- Michael Saylor sparked market rumors by posting a “green dots” cryptic signal, widely seen as a precursor to multi-billion dollar Bitcoin purchases.

- The company’s liquid reserves jumped to $2.19 billion after a fast-paced series of stock sales in late December.

- MicroStrategy currently sits on a 671,268 BTC treasury, boasting nearly $10 billion in paper profits despite recent price swings.

MicroStrategy isn’t just holding the line; it’s widening the trenches. In a year defined by institutional FOMO, the software giant has once again retooled its balance sheet to stay ahead of the curve.

Table of Contents

A $2.2 Billion War Chest Ready for Deployment

While most corporate boards are busy trimming fat for year-end reports, MicroStrategy’s leadership spent the final weeks of 2025 gathering a staggering amount of liquidity. The company revealed its cash position has surged to $2.19 billion, a massive jump fueled by a ruthless execution of its equity program.

This isn’t just a safety net for debt payments. Between December 15 and 21, the firm aggressively sold off 4.5 million Class A shares. That sprint alone added $748 million in fresh capital. In the world of Michael Saylor, sitting on this much “dry powder” is usually a temporary state. The company’s history shows that dollars on the balance sheet are simply Bitcoin that hasn’t been bought yet.

This level of readiness gives them a tactical edge that traditional hedge funds dream of. By holding billions in cash, they can instantly buy up any market flush without waiting for bank approvals or new credit lines. It’s a masterclass in staying nimble while managing a multi-billion dollar enterprise.

The “Green Dots” Mystery and Retail Reaction

The numbers tell one story, but social media tells another. On December 20, Michael Saylor dropped a cryptic “green dots” post on X. To the uninitiated, it looked like a glitch. To Bitcoin veterans, it was a siren song. This specific shorthand has become Saylor’s signature move, often landing just days before the company files an official 8-K to announce a massive Bitcoin purchase.

The market’s reaction was immediate. Traders began front-running the expected news, betting that the world’s largest corporate holder was about to soak up the remaining supply. This “Saylor premium” often keeps prices afloat even when the broader crypto market feels shaky. By the time the official filing hits the SEC’s desk, the company has usually already finished its work, leaving others to chase the momentum.

This communication strategy is genius in its simplicity. It builds a narrative of inevitable accumulation that retail investors and even some institutions find impossible to ignore. Every dot shared is a reminder that the supply of Bitcoin is finite, but MicroStrategy’s appetite is seemingly bottomless.

Read More:

A Closer Look at the 2025 Buying Spree

The pace of acquisition this year has been nothing short of breathless. MicroStrategy has effectively turned itself into a Bitcoin vacuum, pulling in assets regardless of the price tag.

- In a frantic mid-December window, the firm processed a purchase of 10,645 BTC, spending nearly a billion dollars in just seven days.

- They didn’t blink at the price either, buying in at an average of $92,098 per coin.

- Earlier that same month, they rolled out another 10,624 BTC buy, showing a consistency that has become their trademark.

