been fluctuating between $57,815 and $61,815 for nearly seven days, with the 50-day simple moving average (SMA) at $61,662 providing persistent resistance.

At the time of this writing, Bitcoin (BTC) ‘s price is $58,106.44, down 0.2% from an hour ago and 0.6% from yesterday. The value of BTC today is 5.2% lower than it was seven days ago.

Also, in the last 24 hours, 57,708 traders were liquidated, totaling $221.55 million. The highest single liquidation order occurred on Binance – btcusdT for $10.83 million.

According to Glassnode data , bitcoin’s recent price volatility can be ascribed in part to “weakness in spot demand.” Glassnode calculated the current net balance of buying and selling in the Bitcoin spot market by analyzing the cumulative volume delta (CVD) to see whether there is any directional bias.

Source: Glassnode

Source: Glassnode

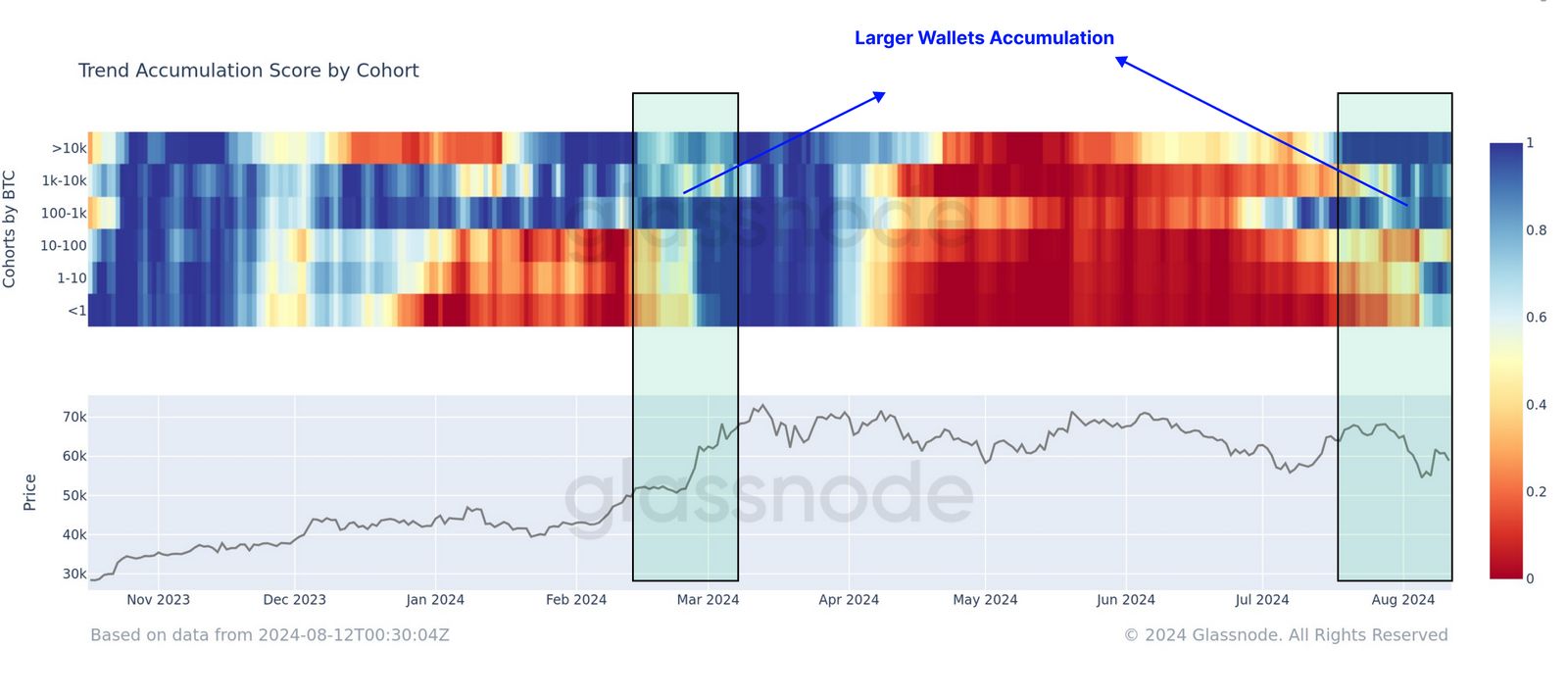

On-chain data from Glassnode shows “Since the Bitcoin price ATH was established in March, the market faced an extensive period of supply distribution, with participation by wallets of all sizes. Over the last few weeks, this trend is showing early signs of reversing, particularly for the largest wallet sizes which are often associated with ETFs. These large wallets appear to be returning to a regime of accumulation.”

According to Glassnode, demand in the spot market will resume once the corrected CVD measure crosses the zero line and enters the positive territory.

If this happens, BTC could break out of consolidation, clear the $70,000 to $72,000 supplier congestion zone, and enter price discovery.

Bitcoin enters the weekend with a negative sentiment

A key Bitcoin indicator is creating new concerns among crypto traders, with a “bearish cross” indicating that the asset may be destined for further drop – while history says this could be a good sign.

In an Aug. 15 X post, pseudonymous crypto trader Mags wrote, “Bitcoin just printed a bearish cross on the daily chart.”

Source: X – Credit Mags

Source: X – Credit Mags

Mags mentioned a negative signal known as a “death cross,” which occurs when BTC’s 50-day simple moving average (SMA) falls below the 200-day SMA. Mags noted that the move indicates “short-term weakness in the market.” Traders use this cross to compare Bitcoin’s recent strength to its overall performance.

IG market analyst Tony Sycamore said adda, “It needs to reclaim the 200-day moving average at $62,432 to stabilize and open up a test of trend channel resistance near $70k.”