Ethereum Surges Past $3K as Bitcoin Recovers Toward $52K (Market Watch)

The past 24 hours were particularly turbulent in the crypto markets, but bulls came out on top with ETH surging past $3K, while BTC recovers toward $52K.

The cryptocurrency market went through quite a rollercoaster in the past 24 hours, but it appears that bulls are getting the better of it.

At the time of this writing, the total capitalization sits at $2.087 trillion (per CoinGecko), and most of it is painted well in green.

Bitcoin’s Price Recovers Toward $52K

The bears attempted to take control of the crypto market in the past day but were unable to do so. Bitcoin’s price dipped to an intraday low below $51K, but the bulls were quick to react and pushed it back to where it currently trades at $52K.

As seen in the chart below, it wasn’t exactly smooth sailing, as the volatility is more than evident:

This has also caused quite a stir in derivatives markets. The day saw around $40 million worth of liquidated BTC positions, while the total number for all cryptocurrencies stands at almost $200 million. Data from CoinGlass reveals that Ethereum is actually leading in terms of liquidations, with over $44 million in 24 hours.

Ethereum Soars Above $3K

ETH’s price also went through substantial volatility, but the bulls took the upper hand and pushed it above $3,000. At the time of this writing, Ethereum is trading at $3,020, up almost 3% in the past 24 hours.

There are many reasons to believe that the rally will continue in the near future. These include:

- The hype associated with the potential approval of a spot ETH ETF in the US.

- The upcoming Dencun upgrade.

- Positive on-chain metrics indicate a shift toward self-custody.

- Bitcoin’s halving in April.

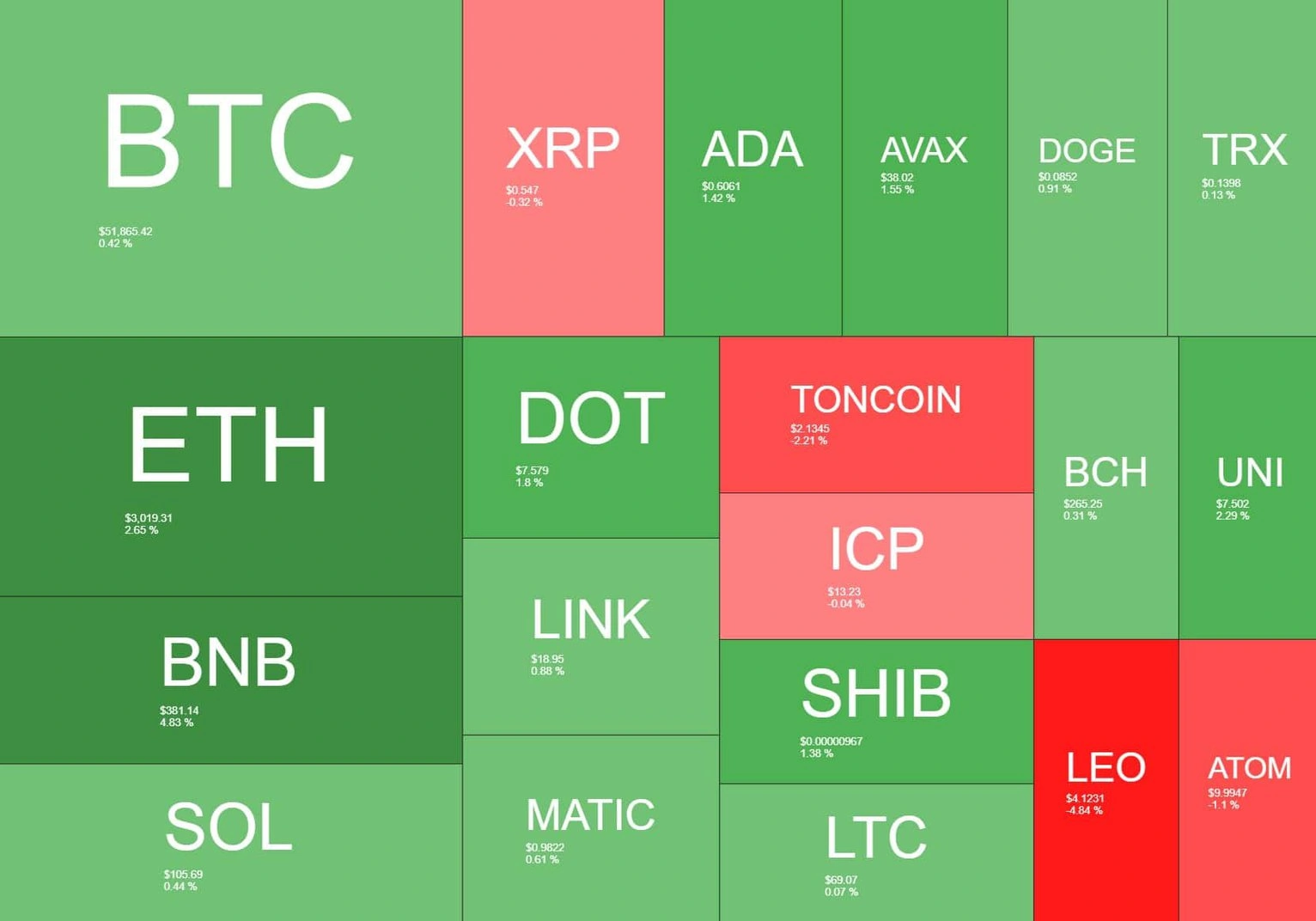

All in all, the market remains mostly in green despite the volatility of the past 24 hours, as it can be seen in the heatmap below:

The best performers of the day are SingularityNET (AGIX) – up 33.8%; Worldcoin (WLD) – up 21.2%; and Render (RNDR) – up 19.3%.

The worst performers of the day are Stacks (STX) – down 5.5%; Hedera (HBAR) – down 5.1%; and LEO Token (LEO) – down 4.2%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.