Rewriting the Rules of the Corporate Treasury

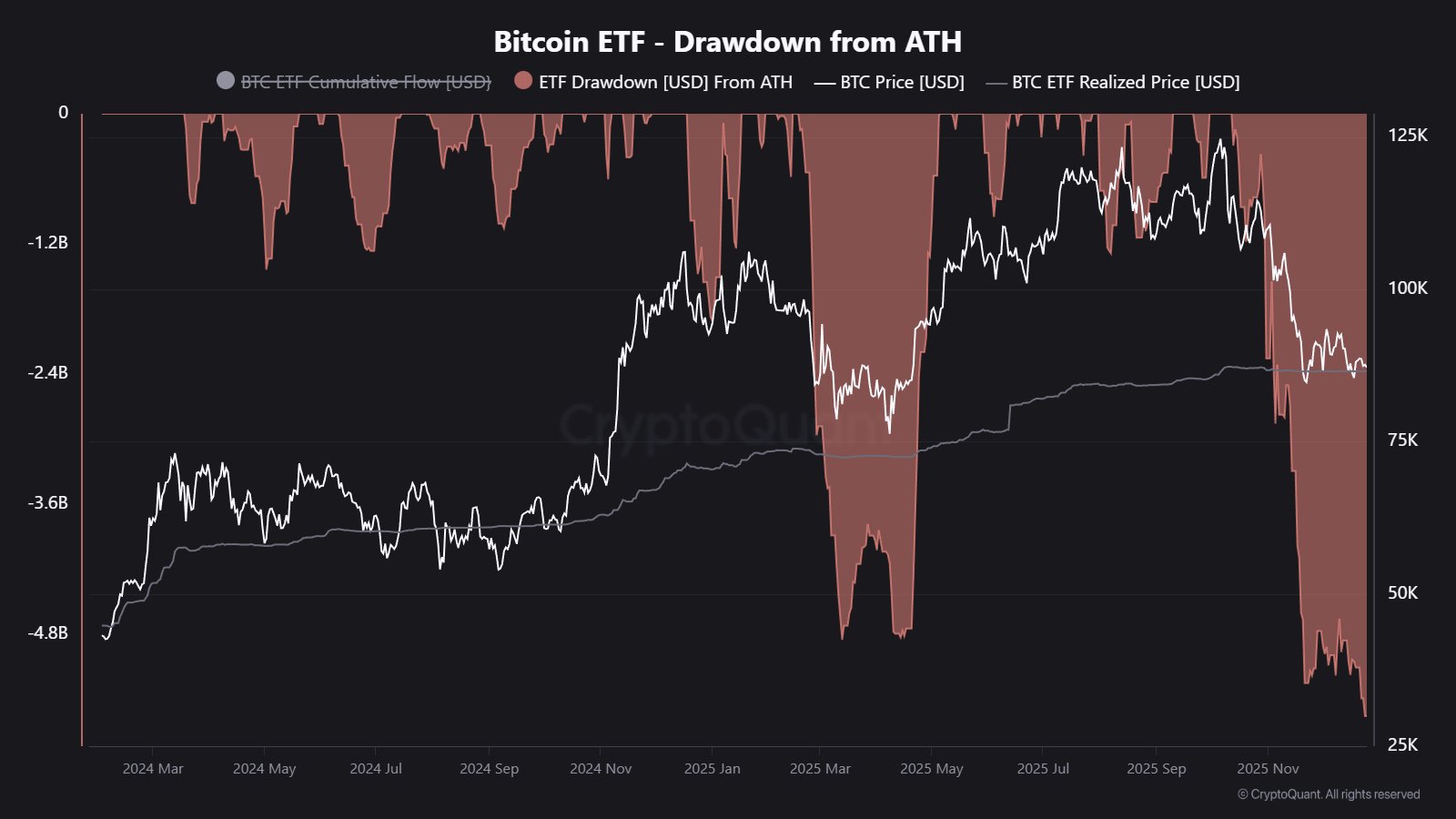

MicroStrategy’s vault now holds a staggering 671,268 BTC. With a total investment of over $50 billion, they’ve crossed a threshold where the company is now a proxy for the asset itself. But the real story is in the margins. With an average entry point of $74,972, the firm is currently sitting on nearly $10 billion in unrealized gains.

This profit cushion is their greatest weapon. It means Saylor can ignore 20% or 30% drawdowns that would crush a less-leveraged competitor. For MicroStrategy, volatility isn’t a risk to be managed; it’s an opportunity to be exploited. This massive profit buffer allows them to keep their “Bitcoin-per-share” metric climbing, which has become the primary goal for their shareholder base.

The broader impact on Wall Street is becoming harder to deny. We’re seeing a new wave of CEOs who are tired of watching their cash lose value to inflation. By treating Bitcoin as a primary reserve asset, MicroStrategy has provided a blueprint for how a public company can escape the “melting ice cube” of the dollar. As long as the company can keep its stock trading at a premium to its assets, the cycle of selling shares to buy more Bitcoin will likely continue until the supply simply runs dry.

Read More: