Bitcoin is currently worth $67,774, and everyone is wondering if it will finally hit the $70,000 mark when Ethereum ETFs start trading tomorrow. BTC has seen a slight increase of $31.75 (0.05%) over the past twenty-four hours.

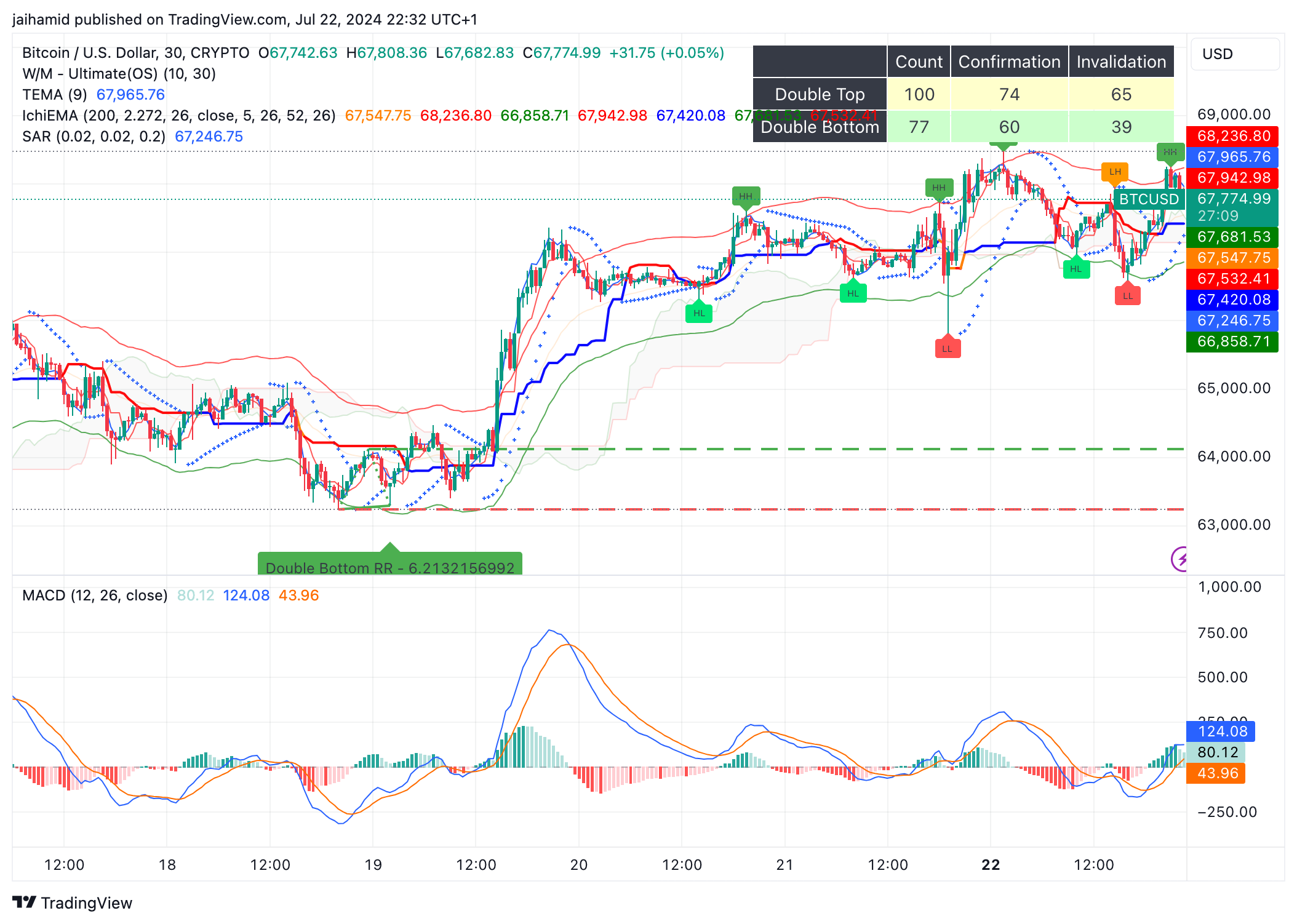

The Ichimoku Cloud, a favorite among traders, shows Bitcoin in a bullish trend. The price is above the cloud, with strong support at $67,532 and $67,246. Green and blue signals say the bulls are in control.

The Parabolic SAR dots below the price candles back this up, pointing to an ongoing bullish trend. The MACD is looking good too. It shows a bullish reading with the MACD line above the signal line.

A recent double bottom pattern at the $67,420 support level means that’s where a bullish reversal happened. Despite all of that though, we must watch out for resistance levels.

A double top pattern around $68,236 acts as a major resistance point. Bitcoin needs to break through this to make it to $70,000.

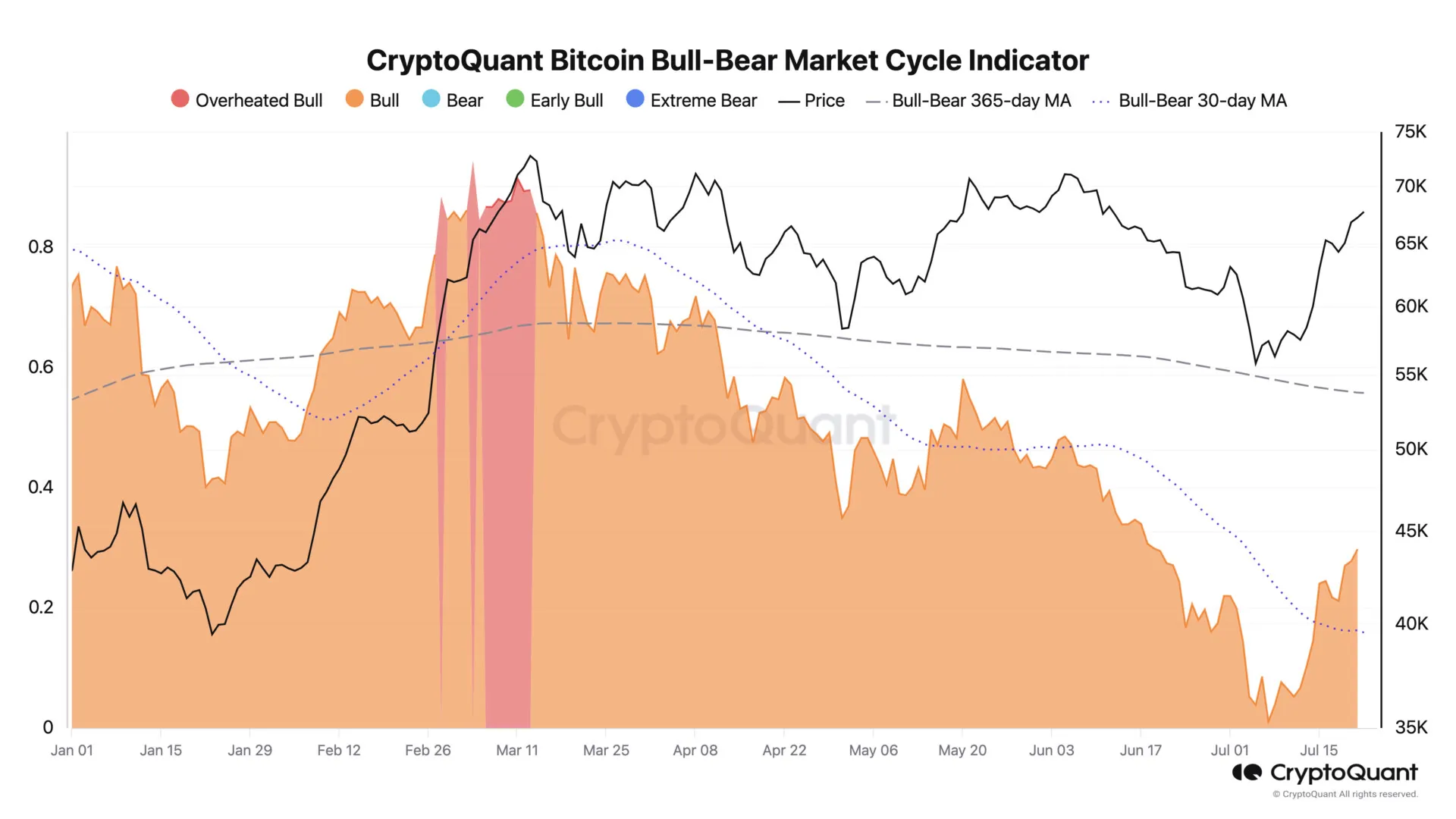

According to the CryptoQuant Bitcoin Bull-Bear Market Cycle Indicator, Bitcoin is transitioning from an Early Bull phase to a potentially Overheated Bull phase.

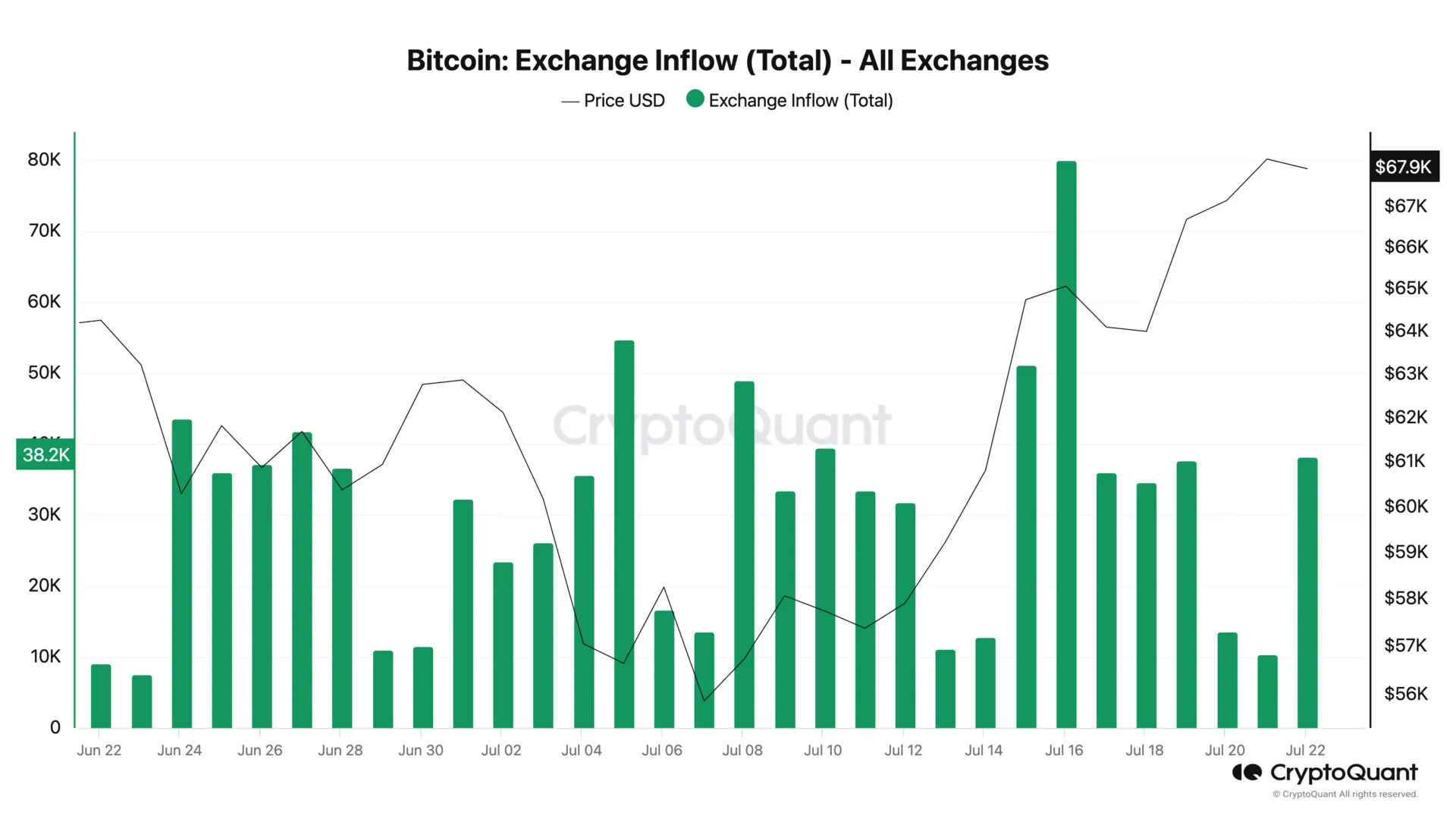

Historically, transitions like that lead to a bull run. Over the past month, exchange inflows have spiked with large holders and institutions accumulating thousands of BTCs.

CryptoQuant shows Bitcoin’s ceiling price to be $112,000, which is the target for December 2024. The steady increase in the realized cap metric shows a healthy accumulation phase.

The floor price, near $30,000, serves as a safety net, indicating the lowest expected trading range for Bitcoin under current market conditions. It also means that any potential market downturns will be limited and short-lived.

The launch of Ethereum ETFs is expected to improve market sentiment even more. Analysts predict the demand for Ethereum ETFs will be lower than for Bitcoin ETFs, with expectations of approximately $4 billion in inflows over the first six months.

Bitcoin hitting $70,000 seems within reach if current trends continue and the launch of Ethereum ETFs triggers a market-wide buying activity.